Fannie Mae’s February economic forecast calls for a steady decline in inflation while both GDP growth and employment growth remain positive, if subdued. The housing forecast predicts that multifamily starts will be higher in 2024 but lower in 2025 than they predicted last month.

Multifamily starts will trend lower

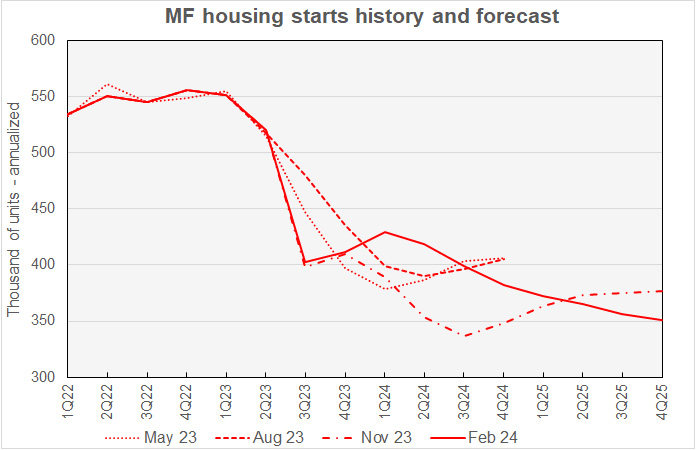

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The revisions to the current multifamily starts forecast followed the same pattern as those made last month; the number of starts in 2024 was revised higher while the number of starts in 2025 was revised lower. Although earlier forecasts had anticipated that the number of multifamily starts would decline to a low point in mid-2024 and then rebound, the current forecast predicts that multifamily starts will slowly decline throughout the forecast period, reaching their lowest point in Q4 2025.

The largest modification from last month’s forecast was a call for 29,000 (annualized) additional multifamily starts in Q2 2024. This matches the revision to Q2’s multifamily starts projection made in last month’s forecast, also the largest for that forecast.

Fannie Mae’s forecasters are predicting that the Federal Reserve will cut the Fed Funds rate by a total of 70 basis points in 2024 and by another 70 basis points in 2025, ending 2025 at a rate of 3.7 percent.

Looking at yearly forecasts, the predicted number of multifamily starts for 2024 was revised higher by 22,000 units to 407,000 units. The forecast for multifamily starts for 2025 was revised lower by 6,000 units to 361,000 units.

Single-family starts seen rising

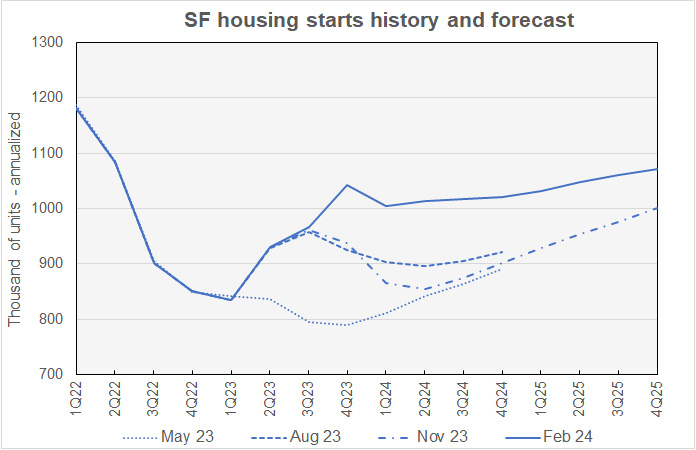

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Compared to last month’s forecast, Fannie Mae’s forecasters again raised their single-family starts forecasts for every quarter of their forecast horizon. Single-family starts are seen to have jumped in Q4 2023 but are anticipated to pull back in Q1 2024. Starts are predicted to then increase slowly quarter-by-quarter in 2024 and 2025.

Fannie Mae revised their forecasts for Q4 2023 through Q2 2024 higher by 31,000 or more annualized units. The revisions to the starts forecasts for the later quarters of 2025 were much smaller, resulting in a flattening in the anticipated rate of growth in starts.

Fannie Mae now expects single-family starts to be 1,014,000 units in 2024, up 25,000 units from the level forecast last month. Single-family starts in 2025 are forecast to be 1,053,000 units, up 7,000 units from the level forecast last month.

Slow GDP growth expected through 2025

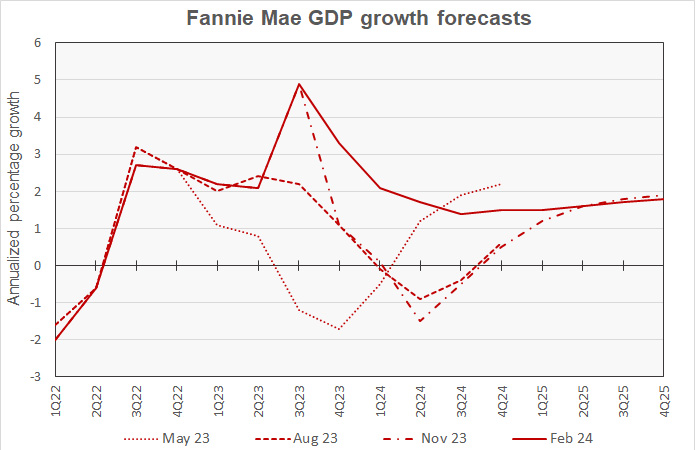

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

The largest revision to quarterly GDP estimates in this month’s forecast was for Q4 2023, where last month’s forecast of 1.2 percent annualized growth was revised higher to 3.3 percent, matching the advanced GDP estimate from the Bureau of Economic Analysis. The slowest GDP growth is now expected to be 1.4 percent, annualized, in Q3 2024, up from last month’s predicted low point of 0.7 percent GDP growth in Q2.

The forecast predicts that the rate of GDP growth will rise very slowly from Q3 2024 through the end of 2025. The 1.8 percent annualized GDP growth predicted for Q4 2025 exactly matches the Fed’s estimate of 1.8 percent long-term growth potential for the U.S. economy.

The full year forecast for GDP growth for 2023 was raised from 2.6 percent to 3.1 percent. The full year GDP growth forecast for 2024 was raised from 1.1 percent to 1.7 percent. The full year GDP growth forecast for 2025 was left unchanged at 1.6 percent.

Steady decline in inflation predicted

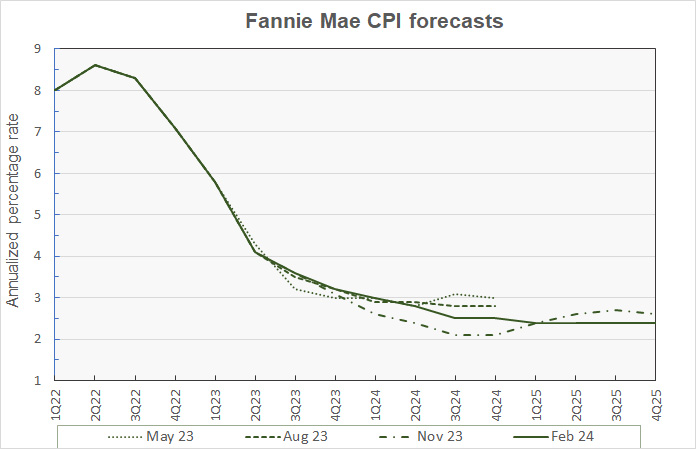

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Fannie Mae’s latest forecast calls for inflation as measured by the CPI to fall gradually through 2024 before stalling at a level of 2.4 percent in 2025. While this level of inflation nominally exceeds the Fed’s target, Fannie Mae’s forecast also predicts that inflation as measured by the Personal Consumption Expenditures (PCE) index will be at the Fed’s target of 2.0 percent by Q1 2025.

Looking at whole-year forecasts, the forecast for year-over-year CPI inflation in Q4 2024 was lowered 0.1 percentage point to 2.5 percent. The Q4 2025 year-over-year inflation forecast was lowered 0.2 percentage points to 2.4 percent.

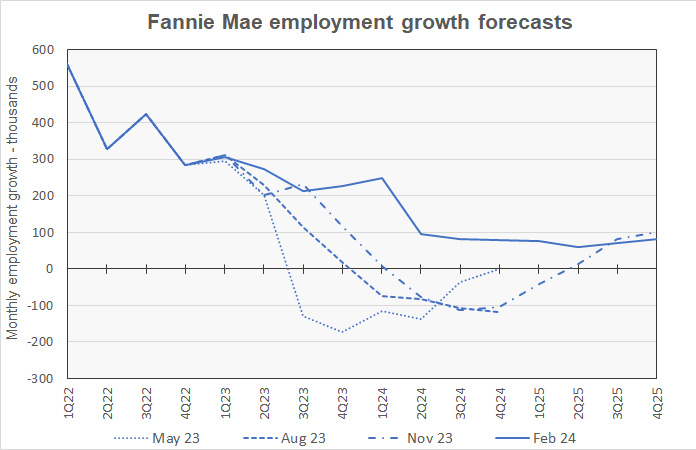

Employment growth forecast raised again

The next chart, below, shows Fannie Mae’s current forecast for the employment growth, along with three earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth. By contrast, the unemployment rate depends on employment but also on the labor force participation rate. Either rising employment or falling labor force participation can drive the unemployment rate lower, but only the former would contribute to economic growth.

Fannie Mae predicts that employment growth will remain strong in Q1 2024 driven by the high economic growth in Q4 2023. However, Fannie Mae’s latest forecast calls for employment growth to slow significantly from its recent pace starting in Q2 2024. It is expected to remain subdued through the end of 2025. The quarter predicted to have the lowest employment growth is Q2 2025, where monthly employment growth is predicted to be 60,000 jobs.

Compared to last month’s forecast, the expected full year forecast for employment growth in 2024 was revised from a gain of 700,000 jobs to a gain of 1,500,000 jobs. The employment growth forecast for 2025 was revised from a gain of 600,000 jobs to a gain of 900,000 jobs.

The Fannie Mae February forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.