From developers pivoting away from stalled markets to value-add investors navigating tighter margins, the multifamily sector is adjusting to a new reality—one shaped less by interest rates and more by housing need, supply imbalances, and affordability pressures.

Investor sentiment is evolving in select markets, with cautious optimism replacing early 2023 anxiety. But make no mistake, this is a reset, not a recovery.

As Gray Capital co-founder, president and CEO Spencer Gray puts it, “Reset means we’re not just watching prices climb back. It means performance expectations, valuation assumptions, and even what a good deal looks like all need to be redefined.” This echoes research from John Burns, which characterizes the current moment as a “multifamily reset” rather than a rebound.

Outcomes remain highly market specific. CBRE’s latest U.S. Cap Rate Survey shows that cap rates for Class A “core” assets compressed in five major metros—Austin, Chicago, Dallas, Los Angeles, and Tampa—during the first half of 2025. That suggests renewed demand for stabilized, high-quality assets, as investors accept lower yields in exchange for long-term stability.

The value-add segment is also attracting fresh attention. Cap rates on acquisitions declined in five U.S. regions during the same period, signaling investor confidence in renovation and operational improvement strategies. But the picture remains uneven. In Denver, for example, value-add cap rates rose by 63 basis points, pointing to caution amid localized headwinds like softening demand and elevated supply.

Development struggles amid structural shortages

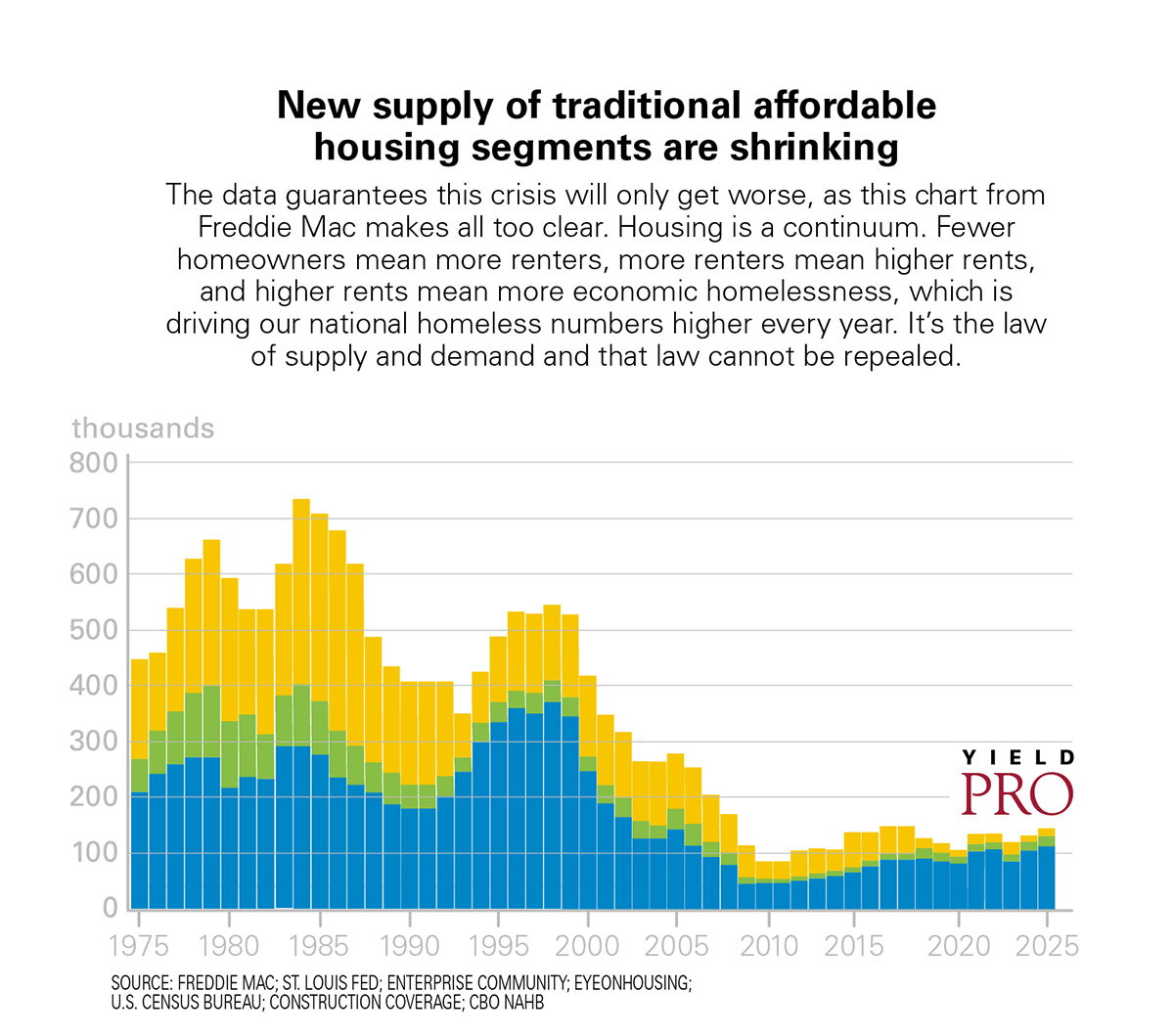

While value-add buyers are finding opportunities, developers face growing constraints. Capital markets remain tight, and the economics of new construction are deteriorating in many regions. Costs for land, labor, and materials continue to rise, while restrictive zoning and prolonged permitting timelines add delays and uncertainty, especially in semi-urban or high-demand Class A locations.

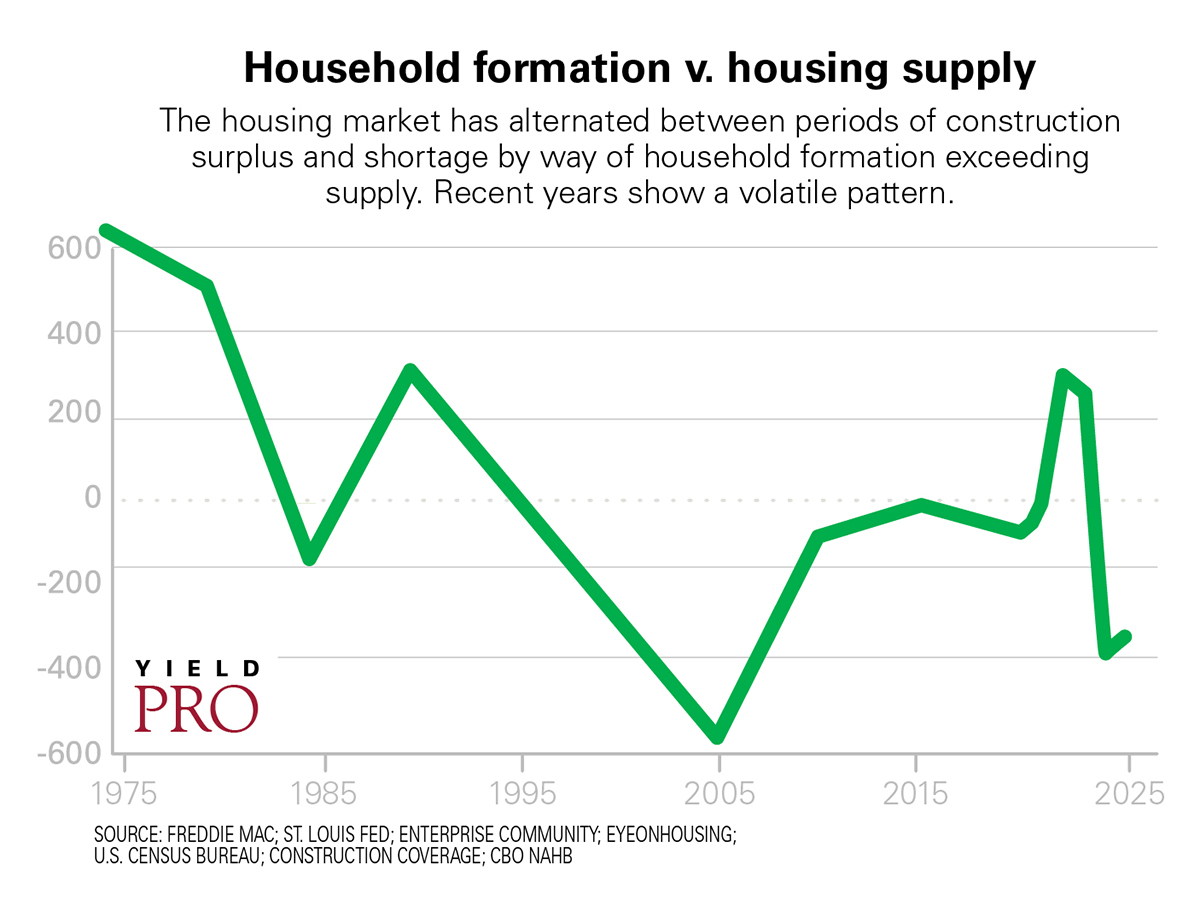

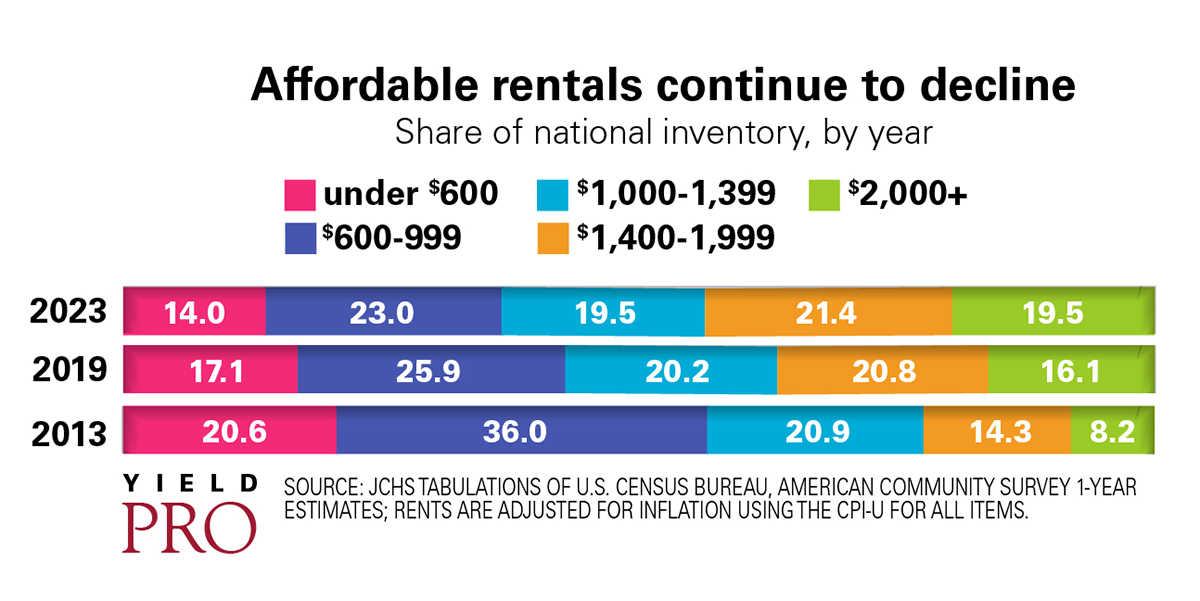

The need for housing is clear. The U.S. Chamber of Commerce reports a shortage of over 4.5 million rental homes. Meanwhile, the rental housing stock is aging: the median age is now 44 years, up from 34 two decades ago, according to the Harvard Joint Center for Housing Studies. Yet building affordable or workforce units is increasingly difficult without subsidies.

The need for housing is clear. The U.S. Chamber of Commerce reports a shortage of over 4.5 million rental homes. Meanwhile, the rental housing stock is aging: the median age is now 44 years, up from 34 two decades ago, according to the Harvard Joint Center for Housing Studies. Yet building affordable or workforce units is increasingly difficult without subsidies.

New and evolving regulations add further friction. States like California and New York impose high entry barriers. Rent control policies In California, a new law (AB 130) freezes most building code updates until 2031, except for certain health and safety standards, further dampening innovation and efficiency.

Some developers are adapting. Wood Partners, ranked number three on the National Multifamily Housing Council’s Top 50 Developers list, exited the West Coast in 2024 and shifted focus to the Southeast, citing lower regulatory friction and stronger demand for “attainable” housing targeting essential workers. In April, they broke ground on three projects in Georgia, Tennessee, and Florida—markets where opportunity still outweighs obstacles.

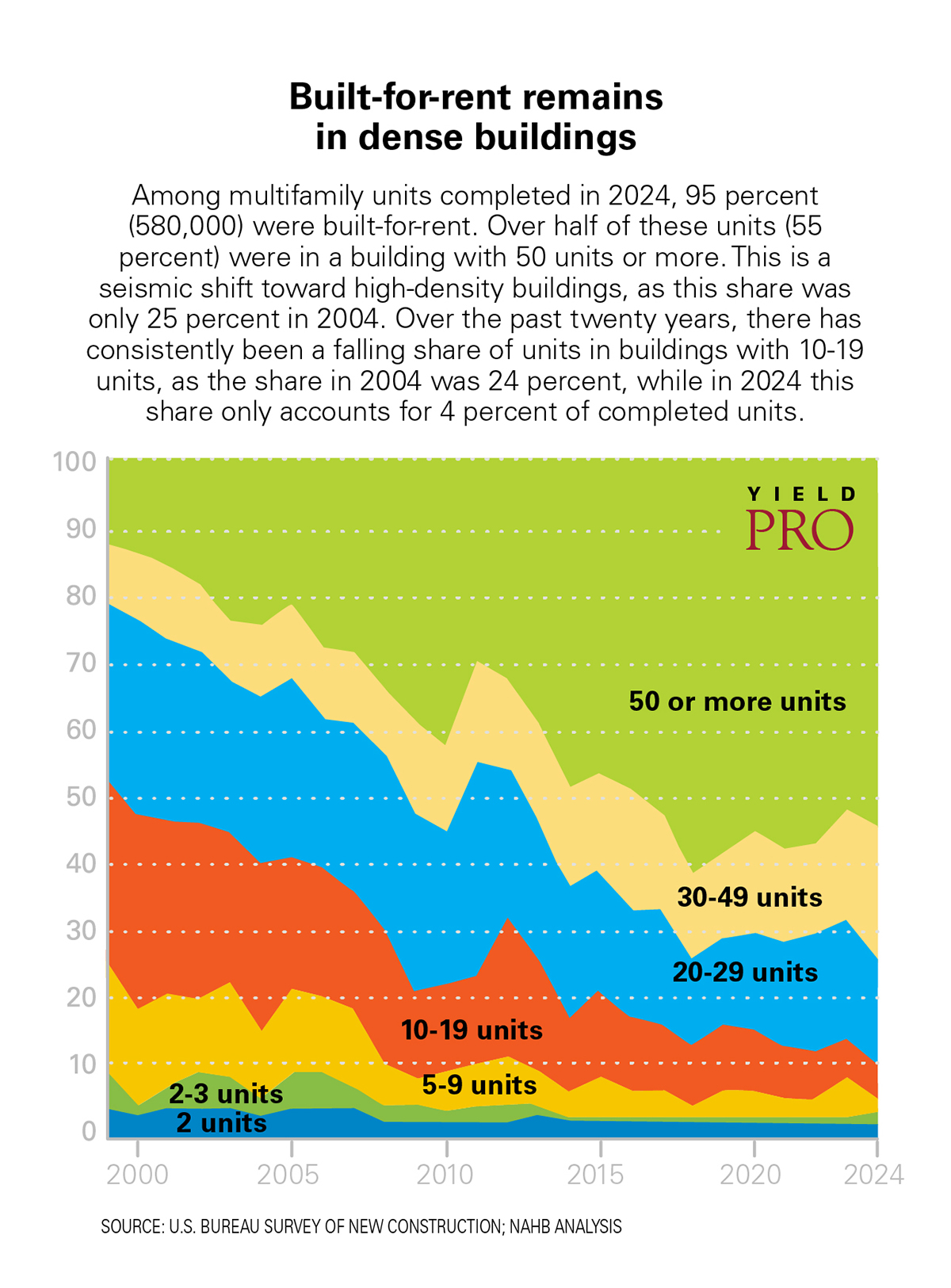

It’s officially a renter’s market in many metros, with over 600,000 new units delivered in 2024, the most since 1986. Rents are down nationally by 0.8 percent year-over-year. Absorption is slow, and landlords are competing more aggressively to fill units.

But this slowdown and reset is far from uniform. The Sunbelt, which absorbed the brunt of recent deliveries, is grappling with oversupply, declining rents, and widespread concessions. In contrast, the Midwest and Northeast are showing signs of stabilization.

But this slowdown and reset is far from uniform. The Sunbelt, which absorbed the brunt of recent deliveries, is grappling with oversupply, declining rents, and widespread concessions. In contrast, the Midwest and Northeast are showing signs of stabilization.

“The Sunbelt is still digesting a flood of new supply,” said Matt Bastnagel, director of communications and marketing at Gray Capital. “But the Midwest and Northeast are further along in the reset. Fundamentals there are improving, and sentiment is stabilizing.”

National averages often obscure local realities. Take Austin: rents are down nearly seven percent year-over-year, yet the city presents a classic tale of two markets. Over the past year, Austin delivered a record 26,800 new units—an 8.5 percent increase in total inventory. But contrary to expectations, Class A occupancy rose to 95.1 percent in Q2—effectively full.

While Class B and C properties struggle with falling rents and rising concessions, top-tier buildings are thriving. This is the flight to quality in action, driven by robust population and job growth, particularly in high-income sectors, and persistently high for-sale home prices. High-earning professionals, priced out of homeownership or opting to rent by choice, are flocking to new, amenity-rich properties without compromise.

While Class B and C properties struggle with falling rents and rising concessions, top-tier buildings are thriving. This is the flight to quality in action, driven by robust population and job growth, particularly in high-income sectors, and persistently high for-sale home prices. High-earning professionals, priced out of homeownership or opting to rent by choice, are flocking to new, amenity-rich properties without compromise.

Even in oversupplied markets, premium, well-located assets can command strong demand. It’s a reminder that you can’t generalize across a metro. Submarket fundamentals and asset class distinctions matter most.

Meanwhile, pockets of strength in Indianapolis, Pittsburgh, and smaller secondary markets are emerging.

Distress deals, cyclical opportunity

Even with generally healthy multifamily fundamentals, distress is emerging at the margins. Properties that secured short-term loan extensions between 2022 and 2024 without improving performance are now out of runway. Undercapitalized Class C assets or those that failed to execute renovations are especially vulnerable.

As Chicago-based Essex Capital Markets notes, the “extend-and-pretend” era is ending. Properties facing expiring rate caps or refinancing pressures may hit the market at discounted pricing. Mesirow Financial recently closed a $1.245 billion fund targeting these opportunities, and other value-add funds are raising capital in anticipation of motivated sellers by late 2025.

Debt funds are also active in the space, so long as buyers bring additional equity and a de-risked business plan. Overbuilt Sunbelt metros and older assets needing rehab are likely acquisition targets.

Cap rate dynamics further support the “buy now” thesis. With stabilized cap rates hovering in the mid-five percent range and mild compression forecasted into 2026, today’s acquisitions could yield upside from both NOI growth and valuation normalization. Essex notes that soft pricing may not last. “There’s a sense that this window could close by 2026.”

Rates matter—but they’re not the whole story

“Interest rate uncertainty is the bad thing hanging over the market,” said Bastnagel. “Arguably worse than trade wars.” While investors had hoped for rate cuts in 2025, inflation data remains stubborn, and the political fog post-2024 election continues to cloud policy direction.

Still, fundamentals remain strong. Matt Vance, head of multifamily research at CBRE, argues that affordability—not rates—is the primary driver. “Homeownership remains out of reach for many households due to high prices and credit barriers. That keeps rental demand strong, regardless of financing costs.”

And, in markets like Austin with a high concentration of institutional-grade (often luxury) units, applicants are exhibiting less concern about affordability compared to other segments of the population, an observation linked to the idea that increasing the supply of housing, including market-rate and even higher-end units, can ultimately improve affordability across the housing market through a process called “filtering.”

Vance notes that supply is the solution to affordability challenges. As an example, Austin rents are now only 6.5 percent higher than 2019—below inflation.

In this light, interest rates function more like temporary headwinds than systemic constraints. Operators have adjusted, with many now focused on leaner operations and recalibrated rent expectations. “The era of five percent annual rent growth is over,” Gray said. “Now it’s about delivering value and managing risk.

Selectivity in action

Gray Capital’s disciplined approach reflects this reality. After a year-long search, the company secured a single deal for 2025—a testament to their commitment to underwriting rigor and market fundamentals. “We love to do multiple deals a year,” said Grey, “but this market won’t let you overpay. Deals must check all the boxes of location, metrics and investor interest.”

Their latest acquisition is a textbook example of a high-quality A-Class property in a growing Indianapolis submarket experiencing 20 percent population growth since 2010, with solid household incomes and expanding retail and medical infrastructure. A recently passed Indiana tax bill reducing property tax assessments by 35 percent over six years further sweetened the deal, a hidden advantage uncovered only through thorough due diligence that gave Gray Capital a strategic edge few others had recognized.

Importantly, Gray Capital is putting substantial capital at risk, investing 10 percent of the equity themselves and offering investors an 80-20 profit split — far more favorable to limited partners than many competitors’ fee-heavy structures. They are underwriting conservatively, targeting mid-to-high five percent cap rates, while leveraging operational efficiencies including AI-driven leasing and centralized management. “It’s a steady asset with upside, a solid base case with real growth potential,” Grey noted.

Concessions: The hidden signal

Concessions are widespread in the current market, particularly among new Class A assets in oversupplied metros. But as Gray explained on his most recent podcast, they’re less about weak demand and more about lease-up velocity and interest carry.

“We’re seeing large one-time concessions—like $1,000 gift cards—not because demand is weak, but because developers are racing to stabilize,” Gray said.

These incentives also serve accounting purposes. “Gift cards don’t show up on the rent roll,” he noted. “They’re sometimes booked as marketing expenses, which makes financials look stronger when selling or refinancing.”

He noted that in some markets, concessions are already tapering off. “We underwrote for concessions, but our competitive survey showed very few still offering them. That suggests we may be exiting that phase in certain submarkets.”

This aligns with RealPage Analytics, which reports that while concession values remain high, usage is dropping, indicating that some submarkets are regaining their footing.

Realistic expectations lasting opportunity

David Sherer, CEO of Origin Investments, urges investors to calibrate expectations to the new environment. “We’re seeing a notable imbalance between supply and demand,” Sherer said. “Starts are down, but demand remains robust. That supports strong fundamentals.”

Origin targets markets in the Southeast and Southwest with strong demographics and barriers to new supply. For Sherer, the long view is clear: “Multifamily isn’t a short-term trade. But for those with patience, it can be a resilient component of a diversified portfolio.”

Spencer Gray echoes that sentiment, “This is a moment to be selective, not reactive. You buy low in uncertainty and sell high when confidence returns.”

The key is discipline. Investors must underwrite conservatively, manage risk proactively, and lean into operational strength. “Opportunities come through work,” Gray said. “Not just from passively watching values rise.”

Smart capital will be patient—but ready.