The “week 39” release of the Census Bureau’s Pulse Survey shows that the portion of residents with rent delinquencies is up slightly since we last reported on this survey. For comparison, the NMHC rent payment tracker reported that 92.9 percent of renters made at least a partial rent payment for September by the end of that month.

What is the Pulse Survey?

The Pulse Survey is an experimental program that the Census Bureau has been running to assess how the population of the country is reacting to the fallout from COVID-19. The current survey, designated Week 39, collected data from September 29-October 11. The renter portion of the survey covers renters of both multifamily and of single-family properties.

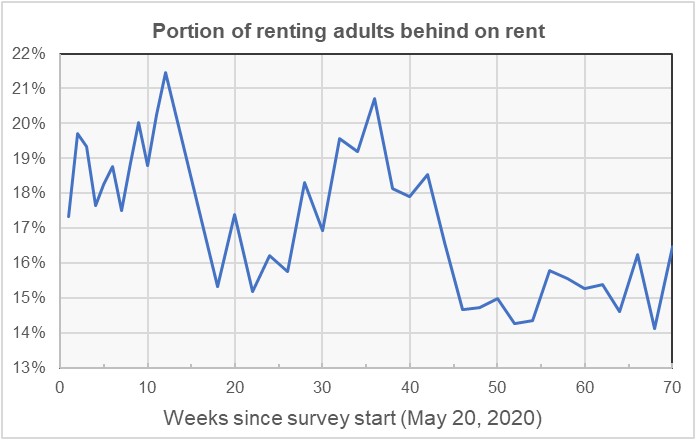

One of the questions that the Pulse Survey asks of renters is whether they are current on their rent. While some say that they occupy their housing without paying rent and some did not report whether they are current on their payments, the majority of respondents answered the question Yes or No. The portion of respondents who pay rent saying that they are not current has varied from survey to survey. The first chart, below, shows the history of responses to this question.

The people reporting that they occupied their dwelling without paying rent were not included in calculating the portion of renters who are behind on their rent.

The chart shows that the portion of renters who are behind on their rent is up in the latest survey. However, in the “week 38” survey only 14.1 percent of respondents indicated that they were behind on the rent, which is the lowest rate since the survey started. The data for that survey was collected between September 15 – 27, late in the month. By contrast, the data for the week 37 and week 39 surveys was collected early in the month, which may be at least part of the reason for the relatively high levels of people saying that they had not fully paid the rent in the latter two surveys.

Rent tracker finds payment rates continue to fall

The NMHC rent tracker recently reported that 92.9 percent of renters at 11.8 million professionally managed apartments had made at least a partial rent payment for September by the end of the month. This was down from the 93.7 percent of renters who had made a least a partial payment by the end of August. The rent tracker data is shown in the next chart, below.

![]()

The chart plots the data by year from April through March. This is because April is when the effects of the pandemic and the related lockdowns were first felt, so the chart shows COVID-years rather than calendar years. Data for the 12 months pre-COVID are also included in the chart.

While a significant portion of renters did not pay any rent by either the 6th of the month or by the end of the month, even pre-COVID, the situation has gotten worse with each COVID-year. The year-to-date monthly average of renters who had not made at least a partial payment by the end of the month rose from 3.6 percent between April and September of 2019 to 5.6 percent in the same period of 2021.

Profiling the participants

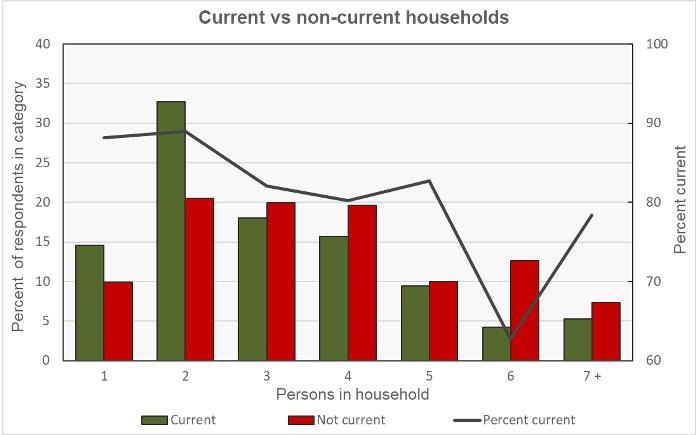

The Pulse Survey asked a series of questions to determine the characteristics of the different households responding to the survey. One question was how many people are in the household. The responses are shown in the first chart, below. The bars show the percentage of respondents within a particular category (current or not current on rent) who responded a certain way.

This chart is a little busy so here is an example of how to read the data for a two-person household: the bars on the chart show that about 33 percent of adults who were current on their rent resided in two-person households. About 21 percent of adults who were not current on their rent resided in two-person households. In either case, the two-person household could consist of one adult and one child or it could consist of two adults; the survey does not differentiate between them. The right-hand scale and the black line indicate that about 88 percent of adults residing in two-person households were current on their rent.

The chart shows that households with more people are generally more likely to be behind on their rent. An extreme example of this rule is households with 6 people. The chart shows that the share of these households who are behind on their rent is much higher than might be expected. When we last reported on the pulse survey, the 6-person household group was shown as being somewhat less likely to be behind on their rent than might be expected. These conflicting results may be telling us that the sample size for households of this size who respond to the survey may be too small to yield a stable result.

Of the respondents reported being current on the rent, 35 percent said that they had children in the household. Of those reporting being behind on the rent, 49 percent reported having children in the household.

Of the respondents who reported being current on the rent, 80 percent said that they or a household member had experienced no loss of employment income over the prior 4 weeks. Of those reporting being behind on the rent, 49 percent reported that they or a household member had experienced a loss of employment income.

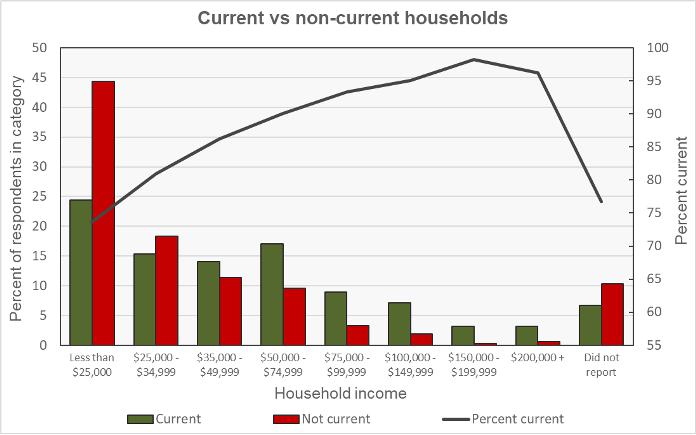

The next chart shows the current/not current status of the respondents by household income level. As in the above chart, the bars show the percentage of adults within a particular category (current or not current on the rent) who reported having a certain household income level. Not surprisingly, a much higher percentage of adult respondents who were behind on their rent reported having lower incomes.

An example of reading this chart for the “Less than $25,000” category is that about 24 percent of responding adults who were current on their rent reported living in households with incomes of less than $25,000. About 44 percent of adults who were behind on their rent reported living in households whose income was less than $25,000. The black line is read on the right-hand scale. It indicates that about 74 percent of adults living in households earning less than $25,000 reported that they were current on their rent.

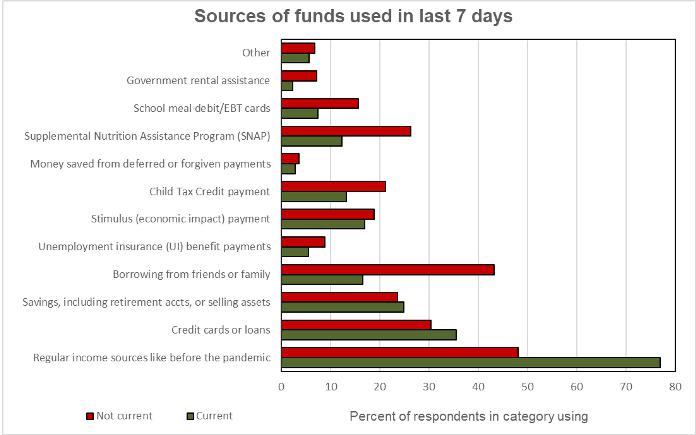

The final chart shows the sources of the funds survey respondents used to meet spending needs. Many of the differences between the people who are current on their rent and those who are behind are as one would expect: the former are more likely to rely on regular sources of income while the latter are more likely to rely on borrowing and on government assistance. One point that is somewhat unexpected is that only about 7 percent of those who are behind on their rent report using government rental assistance. There may be an opportunity for landlords to work with these renters to draw on the government’s rental assistance programs in order to pay some of their rent delinquencies.