Fannie Mae’s January economic and housing forecasts call for higher multifamily housing starts in 2022 and 2023 than in earlier forecasts. They also call for slightly lower GDP growth and slightly higher inflation in 2022 than did earlier reports.

Housing: multifamily up, single-family flat

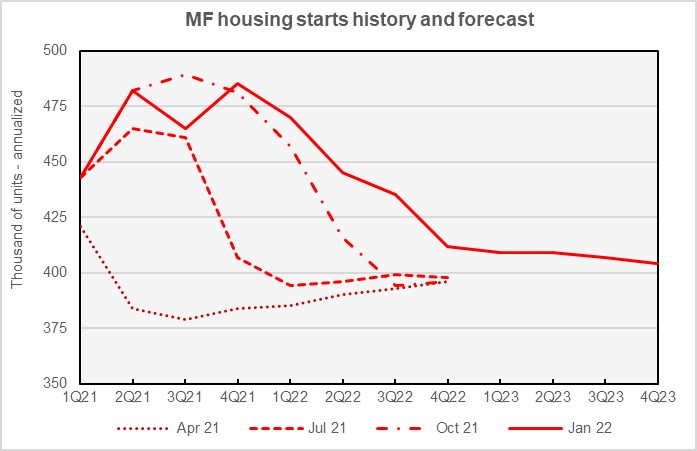

Fannie Mae now expects multifamily starts (2+ units per building) to close out 2021 at 469,000 units, up 21 percent from the number of units started in 2020. This forecast is up 6,000 units from the level forecast last month. The forecast for multifamily starts in 2022 is 441,000 units, up 16,000 units from last month, while the forecast for multifamily starts in 2023 was revised upward by 9,000 units to 407,000 units.

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. The earlier forecasts were selected at 3-month intervals so that the evolving outlook for multifamily housing starts over the last 9 months would be more apparent. The chart shows that Fannie Mae repeatedly revised their projection for multifamily housing starts for 2021 higher as the year progressed.

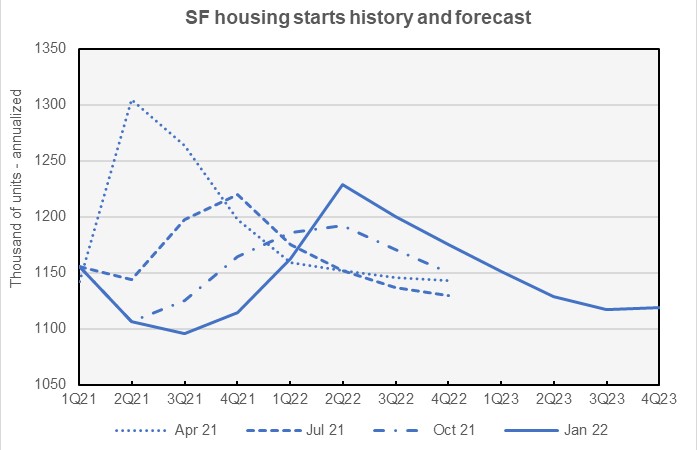

Fannie Mae now expects single-family starts to be 1,118,000 units in 2021, up 2,000 units from the level forecast last month. Fannie Mae’s raised their forecast for single-family starts in 2022 by 1,000 units to a level of 1,192,000 units. while their forecast for single-family starts in 2023 was revised upward by 5,000 units to 1,129,000 units.

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts. The chart shows that Fannie Mae repeatedly overestimated the number of single-family starts that would occur in 2021, while increasing their estimates for starts in 2022.

Fannie Mae sees material supply constraints, slower GDP growth and higher interest rates triggered by rising inflation as headwinds for housing providers over the next year or so.

Inflation forecast higher

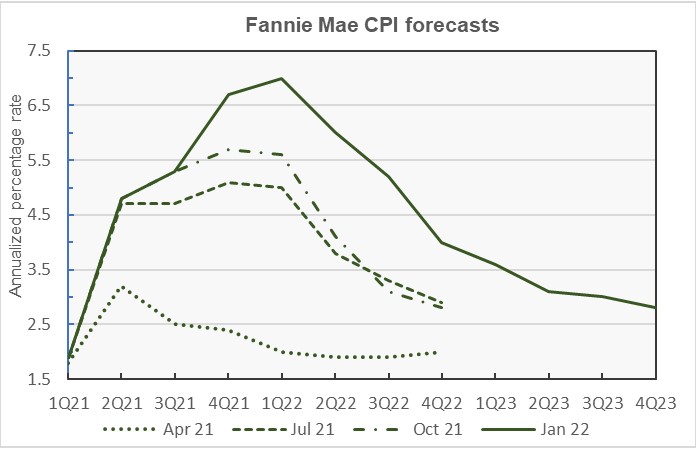

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

The inflation surge which began in late spring of 2021 seemed to catch most forecasters by surprise. The chart shows that this was true for Fannie Mae. They repeatedly revised their forecasts to call for higher inflation over a longer period as the year went on. Compared to last month’s forecast, the revisions this month are minor. Fannie Mae now calls for inflation to be 0.2 percent higher in each of the last 3 quarters of 2022 and to be 0.1 percent lower in each of the last 3 quarters of 2023 than in their last forecast.

GDP growth forecast revised modestly lower

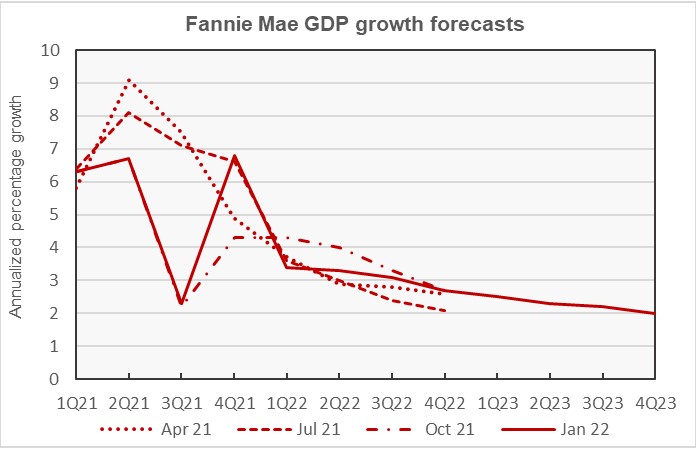

The next chart, below, shows Fannie Mae’s current forecast for the Gross Domestic Product (GDP) growth, along with three other recent forecasts.

Downward pressure on GDP growth is being applied by many of the same factors applying upward pressure on inflation: supply chain disruptions and labor shortages. These factors caused Fannie Mae’s forecasts for GDP growth in Q2 and Q3 to be revised significantly lower later in the year compared to earlier forecasts.

Fannie Mae’s forecast for GDP growth in Q4 2021 was revised downward this month after being revised sharply upward last month. GDP growth in Q4 is now expected to come in at an annualized rate of 6.8 percent, down from 6.9 percent forecast last month. The growth forecasts for Q1 and Q2 2022 were also revised lower. The Q1 forecast fell from 3.9 percent to 3.4 percent while the Q2 forecast fell from 3.6 percent to 3.3 percent. The GDP forecasts for Q3 and Q4 2022 were revised slightly higher.

For the year 2022 as a whole, the GDP growth forecast was revised marginally downward from 3.2 percent to 3.1 percent.

Unemployment forecast slightly lower

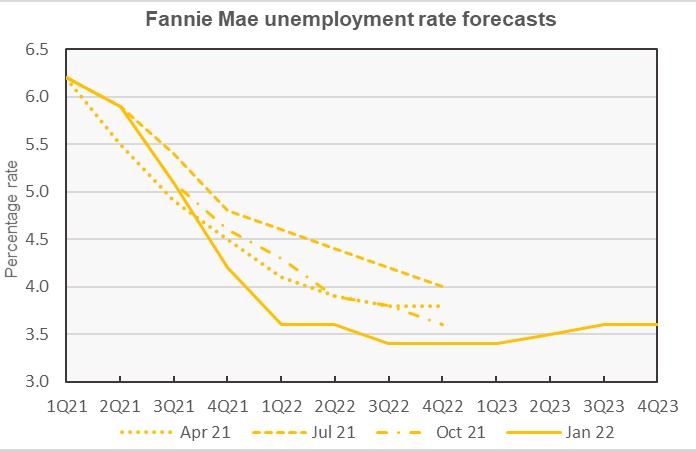

The final chart, below, shows Fannie Mae’s current forecast for the unemployment rate, along with three other recent forecasts. Compared to Fannie Mae’s estimates early in 2021, the unemployment rate stayed higher than they expected early in the year but then fell to a lower level than they expected later in the year.

The unemployment rate is a complicated metric in that it depends both on the number of people working and also on the number of people choosing to participate in the labor market. While this metric may give an indication of the availability of workers actively seeking employment, it does not accurately reflect the growth in employment. Another measure covered by a forecast from Fannie Mae that may give a better indication of the strength of the post-pandemic recovery in the labor market is the change in total non-farm employment.

In the April 2021 forecast, Fannie Mae estimated that the number of jobs lost in 2020 was 9.1 million, while the numbers of jobs they expected to be created in 2021 and 2022 were 8.4 million and 5.3 million, respectively. In the January 2022 forecast, Fannie Mae estimated that the number of jobs lost in 2020 was 9.4 million, while the numbers of jobs they expected to be created in 2021 and 2022 were 6.4 million and 4.3 million, respectively. Therefore, while the January 2022 economic forecast says that the Q4 2022 unemployment rate will be lower than what was predicted in April (3.4 percent vs. 3.8 percent), implying a stronger economy, the employment forecast predicts that there will be 3.3 million fewer jobs in the economy at the end of 2022 than was expected in April, implying a weaker than expected economy.

The Fannie Mae Multifamily Market Commentary for January focused on the unprecedented level of apartment absorption that was seen in 2021. RealPage estimates that over 670,000 units were absorbed, 2/3 higher than the next highest yearly absorption seen since they have been tracking this data. This unprecedented absorption has pushed vacancy rates down while supporting record rent increases.

For 2022, Fannie Mae anticipates that the vacancy rate will remain flat despite lower anticipated absorption and an increase in new supply of apartments. Fannie Mae expects that the rate of rent growth will fall from an estimated level of 10 percent for 2021 to half that level by the end of 2022.

The Fannie Mae forecast discussion can be found here. There are links on that page to the detailed forecasts.