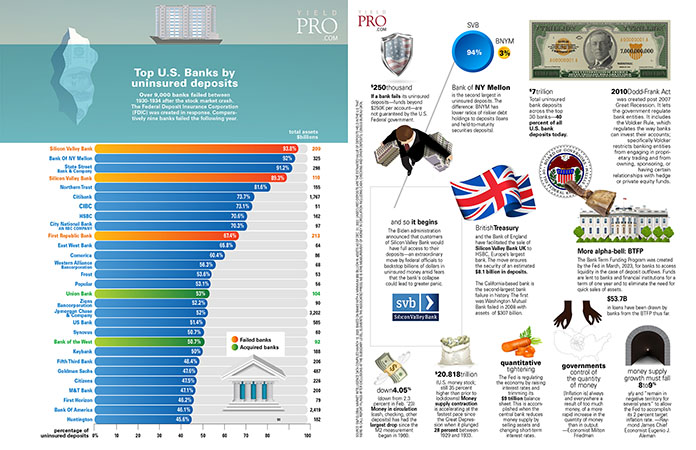

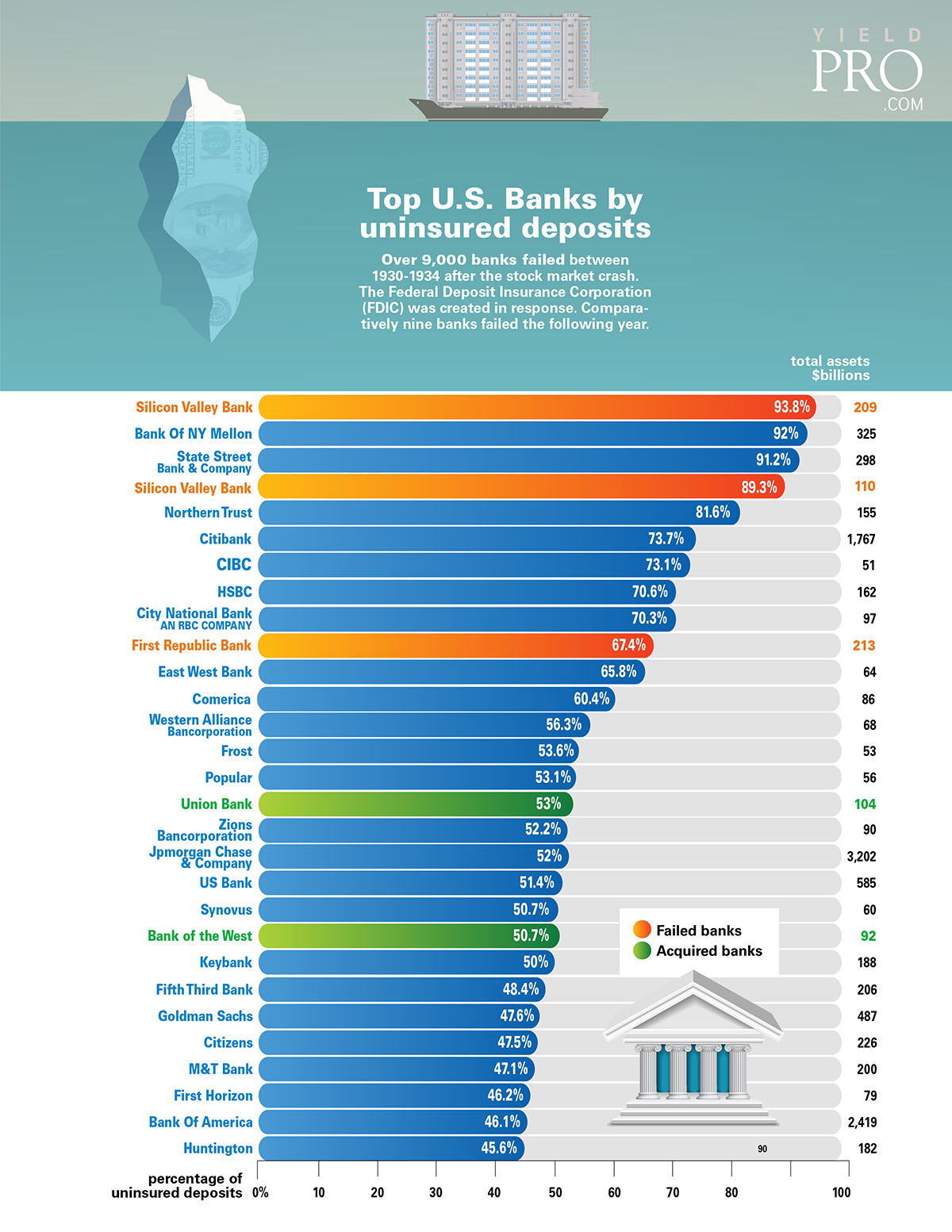

Over 9,000 banks failed between 1930-1934 after the stock market crash. The Federal Deposit Insurance Corporation (FDIC) was created in response. Comparatively nine banks failed the following year.

$250 thousand

If a bank fails its uninsured deposits—funds beyond $250K per account—are not guaranteed by the U.S. Federal government.

Bank of NY Mellon

is the second largest in uninsured deposits. The difference: BNYM has lower ratios of riskier debt holdings to deposits (loans and held-to-maturity securities deposits).

$7 trillion

Total uninsured bank deposits across the top 30 banks—40 percent of all U.S. bank deposits today.

2010 Dodd-Frank Act

was created post 2007 Great Recession. It lets the government regulate bank entities. It includes the Volcker Rule, which regulates the way banks can invest their accounts; specifically Volcker restricts banking entities from engaging in proprietary trading and from owning, sponsoring, or having certain relationships with hedge or private equity funds.

And so it begins

The Biden administration announced that customers of Silicon Valley Bank would have full access to their deposits—an extraordinary move by federal officials to backstop billions of dollars in uninsured money amid fears that the bank’s collapse could lead to greater panic.

British Treasury

and the Bank of England have facilitated the sale of Silicon Valley Bank UK to HSBC, Europe’s largest bank. The move ensures the security of an estimated $8.1 billion in deposits.

The California-based bank is the second-largest bank failure in history. The first was Washington Mutual Bank failed in 2008 with assets of $307 billion.

More alpha-bell: BTFP

The Bank Term Funding Program was created by the Fed in March, 2023, for banks to access liquidity in the case of deposit outflows. Funds are lent to banks and financial institutions for a term of one year and to eliminate the need for quick sales of assets.

$53.7B

in loans have been drawn by banks from the BTFP thus far.

Down 4.05%

(down from 2.3 percent in Feb. ‘23)

Money in circulation (cash, checking, other deposits) has had the largest drop since the M2 measurement began in 1960.

$20.818 trillion

(U.S. money stock; still 35 percent higher than prior to lockdowns) Money supply contraction is accelerating at the fastest pace since the Great Depression when it plunged 28 percent between 1929 and 1933.

Quantitative tightening

The Fed is regulating the economy by raising interest rates and trimming its $9 trillion balance sheet. This is accomplished when the central bank reduces money supply by selling assets and changing short-term interest rates.

Governments control of the quantity of money

[Inflation is] always and everywhere a result of too much money, of a more rapid increase in the quantity of money than in output. —Economist Milton Friedman

Money supply growth must fall 8 to 9% y/y and “remain in negative territory for several years” to allow the Fed to accomplish its 2 percent target inflation rate.

—Raymond James Chief Economist Eugenio J. Aleman