Fannie Mae’s April economic and housing forecasts anticipate that rising interest rates will cause the U.S. economy to contract in the second half of 2023. While this is expected to reduce the number of single-family housing starts, Fannie Mae forecasts the number of multifamily housing starts to be higher than in earlier forecasts.

Fannie Mae issues updates to its forecasts monthly and the changes from month to month are generally small. The April forecast is unusual for the large sizes of some of the revisions to its individual forecasts.

Housing forecast: multifamily up, single-family down

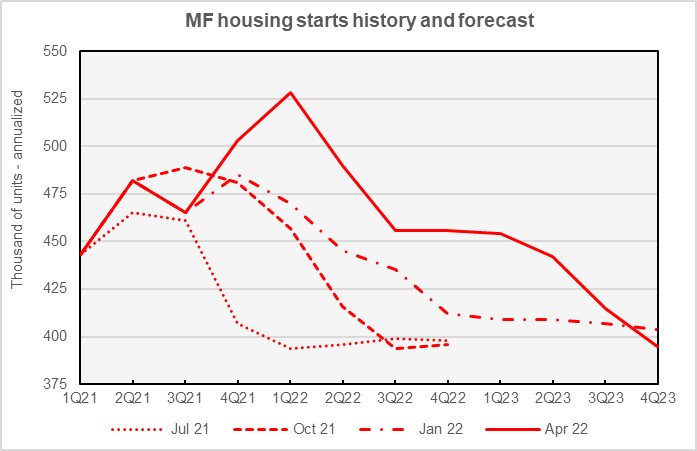

Fannie Mae now estimates that multifamily starts (2+ units per building) in 2022 will come in at 482,000 units, up 2 percent from the number of units started in 2021. This forecast is up 17,000 units from the level forecast last month. The forecast for multifamily starts in 2023 is 426,000 units, down 2,000 units from the level forecast last month.

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. The earlier forecasts were selected at 3-month intervals so that the evolving outlook for multifamily housing starts over the last 9 months would be apparent.

The chart shows that Fannie Mae has been raising its outlook for multifamily housing starts in the first part of 2022. Fannie Mae now expects higher levels of multifamily starts to continue through in the first part of 2023. However, by the end of 2023, Fannie Mae expects that economic conditions will result in a lower level of multifamily starts than it anticipated last month. Despite lowering the forecast for the last two quarters of 2023, Fannie Mae’s the current forecast for 2023 as-a-whole is the second highest it has issued for that period since last November when it first started providing forecasts for 2023.

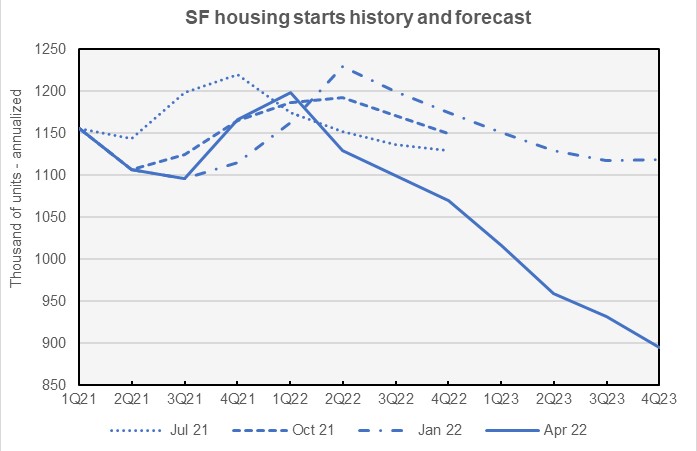

Fannie Mae predicts that the environment of rapidly rising interest rates will have a more immediate and dramatic impact on single-family housing starts than on multifamily starts. Fannie Mae now expects single-family starts to be 1,125,000 units in 2022, down 27,000 units from the level forecast last month. Fannie Mae also lowered its forecast for single-family starts in 2023 to a level of 950,000 units, down 154,000 units from the level forecast last month.

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts. The chart shows how dramatically Fannie Mae’s current outlook for single-family housing starts differs from its earlier projections for this market segment.

Inflation forecast higher in the short term

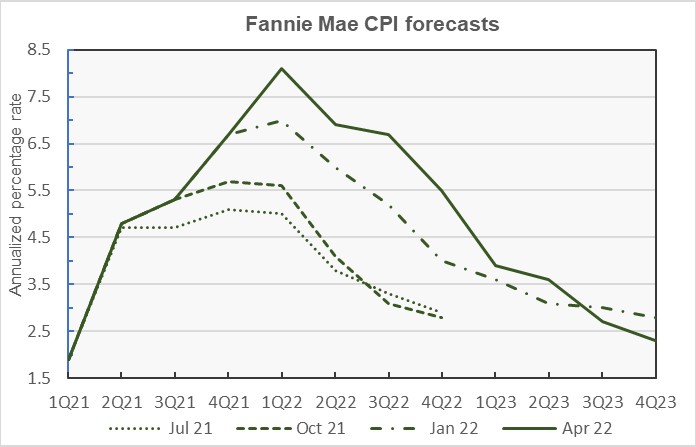

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Fannie Mae’s current economic forecast calls for higher inflation for a longer period than did earlier forecasts. It predicts that the current bout of inflation will peak in Q1 2022 at 8.1 percent year-over-year, before gradually declining. Fannie Mae expects year-over-year inflation to be 5.5 percent in Q4 2022 and to fall to 2.3 percent in Q4 2023.

GDP growth forecast revised lower

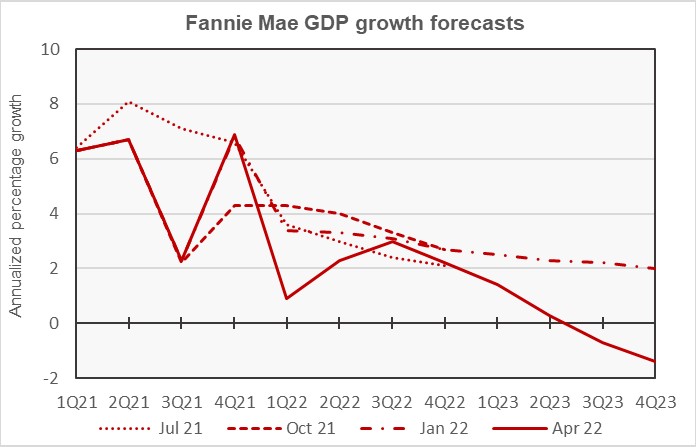

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with three other recent forecasts.

Fannie Mae’s forecast for GDP growth in Q1 2022 was revised upward by 0.1 percent this month. Growth is now expected to come in at an annualized rate of 0.9 percent. The growth forecast for Q2 2022 was revised downward to 2.3 percent while the growth forecast for Q3 2022 was revised upward to 3.0 percent and the growth forecast for Q4 2022 was revised downward to 2.2 percent.

For the year 2022 as-a-whole, the GDP growth forecast was revised downward from 2.3 percent to 2.1 percent. For the year 2023 as-a-whole, the GDP growth forecast was revised downward from 2.2 percent growth to a 0.1 percent contraction.

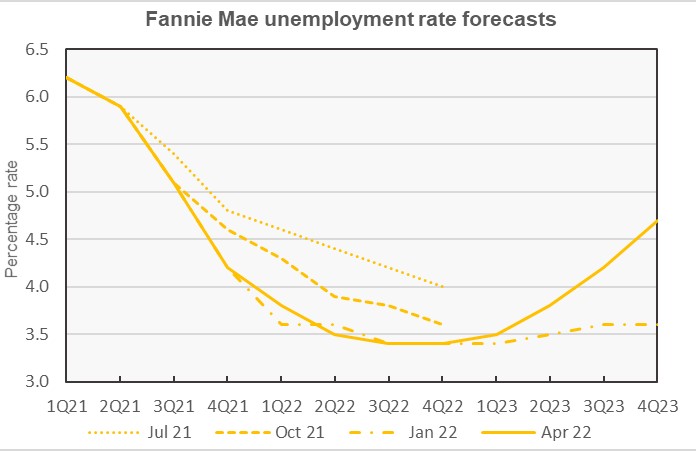

Unemployment forecast to rise in 2023

The next chart, below, shows Fannie Mae’s current forecast for the unemployment rate, along with three other recent forecasts.

The major change in this month’s forecast is the significantly higher unemployment rates expected for the later quarters of 2023 as the Federal Reserve’s interest rate increases cause the economy to slow down. Fannie Mae now expects 2023 to end with the unemployment rate at 4.7 percent, up almost 1 percentage point from the level forecast last month.

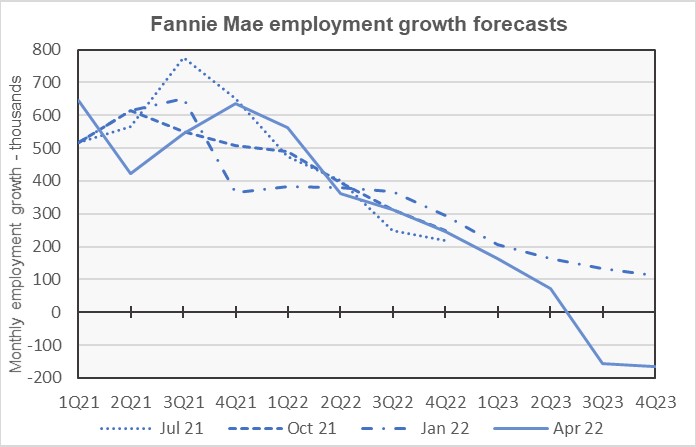

Another key measure of job market’s strength is the change in total non-farm employment. The current forecast for this metric is shown in the last chart, below, along with other recent forecasts.

The chart shows a slight reduction in predicted employment growth for 2022 and a loss of employment in the later parts of 2023. For the full year, the gain in total non-farm employment is forecast to be 4.4 million jobs in 2022. For 2023, the forecast is for a net loss of 200,000 jobs.

The Fannie Mae Multifamily Market Commentary for April focused on the differences between large and small multifamily properties. Fannie Mae defines a small multifamily property as one that contains 50 or fewer units. It found that the average smaller multifamily property is older and charges lower rents than the average larger property.

Currently, about 25 percent of multifamily units in the rental housing market are in small multifamily properties. While small properties are still a large percentage of the total number of properties being built, they contain only about 10 percent of the new units delivered over the past 10 years. To the extent that the lower rents offered by small properties are correlated to the size of the properties and not to their age, the reduction in the portion of rental units offered by small properties may make housing affordability worse.

The Fannie Mae forecast discussion can be found here. There are links on that page to the detailed forecasts.