Rescue capital is available for apartment borrowers that need it, but relatively few owners of over-leveraged apartment properties are willing to pay the price—so far.

High interest rates have stranded the owners of over-leveraged apartment properties worth billions of dollars.

Since interest rates rose, the value of these properties has shrunk so much that many properties can’t afford to refinance. Many lenders want borrowers to come up with more equity before they will write a new loan.

Investors—from family offices to private equity debt funds—are rushing to rescue these properties.

But the deals are proving harder to close than anyone thought. Long-term interest rates have crept higher all spring. Short-term rates have stayed relentlessly high. Slow growth in apartment rents is not helping. And banks keep bending their own rules to give overleveraged borrowers more time to cling to old loans that have often already expired.

“The amount of rescue capital that people put together is not going to be utilized to the degree that people thought,” said Dave Borsos, vice president of capital markets for the National Multifamily Housing Council.

Rescue capital deals hard to find

Investors have made a few rescue capital investments in over-leveraged apartment properties—even if they aren’t closing nearly as many deals as they anticipated.

In January 2024, mortgage banking firm Dekel Capital closed a $4 million rescue capital loan to a new apartment building in the upscale Toluca Lake neighborhood of Los Angeles. The developer had struggled to find a new permanent loan large enough to pay off the existing construction loan. Workers finished the 60-unit property in late 2023. More than half of those apartments had already been pre-leased.

A $4 million mezzanine loan from Dekel Capital filled a gap in the permanent financing for the community, which also received a new, permanent bank loan. The whole package covers 72 percent of the current value of the property.

Dekel Capital had planned to make $100 million in “rescue capital” investments like this one in 2024, using capital typically provided by family offices. But by the beginning of May 2024, Dekel had only closed its one rescue capital investment in the Toluca Lake asset.

“It’s been tough,” said Shlomi Ronen, principal with Dekel. “It’s just been taking longer for a lot of these deals to work their way through the system.”

In May, Dekel still expected to close $50 million in rescue capital deals by the end of 2024—half of its original goal. Dekel aims to provide between $3 and $7 million to each of these deals, providing an internal rate of return (IRR) to its investors of 14 percent to 16 percent. That could provide rescue capital to perhaps a dozen apartment properties.

On the other side of the country, ANAX Real Estate Partners has been working with four different private equity funds eager to provide rescue capital to apartment properties. Each of the four funds has raised more than $30 million specifically to make rescue capital investments. ANAX searched the New York metro area for overleveraged properties to present to these potential rescue capital investors.

“The returns weren’t coming close to the requirement of the rescue capital,” said Eric Brody, founder and principal of ANAX. The investors wanted an internal rate of return of 18 to 22 percent from their rescue capital investments. “Right now, what the borrowers say they need and what the funds say they need for return aren’t matching up.”

In the meantime, ANAX is working with a different kind of distressed apartment property. It has partnered with a private equity debt funds that has seized a partially-finished building. The original developers failed to finish construction. ANAX is now restarting construction on a 15-unit, mid-rise apartment building in Queens.

It’s not exactly rescue capital, because the original sponsors of these apartment investments have been kicked out of the lifeboat, so to speak.

“I’m not seeing as many deals as I would have expected in the rescue space,” said ANAX’s Brody. “I’m seeing one-off deals. I’m not seeing anyone programmatically really owning that space.”

Billions in loans potentially distressed

Apartment borrowers are struggling to make the payments on billions of dollars in loans to over-leveraged apartment properties. Their fight to keep their properties could create opportunities for new investors.

“We are seeing—and will continue to see—opportunities in the ‘rescue capital’ space,” said Stefan Weiss, senior economist with CBRE Econometric Advisors.

Loans to apartment properties totaling $9.98 billion were “distressed” in the first quarter of 2024, according to MSCI, formerly known as Real Capital Analytics. MSCI counts these properties as “troubled” because of problems like announcements of bankruptcy, default, court administration, etc. That might sound like a huge volume of distressed loans, but it is 26 percent of the $38.18 billion in distressed loans to office properties.

More apartment properties might soon fall into serious trouble.

Another $56.1 billion in apartment loans were “potentially distressed” in the first quarter, according to MSCI. These properties suffer from problems like delinquent loan payments, forbearance and slow lease up. In comparison, loans of office properties totaling just $50.26 billion were “potentially distressed” over the same period.

So far, relatively few of these properties have been seized by lenders.

“As a lender, your last resort is to go in and take property,” said NMHC’s Borsos. “Even on the office side, lenders have not been doing it very much.”

Many of these distressed properties were older apartment assets bought by investors with plans to renovate and raise the rents, according to Brian Good, managing partner of iBorrow, a mortgage real estate investment trust. About half of the new bridge loans iBorrow originates this year will refinance other loans that have not gone according to plan. “Their business plan went haywire,” said Good.

Early in the recovery from the coronavirus pandemic, interest rates and cap rates were still historically low, and rents for apartments rose quickly. After just two or three years of renovations many investors could sell or refinance their properties based on the higher value created by the higher rents.

“Then the music stopped,” said Good. Costs like insurance began to rise quickly. Rent growth began to slow as many apartment markets became overbuilt. And interest rates began to rise as federal officials fought to slow down inflation.

“They couldn’t hit the revenue numbers,” said Good. “Their expenses got out of whack and then the lending market shut down and floating-rate interest rates went from 4 percent to 8 or 9 percent.”

In March 2022, the Federal Reserve began to raise its benchmark interest rate from close to zero. Eventually the Fed Rate rose to more than 5 percent and stayed there. The interest rates for many short-term, floating-rate construction loans more than doubled.

Long-term interest rates also rose, though not as dramatically. The yield on 10-year Treasury bonds rose from less than 2 percent in early 2022 to nearly 5 percent in 2023.

Higher interest rates cut into the value of apartment properties. Potential buyers were unwilling to pay high prices, but few sellers were willing to lower their prices. The number of transactions shrank as much as 50 percent in 2023 and cap rates shrank more than 100 basis points for the few deals that closed, according to MSCI.

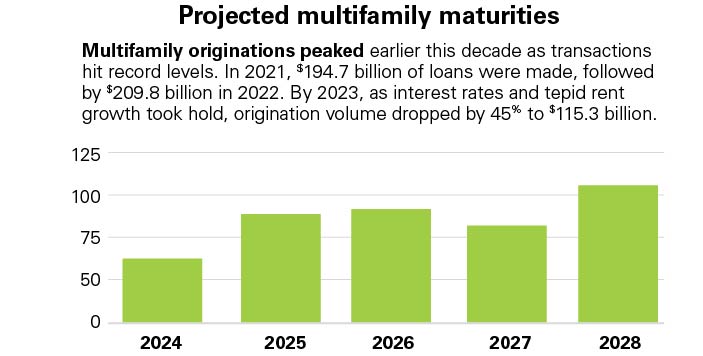

Borrowers who are close to the end of the term of a construction loan or a bridge loan often don’t have enough proven income to qualify for a new loan big enough to pay off the loan that is expiring. A funding gap of $34 billion is materializing for the apartment loans that will mature from 2024 to 2028 across the U.S., according to CBRE.

To put this problem into perspective, the $34 billion funding gap represents only 2 percent of the roughly $1.685 trillion in multifamily originations from 2018 to 2022. It’s also a fraction of the debt-funding gap from the Global Financial Crisis (GFR), where the multifamily had a nearly $190 billion gap, said CBRE.

Banks in general did not seize billions of dollars in apartment buildings during the GFR —and they seem unlikely to in the current crisis.

“The conversations with most lenders that we are privy to have been collegial,” said Dekel’s Ronen.

Lenders have already let borrowers extend the terms for hundreds of billions of dollars in commercial and multifamily loans. “There has definitely been a willingness to cooperate with borrowers,” said Ronen.

Set to mature in 2024 are $929 billion in commercial and multifamily loans, according to the MBA’s 2023 Commercial Real Estate Survey of Loan Maturity Volumes, released in February 2024.

That volume of maturing loans kept growing throughout 2023. Borrowers and lenders appear to have negotiated short-term extensions for more than $300 billion in commercial and multifamily loans that had originally been set to mature in 2023. Back in 2022, before those loans received extensions, just $600 billion in commercial and multifamily loans were set to mature in 2024, according to the 2022 MBA Commercial/Multifamily Loan Maturity Volumes.

“More than 83 percent of the 2023 maturities appear to have been extended,” said CBRE’s Weiss.

The challenge of rescue capital

Investing rescue capital in overleveraged apartments was always going to be difficult.

An attractive target would be an apartment community with a current valuation that is more than the existing loans on the property. But to refinance, the property would need more new equity that the existing sponsor and equity investors are willing to provide themselves. But those existing equity owners would have to be willing to subordinate their stake in the property to a new mezzanine loan or an investment or preferred equity.

In the past, vulture investors circled distressed properties, waiting for lenders to seize troubled assets like the partially-finished building ANAX is working on in New York City. “We’re seeing a ton of lenders, just having conversations,” said Brody.

Other over-leveraged borrowers have been forced to sell as lenders threaten foreclosure. Investors spent nearly $1 billion to buy distressed apartment properties in the first quarter of 2024, according to MSCI.

Many more over-leveraged properties are trapped in a kind of limbo as borrowers struggled to keep their properties and lenders allow them to extend expired loans.

“Those opportunities will be significantly more limited than current expectations given the propensity for extensions among borrowers, lenders and regulators,” said Stefan Weiss, senior economist with CBRE Econometric Advisors.

Even if the value of a property had shrunk to less than amount owed on the existing loan, some borrowers expected that interest rates—and cap rates—would soon fall and that the value of their properties would get back to “normal.”

More recently, officials at the Federal Reserve signaled that the long fight against inflation might finally be over. They suggested they might potentially cut the Fed Rate three times in 2024. Bond markets anticipated even deeper cuts in 2024 totaling a 150-basis-point reduction to the Fed Rate.

“Rates were supposed to drop three times this year and now they may not drop at all,” said Good.

In spring, a few reports on inflation came in slightly higher than expected. Federal Reserve officials signaled in their meeting in April 2024 that they are unlikely to cut their benchmark interest rate anytime soon. “Everybody’s been wrong,” said Borsos.

Rescue capital deals that had seemed possible at the beginning of 2024 slipped once again out of reach.

As federal official kept short term rates high, the yield on 10-year Treasury bonds rose back towards 4.5 percent. Months before, long-term interest rates for permanent loans had eased downwards. The 10-year sank below 3.9 percent at the end of 2023, the lowest it had been in months.

A growing number of economists and dealmakers agree the long-term rate will eventually stabilize near historic averages. Over the last four decades, the yield on 10-year Treasury bonds averaged about 4.5 percent. But it is still not clear how high—or low—interest rates will be over the next year.

“You can’t determine value when interest rates are so dynamic,” said Brody. “If we knew the value of these properties, we could start transacting. We could take our losses, we could take our wins.”