The Employment Situation Report from the Bureau of Labor Statistics stated that employment rose in only one of the two categories of residential construction employment and in only one of the two categories of apartment operations employment that we track. However, both overall residential construction employment and overall apartment operations employment rose for the month.

Employment growth is positive but slowing

The Bureau of Labor Statistics (BLS) reported that total seasonally-adjusted non-farm employment increased by 187,000 jobs in July to 156,342,000, based on their survey of business establishments. This compares to revised employment gains of 185,000 jobs in June and 281,000 jobs in May. June job gains were revised lower in the latest report by 24,000 jobs while May gains were revised lower by 25,000 jobs.

The BLS household survey reported that the U.S. unemployment rate fell to 3.5 percent, down 0.1 percentage point from last month’s level. The household survey found that the number of employed persons rose by 268,000 from that reported last month to 161,262,000. The number of unemployed persons fell by 116,000 to 5,841,000.

The household survey also found that the number of people in the civilian labor force rose by 152,000 in July while the adult civilian population rose by 201,000. The labor force participation rate was unchanged at 62.6 percent. It had been at 63.4 percent before the pandemic. Recovering that 0.8 percent decline in the labor force participation rate would bring 2.1 million more people into the workforce.

The labor force participation rate peaked in early 2000 at 67.3 percent.

Tracking multifamily employment

The BLS reported more detailed employment information on four job categories of interest to the multifamily industry. These are employment as residential construction workers, as specialty trades within residential construction, as residential property managers and as lessors of residential buildings. As usual, some of the data is reported with a month delay, so the latest figures for the latter two categories are for the month of June.

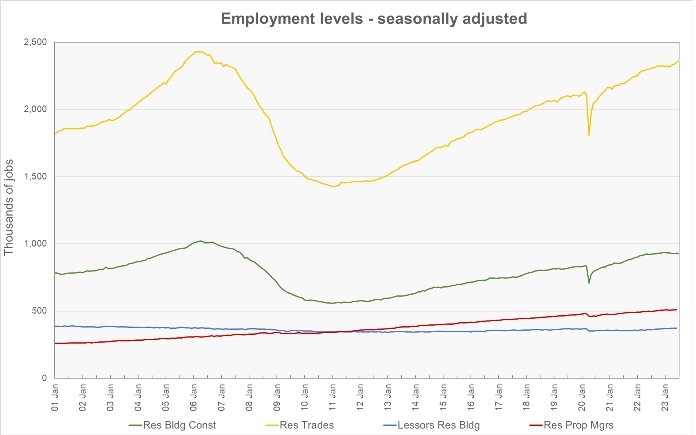

The first chart shows the long-term history of the levels of employment in these four jobs categories.

Residential construction employment rises overall

Employment in residential building construction in July, usually with general contractors, was reported to be down by 5,500 jobs. However, this was after a upward revision of the prior month’s employment level by 800 jobs. The employment level for May was revised lower by 600 jobs. Employment in this category is now 924,500 jobs, up less than 0.1 percent year-over-year and 10.4 percent higher than its level in February 2020.

Employment in residential building trades, i.e. plumbers, electricians, etc., in July was reported to be up by 13,300 jobs from June’s level. In addition, June’s employment level was revised upward by 6,700 jobs. Employment in this category is now 2,362,600 jobs, up 2.5 percent year-over-year and 11.0 percent above its level in February 2020.

Total May employment in these two categories of residential construction jobs combined is up 0.2 percent from the revised level of the month before and up 1.8 percent year-over-year. Residential construction employment is 10.8 percent above its level in February 2020.

Apartment operations jobs also up overall

Employment for residential property managers in June was reported to be up by 1,600 jobs (0.3 percent) from its revised (-200 jobs) level for May to 510,800 jobs. Employment for residential property managers is up 2.6 percent year-over-year and is up from its February 2020 level by 6.2 percent.

Employment for lessors of residential buildings was reported to rise by 300 jobs in June. However, May’s jobs figure was revised lower by 500 jobs so the reported number of jobs for lessors of residential builds for June is lower than the preliminary number for May given in last month’s report. The June employment level is 372,600 jobs. Employment in this category is up 3.4 percent year-over-year and is now 1.3 percent above its pre-pandemic level.

Total employment in these two categories of apartment operations jobs combined was reported to be up 0.2 percent from the revised level for last month. It is now 4.1 percent above its level in February 2020.

Growth below trend

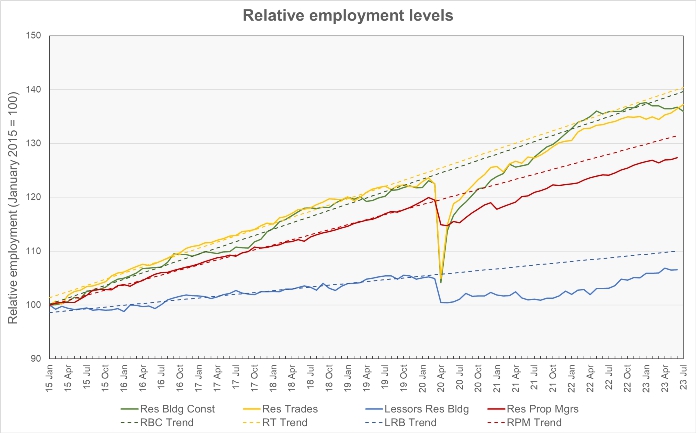

The final chart, below, presents the employment data in a different format. It normalizes the employment levels in all four jobs categories to a reading of 100 for January 2015. It also provides trend lines for the growth in each of the categories of employment based on the period from January 2015 through February 2020.

The chart shows that employment in residential construction exceeded its pre-pandemic trend by January 2022, but has been falling below trend since January 2023. Employment in the lessors of residential buildings category had the largest lag to trend in 2022 but has closed the gap recently.

Residential building construction employment is now 2.7 percent below trend. Residential trades employment is now 2.3 percent below trend. Residential property managers employment is 3.1 percent below trend and lessors of residential buildings employment is also 3.1 percent below trend.

The numbers given in the Employment Situation report are seasonally adjusted and are subject to revision. It is common for small adjustments to be made in subsequent reports, particularly to the data for the most recent month. The current Employment Situation report can be found here.