The Bureau of Labor Statistics (BLS) recently released its Job Openings and Labor Turnover (JOLT) report for June. The report set a series record for the highest number of job openings, easily exceeding the previous high set in April.

Assessing the overall jobs market

For a discussion of the JOLT report and how it relates to the Employment Situation Report, please see the paragraph at the end of this article.

The BLS reported that there were 10.1 million job openings at the end of June. This represents 6.5 percent of the total employment plus job openings. Within the nonfarm labor market, the number of people quitting their jobs rose to 3.9 million, while the number of people who were involuntarily separated from their jobs fell to 1.31 million, down 40.6 percent from the level of a year earlier. The number of people hired for a new job in June was 6.7 million.

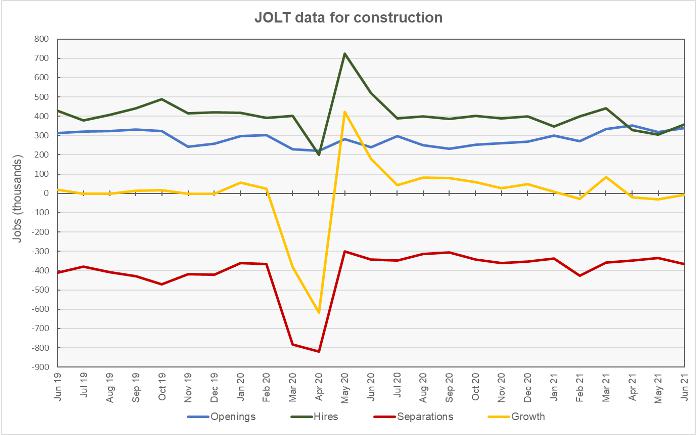

Construction jobs down again

The first chart, below, depicts the employment situation for the construction jobs market over the last 25 months. It shows that the construction jobs market has suffered a net loss in employment in 4 of the last 5 months. As of March, total net hiring since the start of the pandemic had resulted in construction employment exceeding pre-pandemic levels. However, recent hiring and separations trends have brought the net job losses since the start of the pandemic to 55,000 jobs.

Revisions to May’s hires and separations numbers raised the job losses from the preliminary figure of 22,000 jobs reported last month, to a loss of 30,000 construction jobs in the latest report. The preliminary construction job losses for June came in at 7,000 jobs.

Openings for construction jobs rose 7 percent in June from May’s revised figure (+18,000) to 339,000 jobs. Hiring was up sharply in June, rising 18 percent from May’s revised figure (-7,000) to 358,000 jobs.

Separations rose by 9 percent in June to 365,000 jobs. Both layoffs and quits rose by double-digit percentages. “Other separations” which includes retirements and transfers, were down by 47 percent, but they represent a small portion of all separations. Quits represented just under 50 percent of separations for the month.

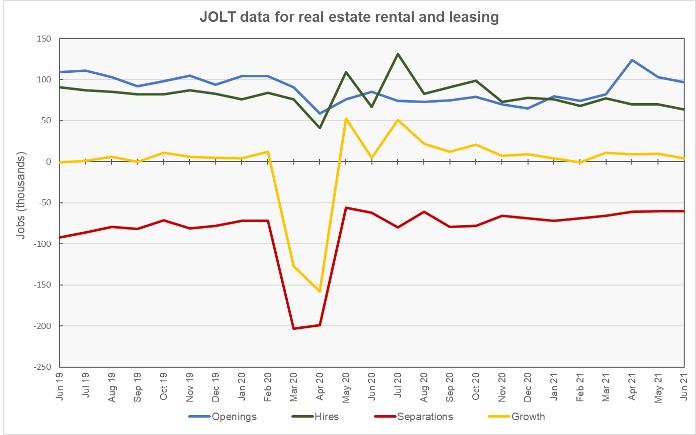

RERL jobs growth stays positive

The last chart, below, shows the employment situation for the real estate and rental and leasing (RERL) jobs category. Employment growth in this jobs category was again positive in June, extending the string of job gains to 4 months in a row.

The number of job openings in the RERL category fell in June to 97,000, down 6 percent from May’s revised (+2,000) figure. Hiring in June was down 9 percent from May’s revised (-7,000) figure to 64,000 jobs.

Separations in June were unchanged at 61,000 jobs. Quits were up 37 percent in June. They represented 92 percent of total separations as layoffs fell 74 percent to only 5,000 jobs.

The numbers given in the JOLT report are seasonally adjusted and are subject to revision. It is common for small adjustments to be made in subsequent reports, particularly to the data for the most recent month. The full current JOLT report can be found here.

The reports

The US labor market is very dynamic with many people changing jobs in any given month. The JOLT report documents this dynamism by providing details about job openings, hiring and separations. However, it does not break down the jobs market into as fine categories as does the Employment Situation Report, which provides data on total employment and unemployment. For example, while the Employment Situation Report separates residential construction from other construction, the JOLT report does not. The Employment Situation Report separates residential property managers from other types of real estate and rental and leasing professionals, but the JOLT report does not. However, the JOLT report provides a look at what is driving the employment gains (or losses) in broad employment categories.