Trilogy Investments Announces Construction for Build-To-Rent Community Rêve at Avondale Station Has Commenced

Trilogy Investment Company, a leader in Build-To-Rent (BTR) community development, announces that land development at Rêve at Avondale Station in Avondale, Arizona, is underway.

The 107-home BTR community, developed in collaboration with Pinnacle Partners, is...

Institutional Property Advisors closes $81 million Central Phoenix multifamily asset sale

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Peak 16, a 233-unit multifamily asset in Phoenix, Arizona. The $81.35 million sales price equates to $349,142 per unit.

“Core multifamily...

Colorado Springs apartments sold to Oak Coast Properties for $37.25 million

JLL Capital Markets announced that it has completed the $37.25 million sale and $28.5 million financing of the Cottonwood Terrace apartments located at 2864 Dublin Blvd in Colorado Springs, Colorado.

JLL worked on the behalf...

Institutional Property Advisors closes $64.65 million multifamily asset sale in Mesa

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Dana Park, a 222-unit apartment property in Mesa, Arizona. The $64.65 million sales price equates to $291,216 per unit.

“For over...

Thayer Manca Residential sells renovated Everett property for $40.2M

Thayer Manca Residential (TMR) has sold Atwater Clearing Apartments in Everett, WA for $40,200,000. Seattle-based TMR purchased the 198-unit, garden style property with a serene lakeside setting in September 2015 for $26,365,000.

With $4,200,000 in...

Mesa West Capital funds $49.2 million loan for recapitalization of Palm Beach County multifamily...

Mesa West Capital has provided a joint venture of ESG Kullen and Angelo Gordon with $49.24 million in first mortgage debt for the recapitalization of a 219-unit multifamily property in Palm Beach County, Florida.

The...

Stepp Commercial completes $2.85 million sale of a 9-unit value-add apartment property in Koreatown...

Stepp Commercial, a leading multifamily brokerage firm in the Los Angeles market, has completed the $2.85 million sale of a nine-unit apartment property located at 821 S. Gramercy Drive within the Koreatown submarket of...

Institutional Property Advisors completes two-property Fort Worth multifamily sale

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Alta LeftBank, a two-property multifamily asset totaling 589 units in the West 7th Street District of Fort Worth, Texas. The...

Cushman & Wakefield arranges sale of The Current at Coastal student housing community

Cushman & Wakefield announced that the commercial real estate services firm has arranged the sale of The Current at Coastal, an off-campus student housing community situated directly adjacent to Coastal Carolina University (CCU).

Travis Prince,...

$24 million multifamily value-add opportunity sale brokered by IPA

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announces the sale of Cambridge Court, a 286-unit value-add multihousing asset in Phoenix. The $24 million sales price equates to nearly $84,000 per unit.

“Positioned...

JLL Arranges $49.5M in Financing for Walnut Hill, a 177-Unit Luxury Rental Community in...

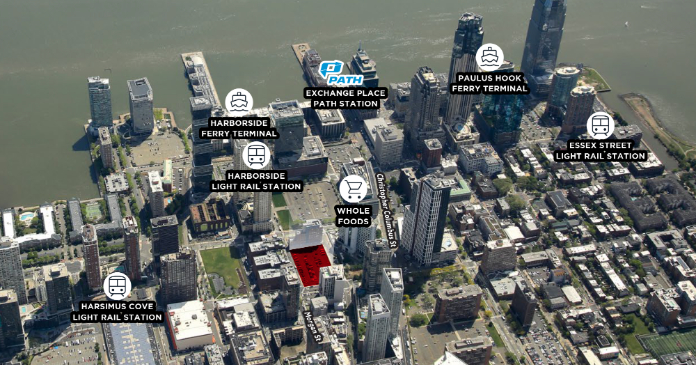

JLL Capital Markets announced that it has arranged the $49.5 million 10-year, fixed-rate financing of Walnut Hill, a newly constructed, luxury multi-housing rental community with 177 apartments located in Clark, New Jersey.

The property offers...

Cushman & Wakefield represents Chandler Residential in Metro Atlanta multifamily sale

Cushman & Wakefield announced the commercial real estate services firm has arranged the sale of Shadow Ridge, a 294-unit apartment community in Riverdale, Georgia.

Mike Kemether, Travis Presnell and James Wilber of Cushman & Wakefield...

JLL Capital Markets Arranged Financing for 700-site Audubon Estates in Alexandria Virginia

JLL Capital Markets announced that it has arranged the refinancing for Audubon Estates, a five-star, 700-site manufactured housing community located near Washington, D.C. in Alexandria, Virginia.

JLL worked on behalf of the borrower, Hometown America,...

Eagle Property Capital and Belay Investment Group announce disposition of Dallas-Fort Worth multifamily asset

Eagle Property Capital Investments, LLC (EPC), a vertically integrated real estate investment manager focused on the value-add multifamily space, announced the disposition of Woodchase & Clarendon, a 266-unit apartment community located in Irving, northwest of...

JLL closes sale, financing of 3 student housing properties

JLL announced today that it has closed the $17.7 million sale and $12.95 million in acquisition financing for a three-property student housing portfolio totaling 294 beds steps from Missouri State University in Springfield, Missouri.

JLL...