The “Week 54” edition of the Census Bureau’s Pulse Survey shows that the portion of renters who are behind on their rent payments rose to 14.2 percent, up from the 12.6 percent reported in the “Week 53” survey.

The Week 54 survey collected data from February 1 to February 13, 2023.

Tracking delinquencies

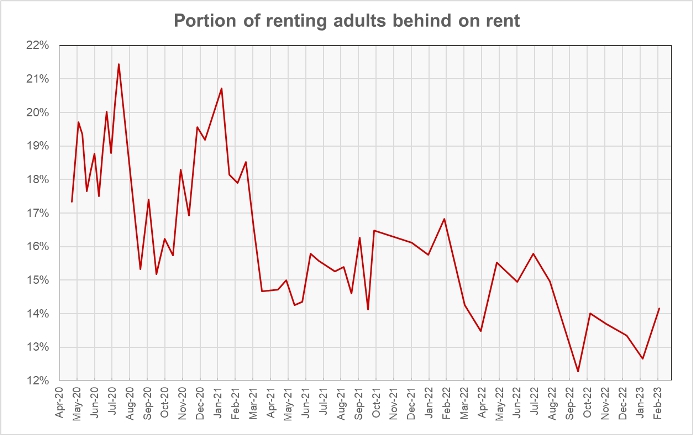

Renters in all phases of the Pulse survey have been asked whether they are behind on their rent. The first chart, below, shows the portion of respondents who said that they were behind at the time they were surveyed. Note that the midpoint of the “Week 54” survey period was February 7, 142 weeks after the initial Pulse Survey.

The portion of renters reporting that they were delinquent rose 0.6 percentage points between the Week 53 and Week 54 surveys. Part of this rise could be due to the Week 54 survey being conducted 3 days earlier in the month. However, this is clearly not the full explanation given that the Week 53 survey had a lower delinquency rate than the Week 52 survey despite the Week 53 survey’s data being collected 5 day earlier in the month. Since the last 6 Pulse surveys have found a delinquency rate between 12.3 and 14.0 percent, this variation may represent the natural variability in the data due to limitations of sampling.

Assessing rent increases

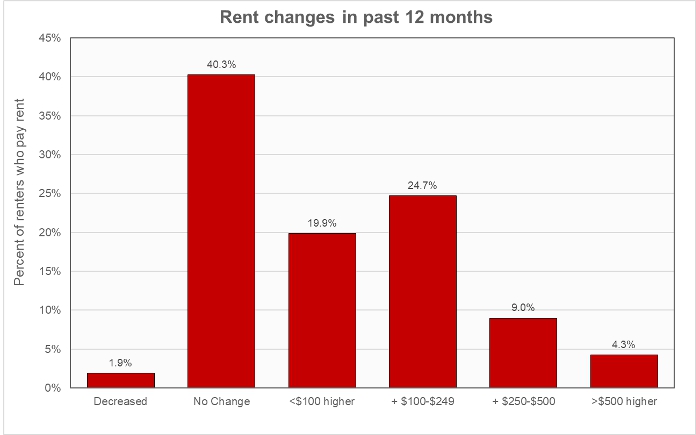

The survey asked participants whether they had experienced rent increases over the past 12 months. In the Week 54 survey, 42.2 percent of respondents who pay rent said that they either had not experienced a rent increase in the past 12 months or that their rent had gone down. An additional 19.9 percent had experienced a rent increase of less than $100. These results are shown in the next chart, below.

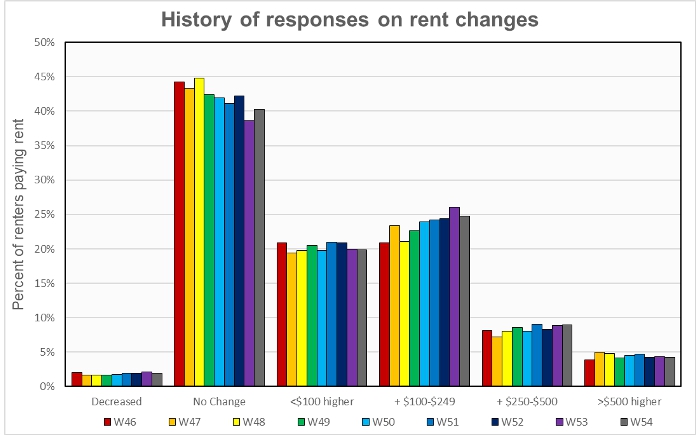

The question about the size of rent increases over the past 12 months has been asked since the Week 46 survey, which was conducted in early June 2022. The next chart gathers all of the answers to this question together to look for trends. The chart shows that the portion of renters who have had no change in their rent has been trending down. The portions of renters experiencing rent increases of $100 to $249 and of $250 to $500 have been trending higher. No clear trend is seen for the other categories of rent changes.

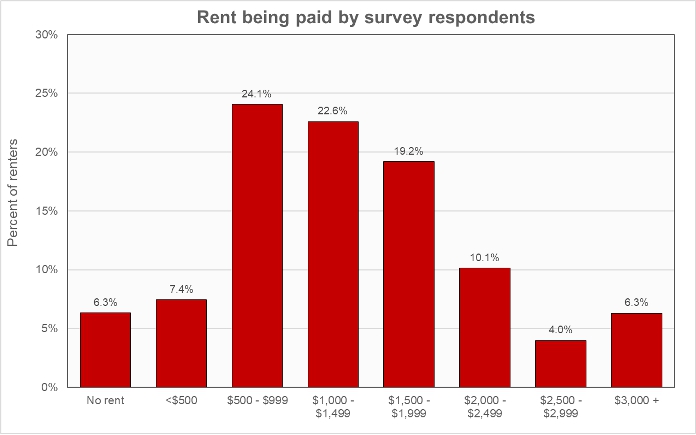

The next chart shows the distribution of rents paid by survey respondents. The data show that 37.8 percent of renters are paying less than $1,000 per month for their housing while 39.6 percent are paying more than $1,500. These figures compare to national average apartment rents of $1,343 from Apartment List and $1,701 from Yardi Matrix.

Profiling the participants

Of the respondents who reported being current on their rent, 36 percent said that they had children in the household. Of those reporting being behind on their rent, 52 percent reported having children in the household.

Of the respondents who reported being current on their rent, 14 percent said that they or a household member had experienced a loss of employment income over the prior 4 weeks. Of those reporting being behind on their rent, 33 percent reported that they or a household member had experienced a loss of employment income.

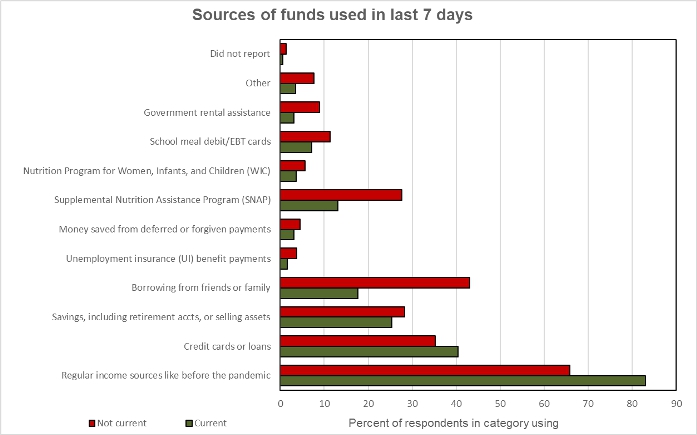

The final chart shows the sources of the funds survey respondents used to meet spending needs. Many of the differences between the people who are current on their rent and those who are behind are as one would expect: the former are more likely to rely on regular sources of income while the latter are more likely to rely on borrowing and on government assistance.

What is the Pulse Survey?

The Pulse Survey is an experimental program that the Census Bureau started shortly after economic shutdowns were imposed in response to COVID-19. It was designed to assess how the population of the country was faring under the economic stress caused by the reaction to the pandemic. The current survey, designated Week 54 despite being conducted 4 weeks after the previous survey, was collected under what Census calls Phase 3.7 of the survey. With each new phase of the survey, Census modifies the set of questions being asked. For example, Phase 3.7 added questions about the impact of natural disasters on respondents’ lives and on Medicaid coverage. The renter portion of the survey covers renters of both multifamily and of single-family properties.