Fannie Mae’s March economic forecast calls for multifamily housing starts to decline modestly through the end of 2025. Single-family housing starts are expected to rise but at a lower rate than predicted last month.

Fannie Mae’s forecasters are predicting that the Federal Reserve will cut the Fed Funds rate by a total of 60 basis points in 2024 but by only 20 basis points in 2025, ending that year at a rate of 4.1 percent. This is 40 basis points higher than the rate they predicted for the end of 2025 in last month’s forecast. Higher interest rates are expected to result in slower housing production.

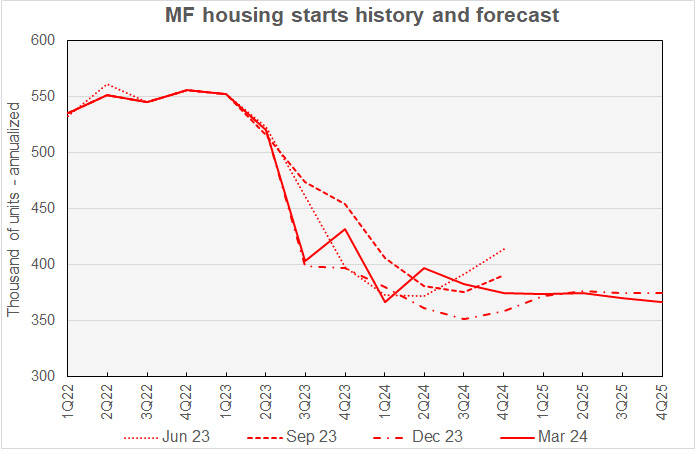

Multifamily starts predicted to trend lower

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The revisions to the current multifamily starts forecast reversed the patterns of those made last month and the month before. The number of starts in each quarter of 2024 was revised lower while the number of starts in each quarter of 2025 was revised higher.

The current forecast predicts some near-term choppiness in the number of multifamily starts. Starts are seen to rise in Q4 2023, then fall in Q1 2024 and then rise in Q2 2024. From Q3 2024, multifamily starts are expected to gradually decline throughout the rest of the forecast period.

The largest modification from last month’s forecast was a call for 62,000 (annualized) fewer multifamily starts in Q1 2024, to a level of 367,000 starts. The largest upward revision was a call for 16,000 additional annualized units in Q4 2025, which also resulted in a predicted annualized starts rate of 367,000 starts.

For reference, the most recent new residential construction report from the Census Bureau has multifamily starts running at an annualized rate of 377,000 units in Q1 2024.

Looking at yearly forecasts, the predicted number of multifamily starts for 2024 was revised lower by 27,000 units to 380,000 units. The forecast for multifamily starts in 2025 was revised higher by 11,000 units to 372,000 units.

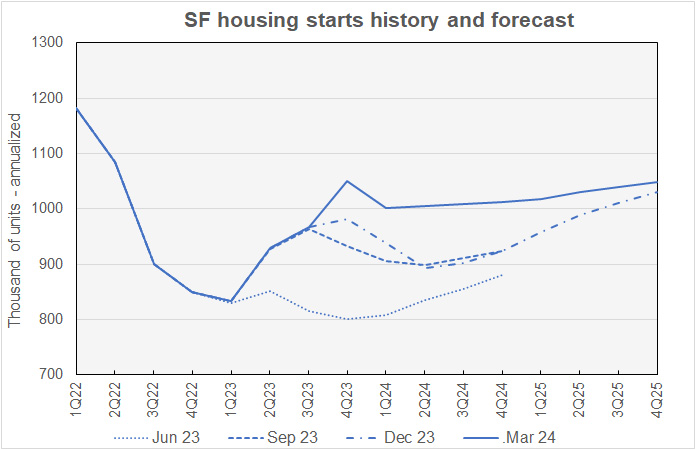

Single-family starts forecast revised lower

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Compared to last month’s forecast, Fannie Mae’s analysts raised their estimate for the number of single-family starts which took place in Q4 2023, but lowered their forecasts for starts in every quarter of 2024 and 2025. Single-family starts are said to have risen in Q4 2023 but are expected to pull back in Q1 2024. Starts are predicted to then increase slowly quarter-by-quarter in 2024 and 2025.

Fannie Mae now expects single-family starts to be 1,007,000 units in 2024, down 7,000 units from the level forecast last month. Single-family starts in 2025 are forecast to be 1,034,000 units, down 19,000 units from the level forecast last month.

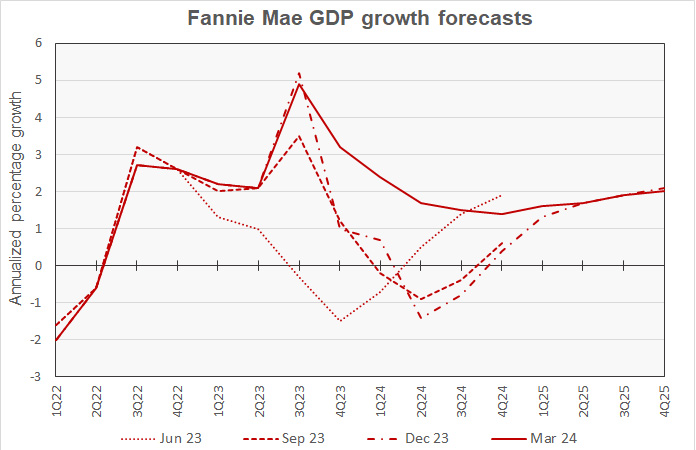

GDP growth to increase in 2025

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

The largest revision to quarterly GDP estimates in this month’s forecast was for Q1 2024, where last month’s forecast of 2.1 percent annualized growth was revised higher to 2.4 percent. This follows a recent pattern of GDP growth surprising to the upside.

While the higher interest rates imposed by the Federal Reserve might have been expected to slow the economy, rising deficit spending by the Federal Government acts to stimulate economic activity. The fiscal year 2023 deficit of $1.7 trillion is a record other than for fiscal years 2020 and 2021. In those years, spending was boosted by one-time measures put in place to counter the effects of the pandemic-related shutdowns. So far, the deficit in fiscal year 2024 is running 14 percent higher than that of last year. This may complicate the Federal Reserve’s efforts to slow the economy in order to bring inflation down.

The slowest GDP growth is now expected to be 1.4 percent, annualized, in Q4 2024, one quarter later than predicted by last month’s forecast. GDP is predicted to grow slowly after that point, ending 2025 with an annual growth rate of 2.0 percent.

The full year forecasts for GDP growth for 2023 and 2024 were left unchanged at 3.1 percent and 1.7 percent respectively. The full year GDP forecast for 2025 was raised from 1.6 percent to 1.8 percent.

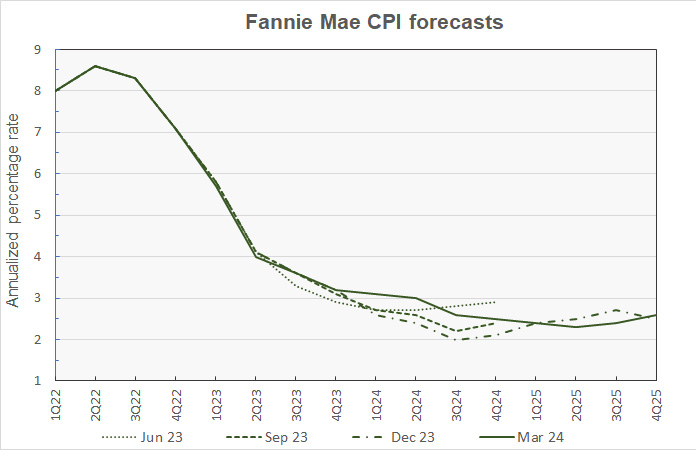

Inflation predicted to fall

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Fannie Mae’s latest forecast calls for inflation as measured by the CPI to fall gradually through Q2 2025, where it bottoms out at an annualized rate of 2.3 percent. CPI inflation is then predicted to drift upward, ending the year at a rate of 2.6 percent.

Looking at whole-year forecasts, the forecast for year-over-year CPI inflation in Q4 2024 was left unchanged at 2.5 percent. The Q4 2025 year-over-year inflation forecast was raised 0.2 percentage points to 2.6 percent.

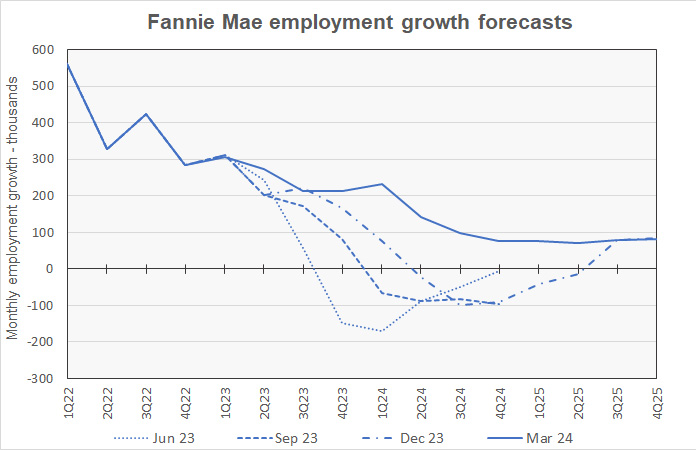

Employment forecast relatively unchanged

The next chart, below, shows Fannie Mae’s current forecast for the employment growth, along with two earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth. By contrast, the unemployment rate depends on employment but also on the labor force participation rate. Either rising employment or falling labor force participation can drive the unemployment rate lower, but only the former would contribute to economic growth.

Fannie Mae made only small changes to its predictions for employment growth in this month’s forecast. Employment growth for Q4 2023 and Q1 2024 were revised lower while employment growth for Q2 and Q3 2024 were revised higher. The lowest rate of employment growth during the forecast window remained at Q2 2025, although the predicted monthly rate of growth for that quarter was revised upward from 60,000 jobs to 72,000 jobs.

Compared to last month’s forecast, the expected full year forecast for employment growth in 2024 was revised from a gain of 1,500,000 jobs to a gain of 1,600,000 jobs. The employment growth forecast for 2025 was left unchanged at a gain of 900,000 jobs.

The Fannie Mae March forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.