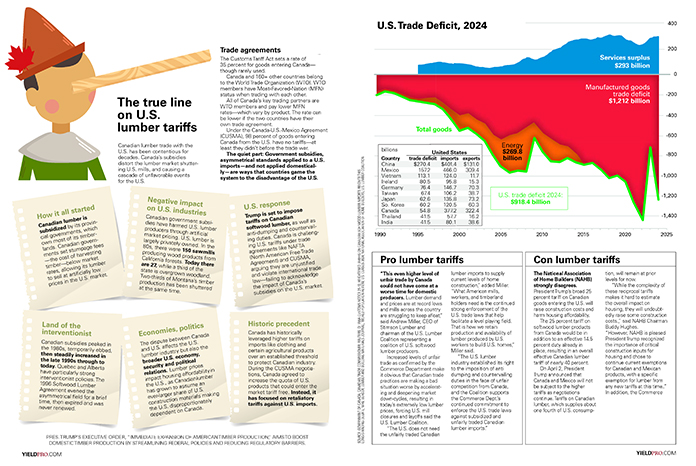

The true line on U.S. lumber tariffs

Canadian lumber trade with the U.S. has been contentious for decades. Canada’s subsidies distort the lumber market shuttering U.S. mills, and causing a cascade of unfavorable events for the U.S.

Trade agreements

The Customs Tariff Act...

Empty apartments finally start to fill

The biggest apartment construction boom in four decades flooded the market with new supply over the past two years. Apartment owners had to contend with a surge in empty units.

That is starting to change.

The...

Rents fall behind inflation

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (September 2021:...

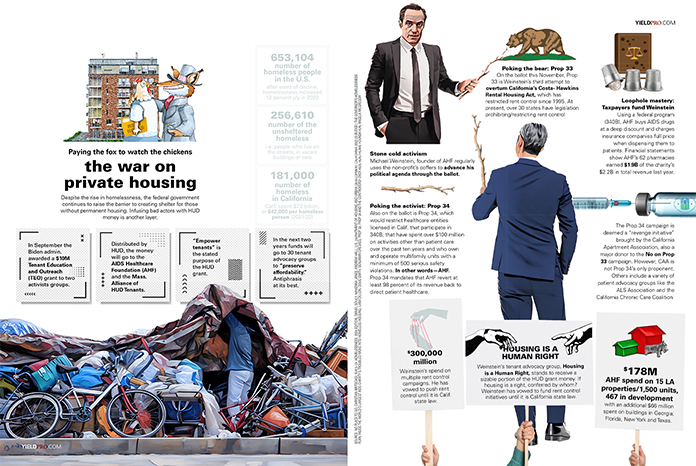

Paying the fox to watch the chickens: The war on private housing

Despite the rise in homelessness, the federal government continues to raise the barrier to creating shelter for those without permanent housing. Infusing bad actors with HUD money is another layer.

In September the Biden admin....

Renters slow their roll

Over a third of U.S. renters have lived in the same home for at least five years—up from 28.4 percent a decade ago according to a new report from Redfin. Economic fundamentals are likely...

Costco life

Costco has jumped into the nation’s affordable housing crisis. The warehouse retailer, which operates more than 500 stores across the U.S., broke ground on a different type of superstore in September—one that will include...

New metrics make Midwest investment attractive

Recently, the Midwest has shown surprising growth and economic resilience, making this region an attractive candidate for multifamily development, investment and general interest.

Often considered the slowest growing region in the U.S., the Midwest has...

Millennials rising

Millennials are now wealthier than previous generations were at their age. They can’t believe it either.

The median household net worth of older millennials, born in the 1980s, rose to $130,000 in 2022 from $60,000...

Men over 70 flooding back into the workforce

The headline figure of 12,000 jobs from the latest labor-market report is getting all the attention—but as usual, the much more interesting stuff is buried in the fine print.

In this case it’s about the...

Interest rates have risen in recent years

Interest rates had already started to rise

Interest rates have risen in recent years, driven primarily by central banks' efforts to combat high inflation and respond to strong economic conditions. In the United States, the...

The calculus of consent

Enjoying the fruits of the world’s economic powerhouse make it hard to dismiss the attributes that set the U.S. on top. It also makes it a challenge to ignore those things that so clearly...

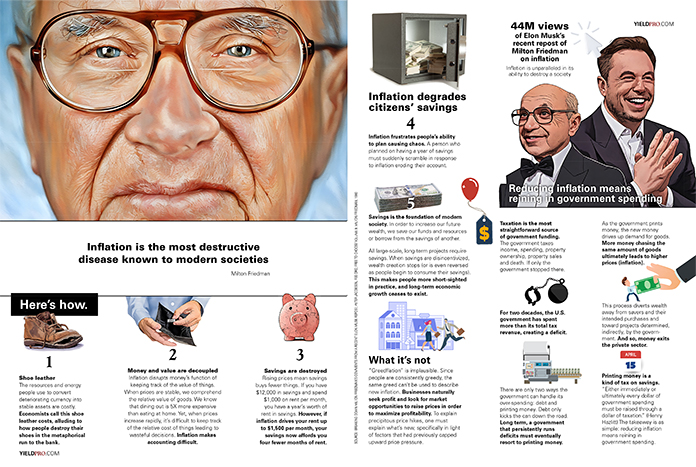

Inflation is the most destructive disease known to modern societies —Milton Friedman

Here’s how.

1 Shoe leather

The resources and energy people use to convert deteriorating currency into stable assets are costly. Economists call this shoe leather costs, alluding to how people destroy their shoes in the metaphorical...

Is land-use regulation holding back construction productivity?

Ed Glaeser is perhaps the pre-eminent urban economist working today, and I’ve cited his work repeatedly when looking at land-use restrictions and burdens on new development.

So I was very interested to see he’s coauthored...

Opportunity Zones: A path forward

Opportunity Zones (OZs) have emerged as a significant tool in driving investment into underdeveloped areas, offering a compelling case for their continuation and expansion. Since their inception in 2017, OZs have attracted nearly $100...

The price of disorder

I was once pitched a deal in the heart of the Amazon—Manaus, Brazil. What was I buying? Firstly, a commercial asset. But I couldn’t shake my concern around governance. The sanctity of a contract...