A Mortgage Bankers Association (MBA) report on commercial and multifamily mortgage debt shows that banks and thrifts again had the largest net increase in multifamily mortgage holdings in Q1 2022. This is the second quarter in a row where this has been the case after a long string of quarters where the GSEs saw the largest increases in multifamily mortgages outstanding.

The MBA reported that multifamily mortgage debt outstanding rose by $37.4 billion in Q1, an increase of 2.1 percent. Total multifamily mortgage debt reached a level of $1.848 trillion. Compared to the year-earlier level, debt was up $131 billion (7.6 percent).

The total of all commercial mortgage debt, including multifamily debt, outstanding at the end of Q1 rose 1.8 percent from its Q4 2021 level to $4.255 trillion. Multifamily mortgage debt represented 43.5 percent of commercial mortgage debt outstanding.

Earlier, the MBA had reported that multifamily mortgage originations had increased in Q1, with the Q1 2022 multifamily mortgage originations index reported to be up 57 percent from its level in Q1 2021. By contrast, the increase in multifamily mortgage debt outstanding in Q1 2022 was only 7.6 percent higher than was the increase in Q1 2021. This implies that, while mortgage originations increased sharply year-over-year, mortgage redemptions reduced the net increase in multifamily debt outstanding.

Dividing the market

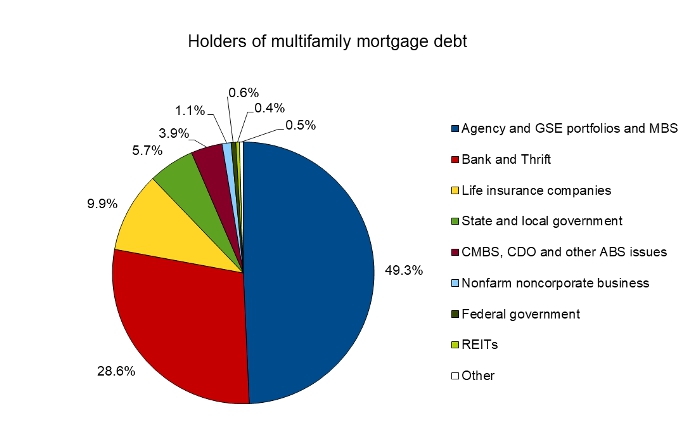

The shares of multifamily mortgage debt held by various classes of mortgage suppliers are shown in the first chart, below.

Of the increase in multifamily mortgage debt outstanding in the quarter, $9.5 billion, was held by “Agency and GSE portfolios and MBS”. These are agencies, like the Federal Housing Administration and Government Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac, who buy up mortgages and sell some of the debt as Mortgage-Backed Securities (MBS). At the end of Q1, the GSEs’ holdings of multifamily mortgages fell to 49.3 percent of the total outstanding. The GSEs had held as much as 50.1 percent of this debt in Q1 2021.

Banks and Thrifts, the second largest holders of multifamily mortgages, increased their multifamily mortgage holdings by $16.5 billion during Q1. This represented 44 percent of the increase in multifamily mortgage debt outstanding and increased their share of this debt to 28.6 percent.

Life Insurance companies increased their direct holding of multifamily mortgage debt by $4.36 billion in the quarter, raising their holdings to $183.4 billion. Their share of total multifamily mortgages outstanding remained unchanged at 9.9 percent in the quarter. It should be noted that this figure does not account for the multifamily mortgages these companies hold through commercial mortgage-backed securities (CMBS).

State and local governments held 5.7 percent of outstanding multifamily mortgage debt at the end of Q4. They reduced their holdings by $574 million to a total of $105.5 billion at the end of the quarter.

CMBS, CDO (collateralized debt obligations) and other ABS (asset backed securities) issuers increased their holdings of multifamily mortgage debt in Q1 by $7.7 billion. Their share of multifamily mortgage debt outstanding rose to 3.9 percent.

REITs are not a major holder of multifamily mortgage debt, but they have been increasing their holdings significantly recently. That trend reversed in Q1 as their holdings fell by $318 million. They now have a 0.4 percent share of multifamily mortgages outstanding.

Who’s growing their share?

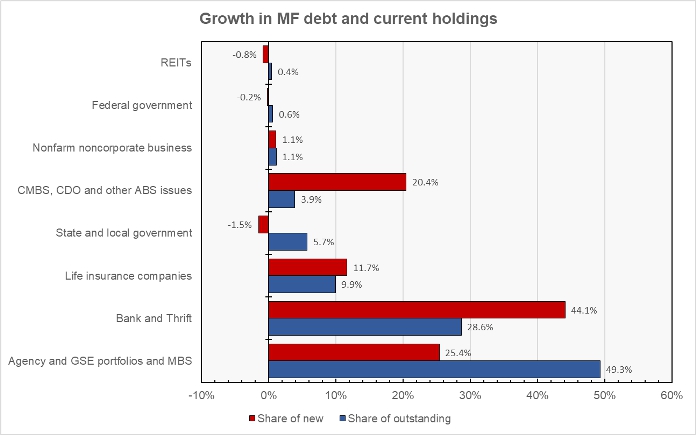

The next chart, below, plots the current share of multifamily mortgages outstanding for a given class of lender alongside that class of lender’s share of net new mortgage debt in Q1. When the latter share is greater than the former, that class of lender is increasing its share of the multifamily mortgages outstanding.

The chart shows that the two biggest holder of multifamily mortgages had shares moving in opposite directions in Q1. The GSEs’ net holdings increased at only half the rate of their current holdings while banks’ holdings grew at a much faster rate than their current level of holdings. The MBA report shows that as recently as 2006, the multifamily mortgage holdings of banks and of the GSEs were nearly the same. If banks continued to increase their holdings by the same differential over the increase of the GSEs as in Q1, it would take more than 13 years for their levels of holdings to once again be the same.

For the second quarter in a row, the net increase in mortgage holdings by CMBS, CDO and other ABS greatly exceeded their current share. However, as recently as Q4 2020, these lenders were reducing their holdings of multifamily mortgages.

The report does not cover loans for acquisition, development or construction, or loans collateralized by owner-occupied commercial properties. The full report also includes information on mortgage debt outstanding for other commercial property types. The full report can be found here.