NAHB tells Congress how excessive regulations and codes harm housing affordability

The National Association of Home Builders (NAHB) told Congress that burdensome government regulations and mandates which support environmental, social and governance (ESG) policies impede the housing industry’s ability to increase the production of quality,...

NMHC, NAA support the introduction of choice in Affordable Housing Act

The National Multifamily Housing Council (NMHC) and the National Apartment Association (NAA) applaud the introduction of the Choice in Affordable Housing Act, bipartisan legislation that aims to increase private sector participation in the Section...

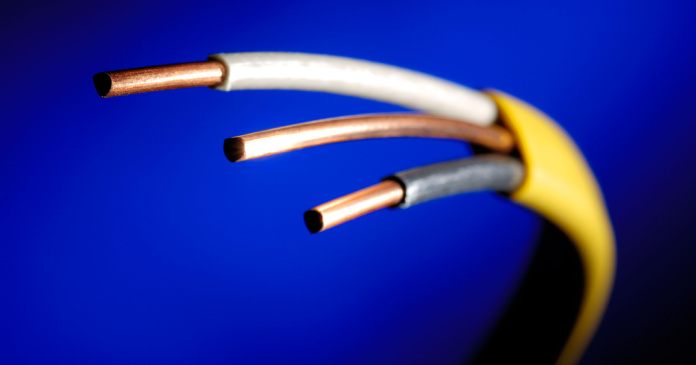

Construction materials prices flat in June

The producer price index (PPI) report from the Bureau of Labor Statistics (BLS) stated that construction materials prices were unchanged month-over-month in June, seasonally adjusted. The index of components and materials for construction was...

Blake Rogers and Alex Caniglia return to JLL’s Capital Markets team

JLL Capital Markets announced that Blake Rogers and Alex Caniglia have re-joined the firm as multihousing investment sales producers. Rogers will serve as a Senior Managing Director in the Los Angeles office and lead the...

Equity placement secured for housing development near UC Davis

JLL Capital Markets announced that it arranged joint venture equity on behalf of sponsor Anton DevCo for Axis @ Davis, a 200-unit housing development located near the University of California, Davis. Axis @ Davis...

Remodeling market sentiment edged down in second quarter

The National Association of Home Builders (NAHB) released its NAHB/Westlake Royal Remodeling Market Index (RMI) for the second quarter, posting a reading of 68, edging down two points compared to the previous quarter.

The NAHB/Westlake...

Marcus & Millichap closes the $5.5 million sale of a Fort Lauderdale multifamily property

Marcus & Millichap, a leading commercial real estate brokerage firm specializing in investment sales, financing, research and advisory services, announced the sale of Bahia Beach, a 35-unit apartment property located in Fort Lauderdale, Florida....

Marcus & Millichap closes $76 million Reno multifamily asset sale

Marcus & Millichap, a leading commercial real estate brokerage firm specializing in investment sales, financing, research and advisory services, announced the sale of Vista Ridge Apartments, a 324-unit multifamily asset in Reno, Nevada. The...

Mosaic Investment Partners secures full capitalization for University of Southern California student housing development

JLL Capital Markets announced that it arranged the capitalization of USC Expo, a 57-unit / 260-bed USC student housing development located less than a half-block from the campus of the University of Southern California...

GFI Realty Services arranges the $1.850 million sale of Bushwick multifamily asset

GFI Realty Services announced the $1.850 million sale of 47 Stanhope Street, a multifamily building located in the Bushwick section of Brooklyn. GFI Associate Moshe Goldberger represented the seller, a local investor, and Zachary Fuchs, Associate Director of...

Merchants Capital secures debt and LIHTC equity financing for affordable, senior property in Pittsburgh

The New York office of leading financial services provider Merchants Capital announces it has secured $11 million in debt and Low-Income Housing Tax Credit (LIHTC) equity financing for the construction of Cedarwood Homes in Pittsburgh,...

Institutional Property Advisors brokers Eastern Washington multifamily sale

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Regal Ridge, a 97-unit apartment asset in Spokane, Washington. The property sold for $21.5 million, or $221,650 per unit.

“Spokane’s growing...

Senior housing occupancy rises in Q2

An NIC Map Vision summary report shows that occupancy and other basic metrics for the senior housing industry continued to improve in Q2.

Analyzing the market

The senior housing market is divided into several sub-markets. NIC...

Gebroe-Hammer Associates arranges $9.72 million off-market multifamily portfolio sale in Central New Jersey

Gebroe-Hammer Associates has arranged the $9.72 million off-market sale of a three-property Middlesex County, NJ multifamily portfolio. The firm brokered the 53-unit transaction on behalf of the unnamed seller and procured the buyer, Golden...

CBRE arranges sales of three four-unit multifamily properties in Orange County, Calif., to three...

CBRE arranged the sales of three four-unit multifamily properties in Orange County, Calif., for a total of $5.48 million to three separate private buyers in 10 days.

In the first transaction, CBRE’s Executive Vice President...