CoStar reported that multifamily property prices rose in April after slight declines in each of the 2 previous months.

CCRSI defined

The CoStar report focuses on a relative measure of property prices called the CoStar Commercial Repeat Sales Index (CCRSI). The index is computed based on the resale of properties whose earlier sales prices and sales dates are known. The index represents the relative change in the price of property over time rather than its absolute price. CoStar identified 1,826 repeat sale pairs in April for all property types. These sales pairs were used to calculate the results quoted here.

Price growth is positive

CoStar reported that its value-weighted index of multifamily property prices increased 21.8 percent, year-over-year, in April 2022. The index was up 1.4 percent month-over-month.

The combined value-weighted index of non-multifamily commercial property rose by 8.4 percent, year-over-year, in April. The index fell 1.4 percent month-over-month. The other commercial property types tracked by CoStar are office, retail, industrial and hospitality.

Comparing property types

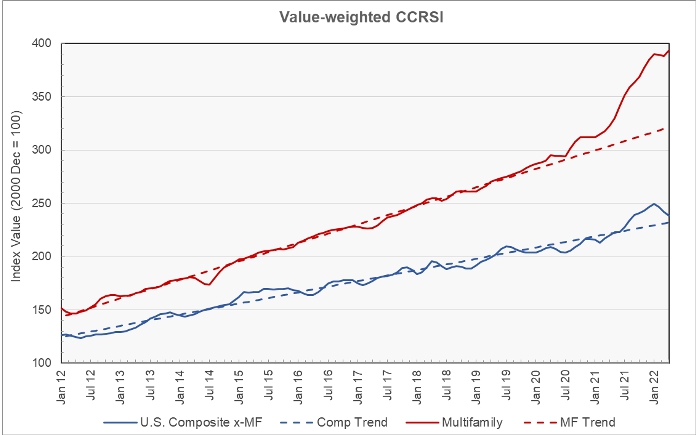

The first chart, below, shows the history of the value-weighted CCRSI’s since January 2012 for multifamily property and for all other commercial property considered as a single asset class. It also shows trend lines for the growth in the two CCRSI’s based on their growth in the period from January 2012 to January 2020. The indexes are normalized so that their values in December 2000 are set to 100.

The chart shows that both indexes had remarkably steady growth in the years leading up to the pandemic. It also shows that the growth in multifamily property prices began to significantly exceed the trend line during the pandemic year of 2020 and that this divergence increased in 2021.

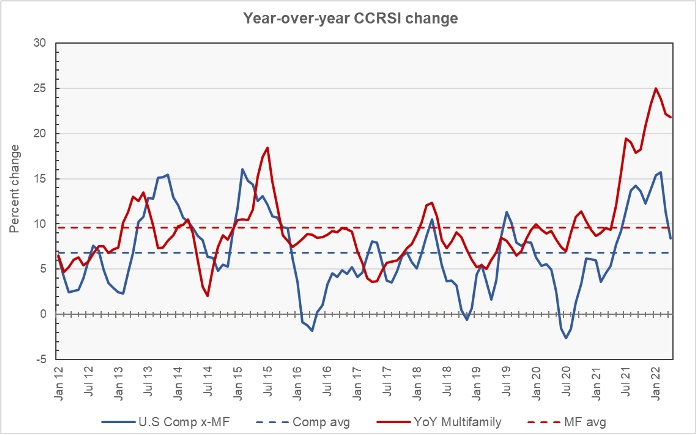

The second chart shows the year-over-year change in the value-weighted multifamily property price index and that for all other commercial property types since January 2012. It also shows the average rates of annual price growth for the two property classes over that time.

The chart shows that, while the year-over-year rate of increase in multifamily property prices is off its recent record highs, it is still well above the average rate over the last 10 years. The year-over-year rate of increase for other commercial property is returning to a level closer to its recent average.

The annual increase in multifamily property prices has been 9.6 percent while that of other commercial property has been 6.8 percent. These rates of increase are slightly less than those reported by Real Capital Analytics.

Transaction volumes moderating

CoStar reported that number of repeat-sale transactions were down about 17 percent in April, falling 375 from March’s level. Transaction dollar volume was also down in the month, falling 22 percent to $14.8 billion. However, transacted prices remained high relative to asking prices at 95.3 percent, the highest level in 16 years. Average days-on-market remained relatively low at 210 days. Both of these latter metrics are signs of good market liquidity.

The full report discusses all commercial property types, but detailed data on each of the property types and regional data are only reported quarterly and so are not included in this month’s report. While the CoStar report provides information on transaction volumes, it does not break out multifamily transactions. The latest CoStar report can be found here.