A new report from CBRE states that cap rates used for underwriting prime class A multifamily assets were nearly unchanged in Q2 from their levels of the previous quarter.

The pulse of the market

The report surveys CBRE investment professionals in 15 markets to gather their opinions on the current underwriting assumptions being used by buyers in their markets. Buyers are considering the highest quality assets in the best locations in these markets.

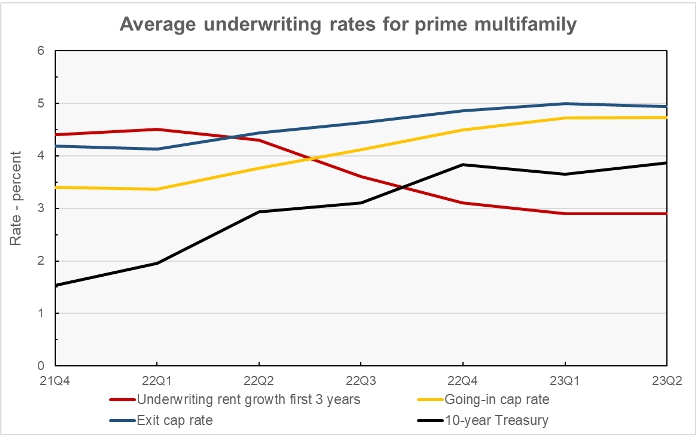

The chart, below, shows the recent history of the survey results for assumptions about the average annual rent growth expected for the first three years after a property is purchased, the going-in cap rate, the exit cap rate and the 10-year Treasury rate. The average assumed holding period for a newly purchased property has been between 8.5 years and 9.3 years in recent surveys. The average assumed holding period in the latest survey is 8.5 years.

The chart shows that cap rates used in underwriting assumptions have risen over the last 6 quarters as the Federal Reserve has raised interest rates. However, cap rates have risen much more slowly than has the 10-year Treasury rate. CBRE expects that will also be the case if the rate rises due to the additional quarter-point hike in the Fed Funds rate announced at the July meeting of the Federal Open Market Committee.

CBRE believes that cap rates might be near their peak for this cycle with the going-in cap rate averaging 4.73 percent.

Exit terms

Although both the going-in and the exit cap rates have risen, the exit cap rate has risen more slowly than has the going-in cap rate. Because of this, the spread between the rates has fallen from a recent high of 78 basis points in Q4 2021 to only 21 basis points in Q2 2023.

In certain markets, including Chicago, New York, Philadelphia and Phoenix, the exit cap rate is either equal-to or less-than the going in cap rate, implying that property prices are expected to rise in those markets.

Rent growth trends

CBRE quotes rents on a dollars per square foot per month basis, so it is difficult to make comparisons between their estimates of rent levels to those from other sources. However, CBRE’s underwriting rent level increased 2.7 percent over the past year on a quarterly basis. This compares to year-over-year rent growth estimates in June of 1.8 percent from Yardi Matrix and negative 0.5 percent from Apartment List. Both of the latter two sources quote rents on a monthly basis, so there is likely to be more volatility in their numbers.

Looking ahead, buyers underwrote properties in Q2 assuming that they would be able to achieve average annual rent increases of 2.9 percent over the next 3 years. While rent growth projections for gateway markets were below those in other markets in late 2021 through early 2022, buyers now expect rent growth in gateway markets to exceed that in other markets according to CBRE.

The full CBRE report can be found here.