Fannie Mae’s July economic and housing forecast projects a flattening of the GDP growth curve in 2021, with lower growth in Q2 but higher growth in Q3 and Q4 than projected in earlier forecasts. The forecast for multifamily housing starts was also revised slightly upward for late 2021.

Housing: less single-family, more multifamily

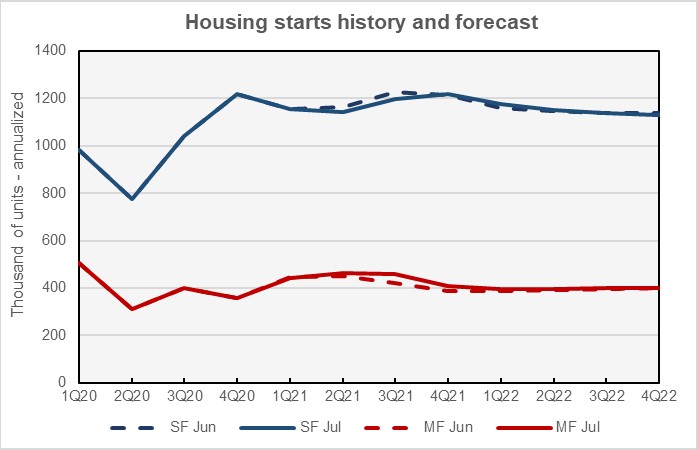

For the second month in a row, Fannie Mae adjusted its forecast for single-family housing starts down while revising its forecast for multifamily housing starts up. Both adjustments were modest as is shown in the first chart, below. For 2021 as-a-whole, Fannie Mae now expects single family starts to be 1,179,000 units, down 11,000 units from the level forecast in June. Their forecast for single-family starts in 2022 was revised upward by 2,000 units to 1,148,000 units.

Fannie Mae expects multifamily starts (2+ units per building) to be 444,000 units in 2021, up 18,000 units from the level forecast in June. The forecast for multifamily starts in 2022 was revised upward by 4,000 units to 397,000 units.

GDP growth shifts later

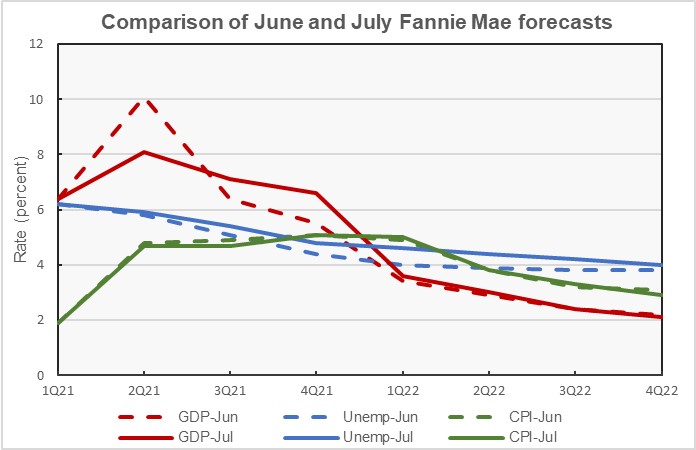

Since Fannie Mae releases its forecast reports monthly, the changes from one report to the next are generally small. However, in last month’s report, Fannie made significant changes to their inflation forecasts in response to the jump in prices seen in reports from the BLS. In this month’s report, the forecast with the largest change is that for GDP growth. This is shown along with forecasts for unemployment and inflation in the second chart, below.

The chart shows that Fannie Mae now expects the rate of GDP growth in Q2 2021 to be 2.0 percent lower than they forecasted last month. However, they expect GDP growth to be higher later in the year. When looked on an annual basis, the GDP forecast from Fannie Mae was revised only slightly. They revised the GDP growth forecast for 2021 downward by 0.1 percent to a rate of 7.0 percent. They revised the GDP growth forecast for 2022 upward by 0.1 percent to a rate of 2.8 percent

Unemployment forecast higher

The July forecast projects modestly higher unemployment for late 2021 into 2022 than was forecast in June. The largest difference between the forecasts is in Q1 2022 where the July forecast predicts an unemployment rate that is 0.6 percent higher than that forecast in June. When viewed on an annual basis, Fannie now forecasts unemployment in 2021 to be 0.2 percent higher than predicted in their last forecast, at 5.6 percent. Fannie now forecasts unemployment in 2022 to be 0.4 percent higher than predicted in June at 4.3 percent.

Inflation forecast nearly unchanged

After significantly revising its inflation forecast higher in last month’s report, the inflation forecast was adjusted only modestly in the latest report. Fannie’s forecast made small adjustments to the quarterly figures but the forecast for the year 2021 as-a-whole remained unchanged at 5.1 percent. The forecast for 2022 was revised downward by 0.2 percent to a rate of 2.9 percent.

Fannie Mae’s Multifamily Market Commentary discussed the outlook for multifamily housing. They expect that new supply will outpace demand in 2021 but that supply and demand will become closer to balance in 2022 and 2023, and then shift to demand outpacing supply in 2024. As has been reported elsewhere, they note that recent rent growth has been strong and that rent growth in high-end product has exceeded that in lower-end product recently. Concessions have been dropping lately and lease signings are up, both signs of strength in the multifamily market. Fannie Mae expects that cap rates will remain in the 4.75-5.25 percent range for the rest of 2021.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed forecast.