Fannie Mae’s February economic and housing forecasts predict a higher number of multifamily starts in 2023 and 2024 than did last month’s forecast. The forecast for single-family starts was also revised higher for both 2023 and 2024.

Multifamily starts forecast rises

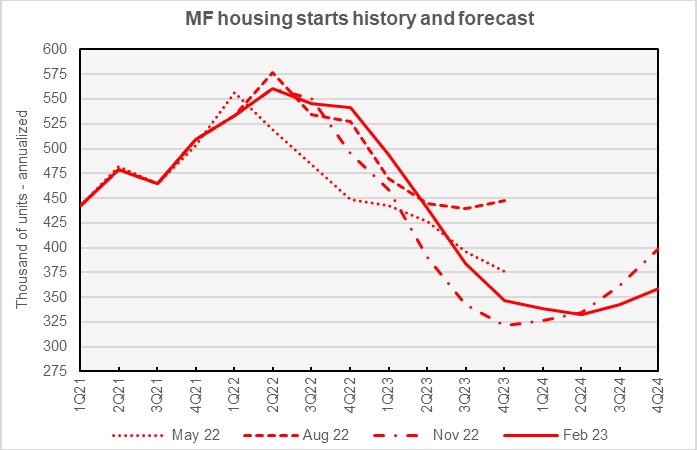

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The upward revisions to earlier forecasts shows that than Fannie Mae’s forecasters were surprised by the endurance of the surge in multifamily housing starts that occurred in 2021 and 2022. However, their outlook for late 2023 has become more negative since their forecast in August, which had the highest estimate for multifamily housing production in that year of any of their recent forecasts.

Compared to last month’s forecast, the February forecast calls for fewer multifamily starts in Q4 2022 and Q1 2023 but more starts in each subsequent quarter through the end of 2024. Fannie Mae now expects multifamily starts (2+ units per building) for 2022 to come in at 545,000 units, down 8,000 units from the level forecast last month. The forecast for multifamily starts in 2023 is now 416,000 units, up 25,000 units from the level forecast last month, and the forecast for 2024 is 344,000 units, up 24,000 units from last month’s forecast.

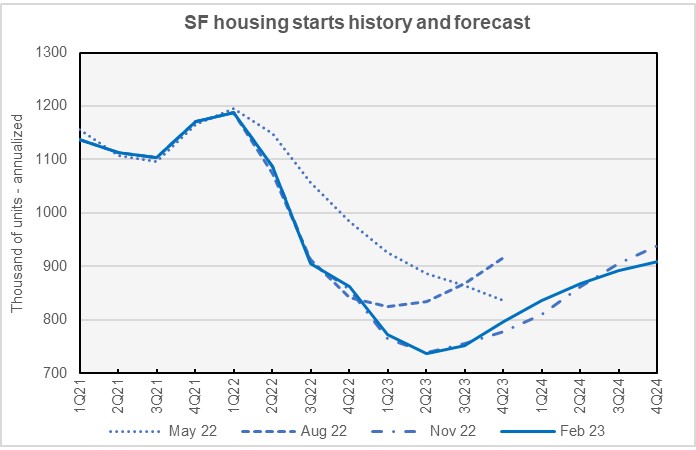

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

In the February 2023 forecast, Fannie Mae’s forecasters raised their predicted numbers for single-family starts in every quarter of the forecast horizon, the opposite of what they did in last month’s forecast. However, they still expect the low point in single-family housing starts to occur in Q2 2023. While single-family starts are forecast to rise from that point, they are not expected to return to the average level of 2021, or even 2022, by the end of 2024.

Fannie Mae now expects single-family starts to be 1,008,000 units in 2022, up 6,000 units from the level forecast last month. Fannie Mae raised their forecast for single-family starts in 2023 by 15,000 units to a level of 764,000 units. Fannie Mae’s also raised their forecast for single-family starts in 2024 by 32,000 units to a level of 876,000 units.

GDP recovery comes later

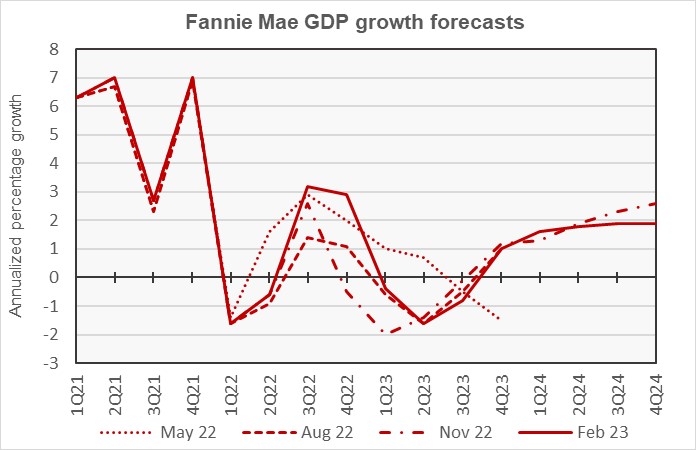

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with three other recent forecasts.

Fannie Mae’s forecasters were among the first to predict that a recession would occur in 2023. While they originally predicted it for late in the year, they subsequently saw it starting as early as Q4 2022. However, their last 3 forecasts have been predicting increasingly strong GDP growth for Q4 2022, with GDP growth not turning negative until Q1 2023. These forecasts also foresaw progressively lower GDP growth by year-end 2024.

The full year forecast for GDP growth in 2022 is now for growth of 1.0 percent, up from a forecast 0.8 percent growth last month. The full year GDP forecast for 2023 was revised upward by 0.1 percentage point to -0.5 percent. The full year forecast for 2024 was revised downward by 0.1 percentage points to 1.8 percent.

Higher inflation forecast

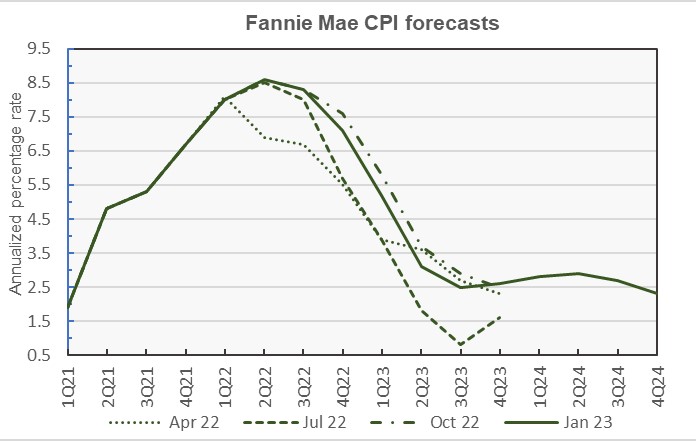

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Compared to last month’s forecast, Fannie Mae is predicting higher inflation in every quarter from Q1 2023 through the end of 2024.

The February forecast for year-over-year CPI growth in Q4 2022 was left unchanged at 7.1 percent. The year-over-year CPI forecast for Q4 2023 was revised upward from 2.6 percent to 3.0 percent, while that for Q4 2024 was revised upward by 0.2 percentage points to 2.5 percent.

Unemployment rate rises more slowly

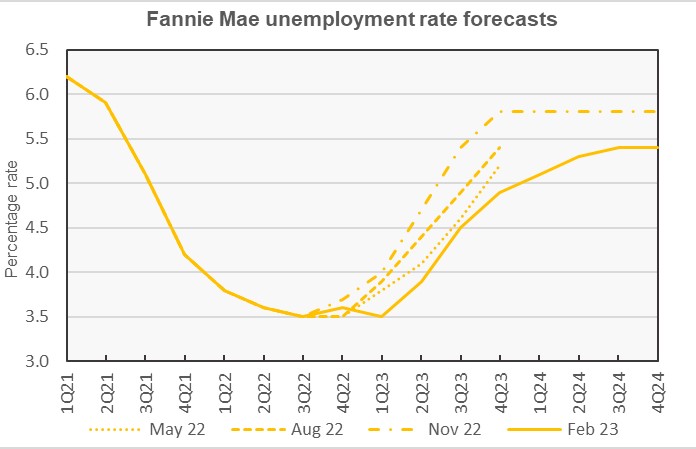

In recent reports, we have discussed the jobs market in terms of total employment rather than in terms of the unemployment rate since the latter also depends on the labor force participation rate, which has fallen since the COVID pandemic. However, because of changes in population estimates and in seasonal revision factors, the employment numbers in this month’s report cannot be directly compared to those in previous reports. Therefore, we will examine Fannie Mae’s estimates for the unemployment rate.

The next chart, below, shows Fannie Mae’s current forecast for the unemployment rate, along with three other recent forecasts.

The delay predicted for the onset of the downturn shows up in the employment numbers. The unemployment rate is predicted to rise beginning in Q2 2023 and to continue rising to the end of 2024. However, the predicted rises are smaller than those in last month’s forecast.

The full year forecast for the unemployment rate in 2022 was left unchanged at 3.6 percent. The full-year unemployment rate forecast for 2023 was revised downward from 4.6 percent to 4.2 percent. The unemployment rate forecast for 2024 was revised downward from 5.7 percent to 5.3 percent.

Commentary looks at performance of LIHTC vs. market rate multifamily during COVID

Fannie Mae compared the performance of LIHTC properties versus market rate properties for the years surrounding the COVID pandemic for both senior housing and for family housing market segments. They found that occupancy during the pandemic dropped much more for market rate properties than for LIHTC properties, particularly in the senior housing segment. Also, the surge in rents experienced in 2021 and 2022 for market rate properties was less pronounced in LIHTC properties.

The Multifamily and Economic Market Commentary also took a broad look at where apartment business fundamentals are expected to go in 2023. It predicted that weak apartment demand in the first part of 2023 will result in weak rent growth and falling occupancy in that period. However, stronger demand in the second half of the year should have occupancy rising and rent growth returning to historical averages.

The commentary also looked at long term trends in rent growth for class B and C apartments and in income growth for the people most likely to occupy them. It found that the wages for people who occupy class C apartments have come closer to keeping up with rent growth than have the wage incomes of those occupying class B apartments. However, wage growth for both classes of renters have fallen behind rent growth over the past 11 years.

The Fannie Mae forecast can be found here. There are links on that page to the detailed forecasts and to the commentary.