3 projections for the future

Prior to the COVID-19, the U.S. was in an historic economic expansion. Without this boom preceding the crisis, life for Americans would likely have been much worse. It stands to reason that the nation can pick up the pieces and move forward on the gains made just months ago. But how soon?

The fallout of COVID-19 has—momentarily—upended a roaring economy, overshadowed the psyche of a nation and shaped how the U.S. does business for years to come.

Uncertainty is a rough road for businesses. Economic projections are beginning to emerge from the brightest minds in the nation.

Here are three economic recovery scenarios for the remainder of 2020 by The Conference Board, a non-profit based in New York, N.Y.

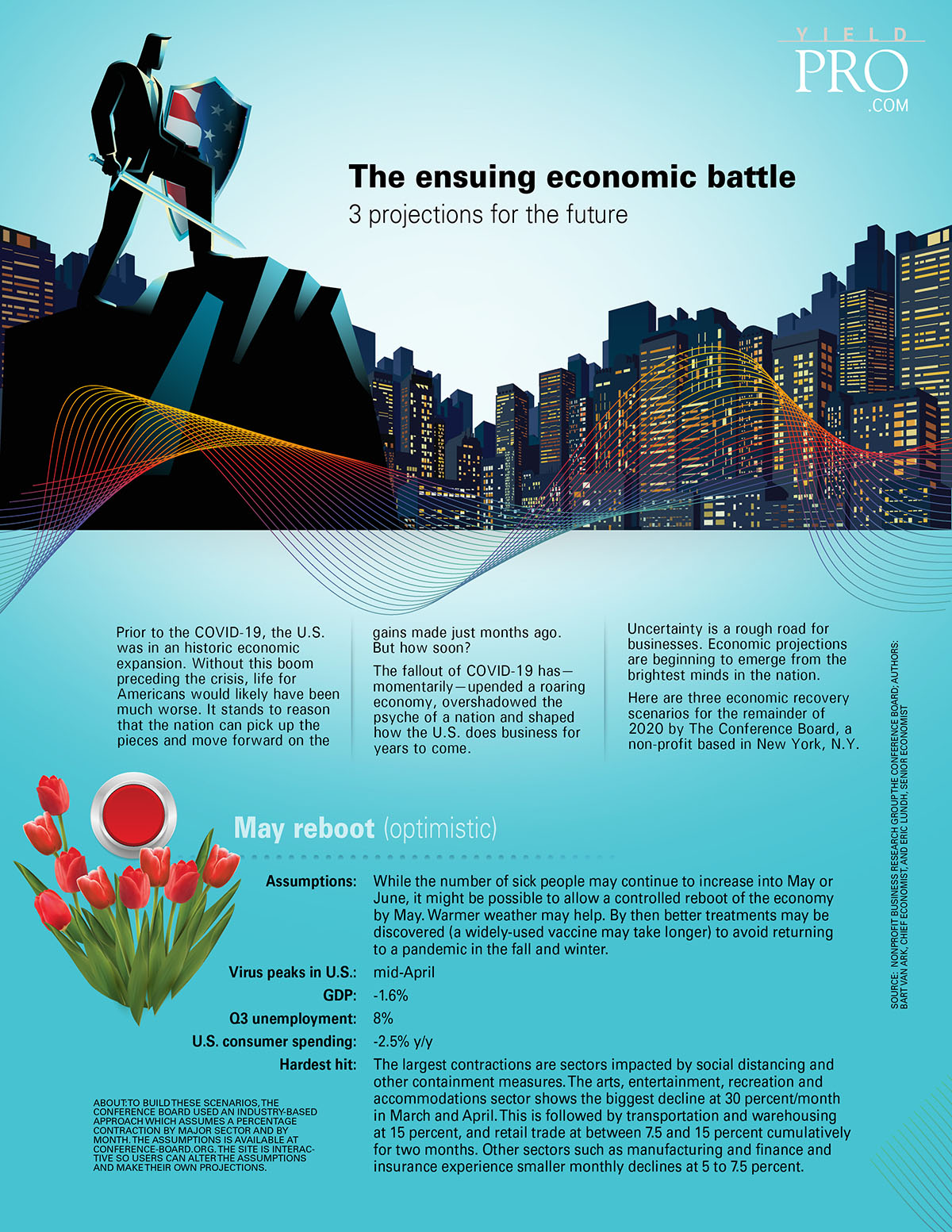

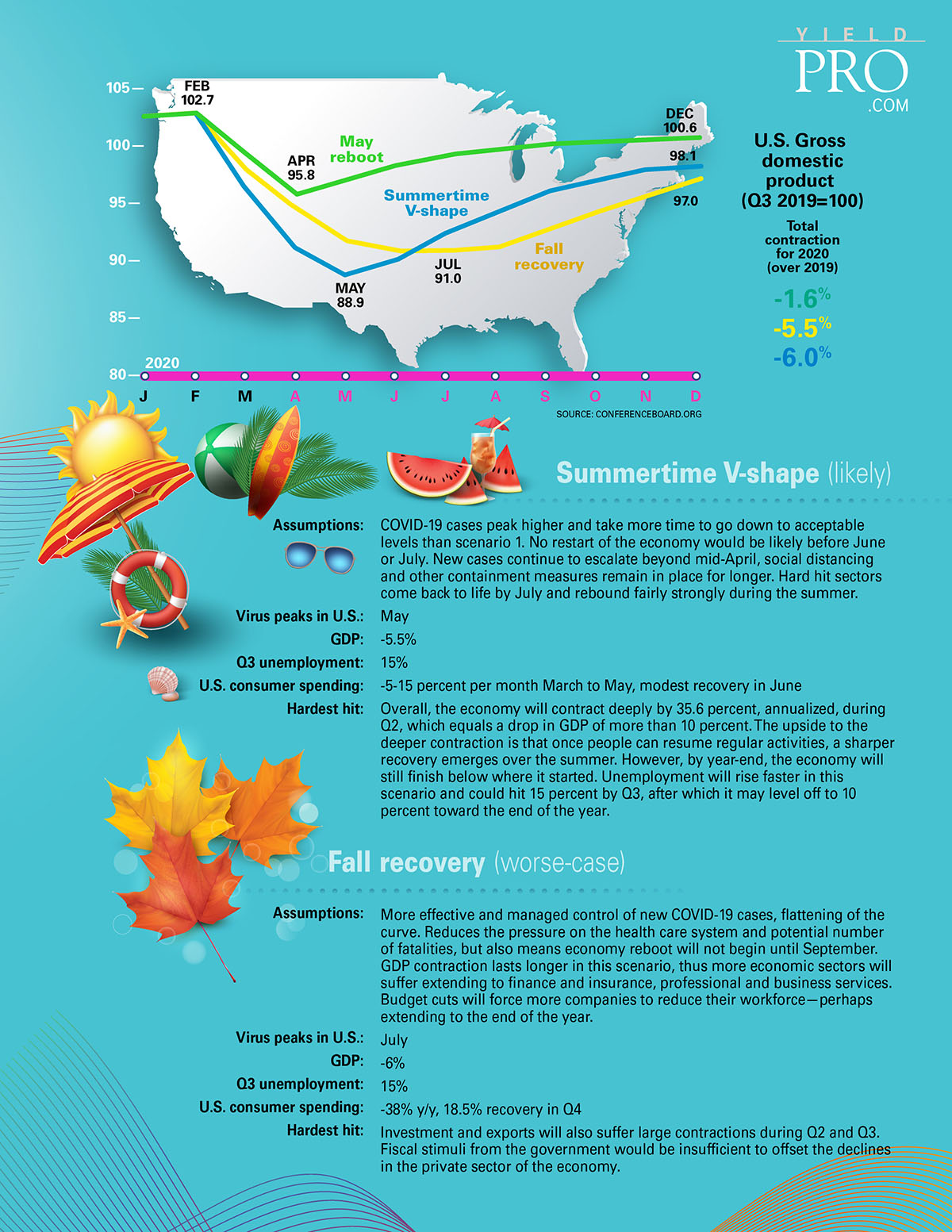

May reboot (optimistic)

Assumptions:

While the number of sick people may continue to increase into May or June, it might be possible to allow a controlled reboot of the economy by May. Warmer weather may help. By then better treatments may be discovered (a widely-used vaccine may take longer) to avoid returning to a pandemic in the fall and winter.

Virus peaks in U.S.:

mid-April

GDP:

-1.6%

Q3 unemployment:

8%

U.S. consumer spending:

-2.5% y/y

Hardest hit:

The largest contractions are sectors impacted by social distancing and other containment measures. The arts, entertainment, recreation and accommodations sector shows the biggest decline at 30 percent/month in March and April. This is followed by transportation and warehousing at 15 percent, and retail trade at between 7.5 and 15 percent cumulatively for two months. Other sectors such as manufacturing and finance and insurance experience smaller monthly declines at 5 to 7.5 percent.

Summertime V-shape (likely)

Assumptions:

COVID-19 cases peak higher and take more time to go down to acceptable levels than scenario 1. No restart of the economy would be likely before June or July. New cases continue to escalate beyond mid-April, social distancing and other containment measures remain in place for longer. Hard hit sectors come back to life by July and rebound fairly strongly during the summer.

Virus peaks in U.S.:

May

GDP:

-5.5%

Q3 unemployment:

15%

U.S. consumer spending:

-5-15 percent per month March to May, modest recovery in June

Hardest hit:

Overall, the economy will contract deeply by 35.6 percent, annualized, during Q2, which equals a drop in GDP of more than 10 percent. The upside to the deeper contraction is that once people can resume regular activities, a sharper recovery emerges over the summer. However, by year-end, the economy will still finish below where it started. Unemployment will rise faster in this scenario and could hit 15 percent by Q3, after which it may level off to 10 percent toward the end of the year.

Fall recovery (worse-case)

Assumptions:

More effective and managed control of new COVID-19 cases, flattening of the curve. Reduces the pressure on the health care system and potential number of fatalities, but also means economy reboot will not begin until September. GDP contraction lasts longer in this scenario, thus more economic sectors will suffer extending to finance and insurance, professional and business services. Budget cuts will force more companies to reduce their workforce—perhaps extending to the end of the year.

Virus peaks in U.S.:

July

GDP:

-6%

Q3 unemployment:

15%

U.S. consumer spending:

-38% y/y, 18.5% recovery in Q4

Hardest hit:

Investment and exports will also suffer large contractions during Q2 and Q3. Fiscal stimuli from the government would be insufficient to offset the declines in the private sector of the economy.