A recent report from CoStar says that commercial property prices in general, and multifamily property prices in particular, continued their recent strong performance in July.

CCRSI defined

The CoStar report focuses on a relative measure of property prices called the CoStar Commercial Repeat Sales Index (CCRSI). The index is computed based on the resale of properties whose earlier sales prices and sales dates are known. The index represents the relative change in the price of property over time rather than its absolute price. CoStar identified 1,591 repeat sale pairs in July for all property types. These sales pairs were used to calculate the results quoted here.

Prices rise

CoStar reported that its value-weighted index of multifamily property prices increased 16.2 percent, year-over-year, in July 2021. The index was up 1.4 percent month-over-month.

The combined value-weighted index of non-multifamily commercial property rose by 9.5 percent, year-over-year, in July. However, the CCRSI for non-multifamily commercial property took a short-term dip in July 2020, so the year-over-year comparison is benefiting an unusually weak basis for comparison. The index rose 1.4 percent month-over-month. The other commercial property types which are tracked by CoStar are office, retail, industrial and hospitality.

Comparing property types

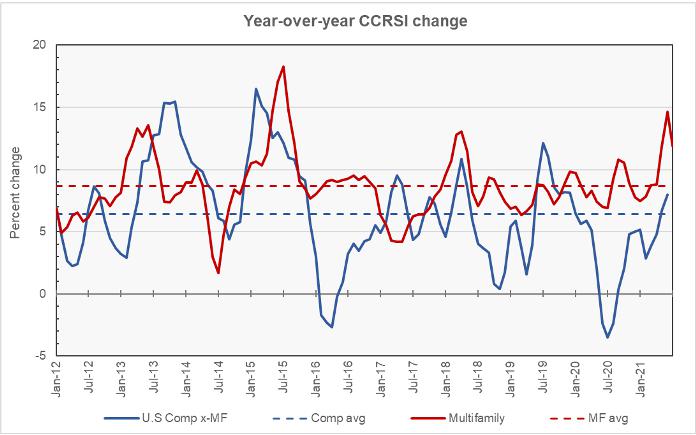

The chart, below, shows the year-over-year change in the value-weighted multifamily property price index and that for all other commercial property types since January 2012. The chart also shows the average growth rates for the two indices over this time span.

The average annual rate of increase in multifamily property prices since January 2012 is 8.6 percent, based on the value-weighted CCRSI. The average annual increase in all other commercial property types taken together is 6.4 percent. In addition to having a higher long term average rate of price appreciation, the chart illustrates that the volatility in the rate of price appreciation for multifamily property has been less than that for other commercial property types, particularly since the middle of 2016.

Transaction volumes remain strong

CoStar reported that number of repeat-sale transactions were down slightly for the month in July but were in line with the trailing 12-month average sales volume. Other positive factors for the market cited by CoStar include transacted prices being high relative to asking prices at 94.4 percent, a record for their data series, and average days-on-market being relatively low at 222 days.

The full reports discuss all commercial property types, but detailed data on each of the property types and regional data is only reported quarterly and so are not included in this month’s report. While the CoStar report provides information on transaction volumes, it does not break out multifamily transactions. The latest CoStar report can be found here.