Fannie Mae’s October economic and housing forecasts predict that the economy will briefly return to growth in Q3 before entering a recession in early 2023. The downturn is expected to lower housing starts next year.

Fannie Mae sees earlier downturn, earlier recovery

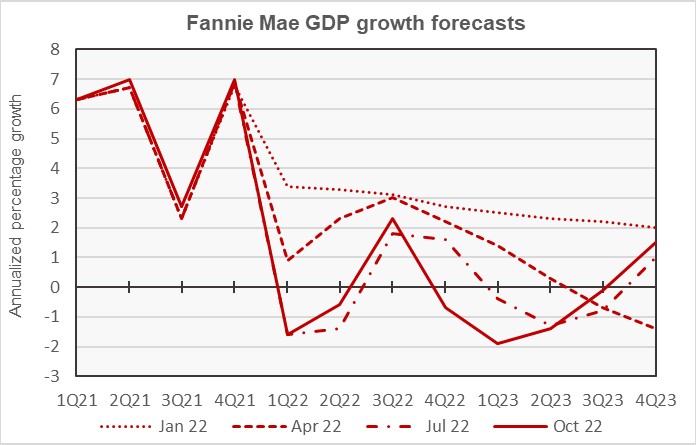

The first chart, below, shows Fannie Mae’s current forecast for the Gross Domestic Product (GDP) growth, along with three other recent forecasts.

Fannie Mae’s forecasters were among the first to predict an economic downturn in 2023 with their April 2022 forecast. In their subsequent forecasts, they have moved both the date when they expect the downturn to begin and the date at which they expect growth to resume earlier. The October forecast anticipates that only Q3 will see positive GDP growth in 2022. GDP is expected to decline again in Q4 and not return to growth until Q4 2023.

The full-year forecast for GDP growth in 2022 is now -0.1 percent, down from a no-growth forecast last month. The full-year GDP growth forecast for 2023 was left unchanged at -0.5 percent.

Inflation forecast higher for longer

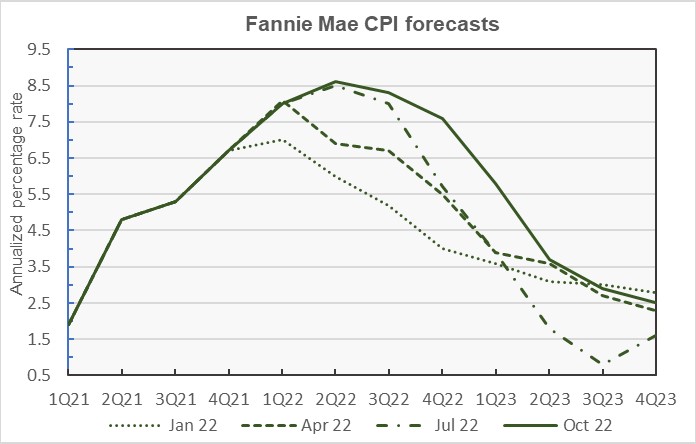

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Forecasters from Fannie Mae and elsewhere have consistently underestimated the persistence of the inflation now gripping the economy. The chart shows that Fannie Mae’s forecasters have again revised their inflation forecast higher for Q4 2022 through Q4 2023. They project that year-over-year inflation will drop to only 2.5 percent by the end of 2023, still above the Fed’s 2 percent target.

The October forecast for year-over-year CPI growth in Q4 2022 was revised upward from 7.2 percent in last month’s forecast to 7.6 percent. The year-over-year CPI forecast for Q4 2023 was revised upward from 2.0 percent to 2.5 percent.

Employment growth forecast lower

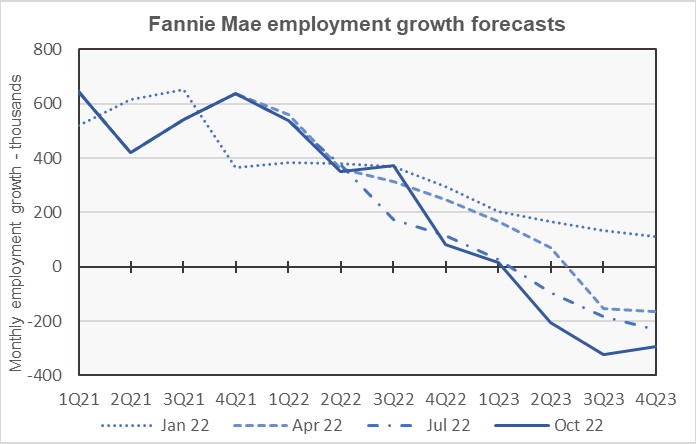

The next chart, below, shows Fannie Mae’s current forecast for the growth in employment, along with three other recent forecasts.

Fannie Mae’s analysts believe that the Fed is focused on the tightness of the labor market as a driver of inflation. Therefore, they believe that the Fed will act to loosen up this market despite the Fed’s mandate to maintain full employment.

The remarkable recent strength of the labor market is reflected in Fannie Mae actually raising their forecast for employment growth in Q4 2022. However, as rising interest rates cause economic growth to slow and to turn negative in 2023, Fannie Mae’s forecasters expect employment growth to decline, turning negative by Q2 2023.

The full-year forecast for employment growth in 2022 was revised upward from 3.9 million jobs in last month’s forecast to 4.0 million jobs. The full-year employment forecast for 2023 was revised downward from a loss of 2.0 million jobs to a loss of 2.4 million jobs. For reference, the U.S. economy currently employs nearly 159 million people.

Multifamily starts forecast to fall in 2023

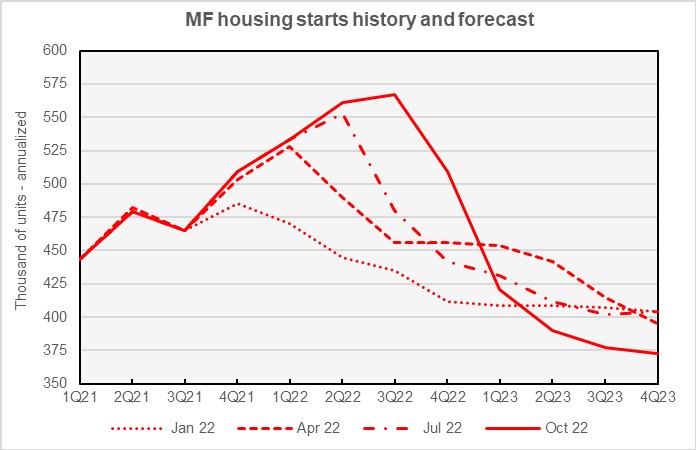

The current forecast for multifamily housing starts is shown in the next chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

Fannie Mae’s forecasters revised the forecast for multifamily starts in Q3 2022 higher in this month’s forecast reflecting the strong current momentum for multifamily housing construction. However, the multifamily starts forecast for every quarter from Q4 2022 through Q4 2023 was revised lower in the October forecast.

Fannie Mae now expects multifamily starts (2+ units per building) for 2022 to come in at 542,000 units, unchanged from the level forecast last month. The forecast for multifamily starts in 2023 is now 390,000 units, down 31,000 units from the level forecast last month.

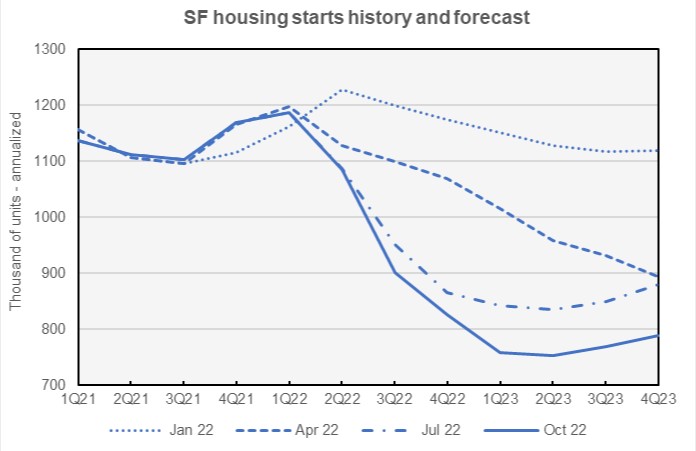

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Fannie Mae’s forecasters now expect the rate of single-family starts to decline more slowly in the last two quarters of 2022 than they expected last month. However, they now expect the level of starts to be lower throughout 2023 than they projected last month.

Fannie Mae now expects single-family starts to be 1,001,000 units in 2022, up 25,000 units from the level forecast last month. However, Fannie Mae lowered their forecast for single-family starts in 2023 by 34,000 units to a level of 768,000 units.

Commentary looks at concessions

The Multifamily Economic and Market Commentary for this month focuses on the health of the multifamily rental market as reflected in the percentage of units offering concessions and the sizes of the concessions being offered. The portion of units offering concessions has dropped below the level existing before the pandemic and well below the level existing during the pandemic. However, the sizes of concessions offered has not declined significantly from the elevated level it reached during the pandemic. Currently, about 5.3 percent of units offer concessions with an average value of 7.7 percent of rent.

The report also offers information of concession rates in 10 major metros, with New York offering the highest concession rate while Phoenix offers the lowest. It also notes that class A properties offer concession on a higher percentage of their units and at a higher concession rate than do class B or C properties.

The Fannie Mae forecast discussion can be found here. There are links on that page to the detailed forecasts and to the commentary.