Preserving affordable housing in the Trump era

The United States is experiencing a rental housing crisis. There is a shortage of affordable housing, and many renters struggle to pay rent. Making matters worse, thousands of the nation’s affordable housing units are...

New metrics make Midwest investment attractive

Recently, the Midwest has shown surprising growth and economic resilience, making this region an attractive candidate for multifamily development, investment and general interest.

Often considered the slowest growing region in the U.S., the Midwest has...

Opportunity Zones: A path forward

Opportunity Zones (OZs) have emerged as a significant tool in driving investment into underdeveloped areas, offering a compelling case for their continuation and expansion. Since their inception in 2017, OZs have attracted nearly $100...

Rents fall behind inflation

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (September 2021:...

The price of disorder

I was once pitched a deal in the heart of the Amazon—Manaus, Brazil. What was I buying? Firstly, a commercial asset. But I couldn’t shake my concern around governance. The sanctity of a contract...

Millennials rising

Millennials are now wealthier than previous generations were at their age. They can’t believe it either.

The median household net worth of older millennials, born in the 1980s, rose to $130,000 in 2022 from $60,000...

Market demand sets stage for few rent hikes

While asking rents for new leases nationally are running nearly flat over the past 12 months, those figures are heavily influenced by the Sunbelt, where record-high supply has turned rent growth negative in some...

Factors driving apartment demand and consumer sentiment

Last year’s surprising upside in apartment demand is expected to continue this year, even if the pace of absorption slows due to fewer new deliveries, said RealPage Chief Economist Carl Whittaker, who...

INFOGRAPHIC: A luxury vibe

High-income millennials and Gen Zers are choosing Class A apartments over home ownership. Is it a lifestyle choice or the economy?

National Class A rents average $660 to $2,000 below the average monthly mortgage

Hospitality-focused apartments

Class...

Empty apartments finally start to fill

The biggest apartment construction boom in four decades flooded the market with new supply over the past two years. Apartment owners had to contend with a surge in empty units.

That is starting to change.

The...

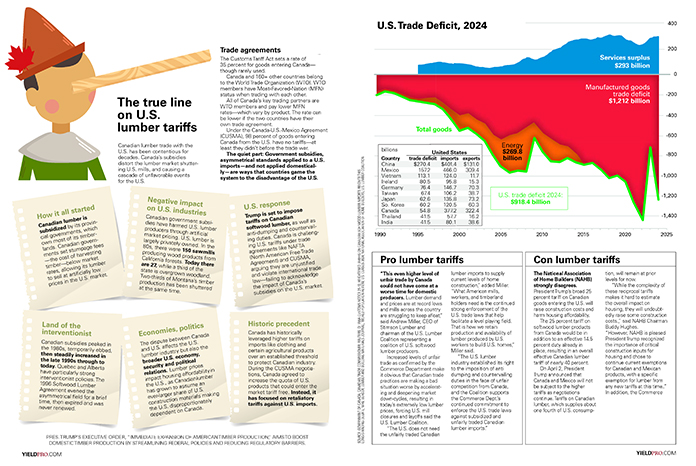

The true line on U.S. lumber tariffs

Canadian lumber trade with the U.S. has been contentious for decades. Canada’s subsidies distort the lumber market shuttering U.S. mills, and causing a cascade of unfavorable events for the U.S.

Trade agreements

The Customs Tariff Act...

The housing theory of childless cat ladies

Would a YIMBY building boom rejuvenate urban family life or produce sterile, megacity hellscapes?

Housing Boom = Baby Bust?

America’s low birth rate is in the news again, thanks largely to Vice Presidential candidate Sen. J.D....

Is land-use regulation holding back construction productivity?

Ed Glaeser is perhaps the pre-eminent urban economist working today, and I’ve cited his work repeatedly when looking at land-use restrictions and burdens on new development.

So I was very interested to see he’s coauthored...

Categories hit hardest by inflation

Despite inflation cooling to the lowest level in more than three years in July, there’s no way around the fact that consumer prices in the United States have risen sharply over the past three...

Market set for recovery

The multifamily housing market is showing promising signs of recovery, with recent data from CoStar Group revealing a significant increase in demand and stabilization of vacancy rates.

Absorption rates have notably risen from 118,000 units...