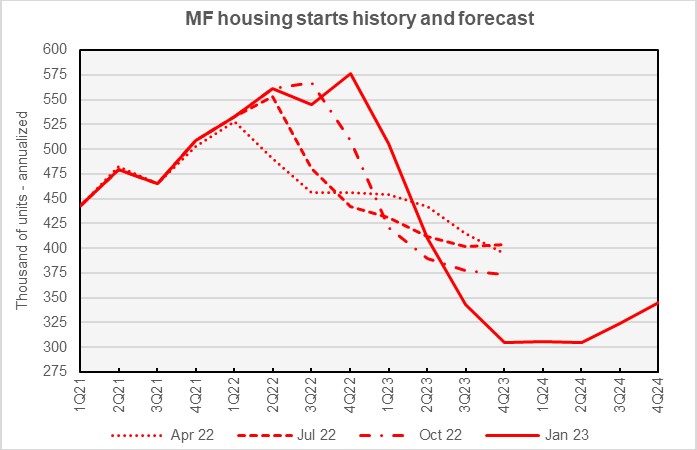

Fannie Mae’s January economic and housing forecasts predict a stronger finish for multifamily starts in 2022 and a higher number of multifamily starts in 2023 than did earlier forecasts. However, it also foresees a slightly lower number of multifamily starts in 2024 as the economy slowly recovers from recession.

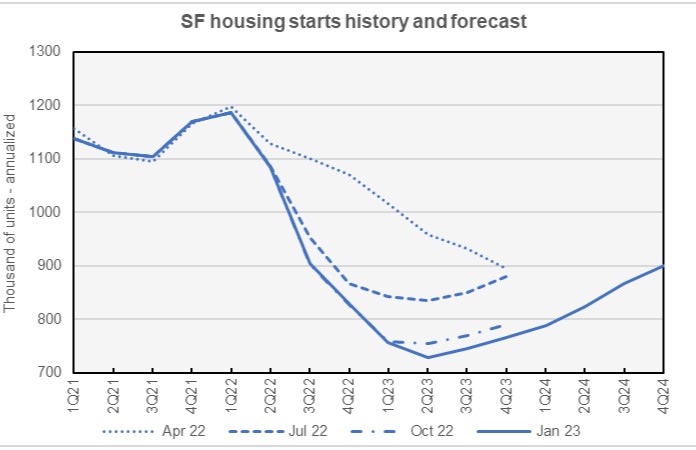

The forecast for single-family starts was revised lower for both 2023 and 2024.

Multifamily starts forecast declines

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The chart shows that Fannie Mae’s forecasters repeatedly revised their forecast for multifamily housing starts in 2022 higher over the course of the year. Their estimate for 2022 starts in the January 2023 forecast is higher than they had forecast for that year in any of their prior forecasts. Until the latest forecast release, Fannie Mae’s prediction for multifamily starts in 2023 had been trending lower since it reached a high of 451,000 units in their August forecast, but Fannie Mae’s January 2023 forecast raised the outlook for starts in 2023. However, Fannie Mae’s latest release also lowered their forecast for multifamily starts in 2024, although only slightly.

Fannie Mae now expects multifamily starts (2+ units per building) for 2022 to come in at 553,000 units, up 7,000 units from the level forecast last month. The forecast for multifamily starts in 2023 is now 391,000 units, up 15,000 units from the level forecast last month, and the forecast for 2024 is 320,000 units, down 2,000 units from last month’s forecast.

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

In the January 2023 forecast, Fannie Mae’s forecasters reduced their predicted numbers for single-family starts in every quarter of the forecast horizon. Consistent with last month’s estimate, they expect the low point in single-family housing starts to occur in Q2 2023, although they revised their starts forecast for that quarter lower to a level of 728,000 units, annualized. Single-family starts are predicted to increase from that point, although by the fourth quarter of 2024 they are only expected to return to their level of Q3 2022.

Fannie Mae now expects single-family starts to be 1,002,000 units in 2022, down 4,000 units from the level forecast last month. Fannie Mae lowered their forecast for single-family starts in 2023 by 20,000 units to a level of 749,000 units. Fannie Mae’s also lowered their forecast for single-family starts in 2024 by 18,000 units to a level of 844,000 units.

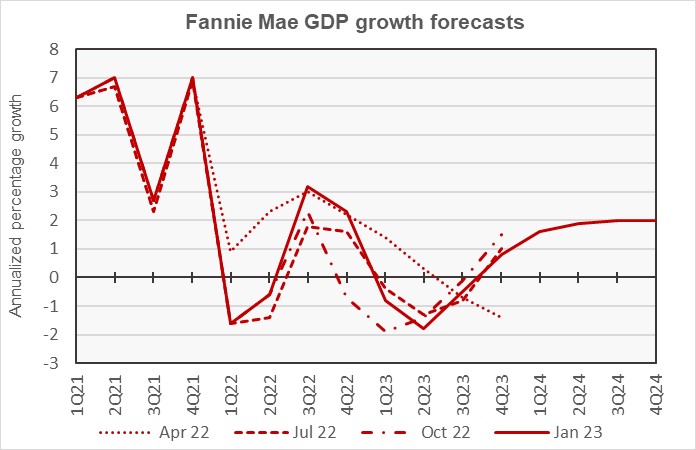

GDP expected to fall in 2023

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with three other recent forecasts.

Fannie Mae’s forecasters have long been calling for a recession to occur in 2023, although their view as to its exact timing has changed from forecast to forecast. In the current forecast, they note that the economy was stronger than they had foreseen ending 2022. Because of this, they have shifted the timing of their expected downturn to later in 2023. The effect is for slightly lower anticipated growth in both 2023 and 2024 as the recovery is also delayed.

The full year forecast for GDP growth in 2022 is now for growth of 0.8 percent, up from a forecast 0.4 percent growth last month. The full year GDP forecast for 2023 was revised downward by 0.1 percentage point to -0.6 percent. The full year forecast for 2024 was revised downward by 0.3 percentage points to 1.9 percent.

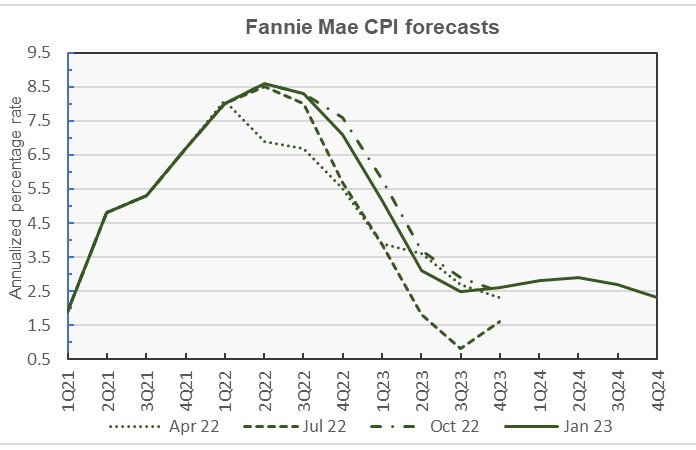

Inflation forecast mixed

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Compared to last month’s forecast, Fannie Mae is predicting lower inflation in Q4 2022 through Q3 2023. However, they foresee higher inflation in Q4 2023 through Q2 2024. They then predict lower inflation for the last two quarters of 2024.

The January forecast for year-over-year CPI growth in Q4 2022 was revised downward by 0.3 percentage points to 7.1 percent. The year-over-year CPI forecast for Q4 2023 was revised upward from 2.3 percent to 2.6 percent, while that for Q4 2024 was revised downward by 0.5 percentage points to 2.3 percent.

Employment losses delayed

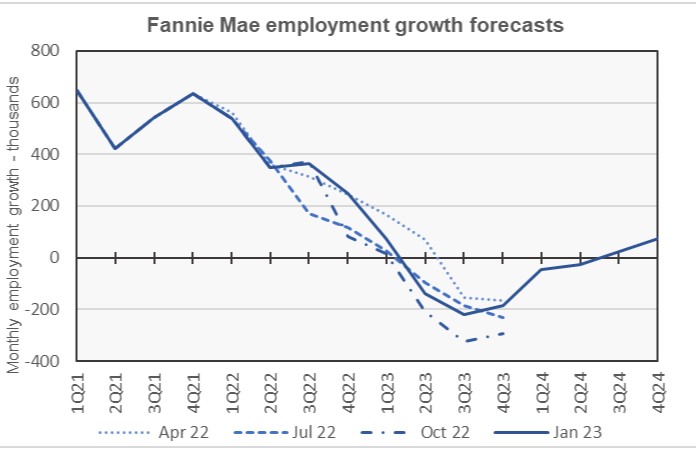

The next chart, below, shows Fannie Mae’s current forecast for the growth in employment, along with three other recent forecasts.

The delay predicted for the onset of the downturn also shows up in the employment numbers. Net job losses are still predicted to begin in Q2 2023, but the predicted losses are smaller than those called for in the last several monthly forecasts. However, job losses are expected to persist into Q2 2024, a quarter later than what was foreseen in earlier forecasts.

The full year forecast for employment growth in 2022 was revised upward from 4.3 million jobs in last month’s forecast to 4.5 million jobs. The full-year employment forecast for 2023 was revised upward from a loss of 2.0 million jobs to a loss of 1.4 million jobs. The employment growth forecast for 2024 was revised downward from a gain of 900,000 jobs to a gain of only 100,000 jobs. For reference, the U.S. economy currently employs 158 million people.

Commentary looks at multifamily outlook for 2023

This month’s Multifamily and Economic Market Commentary takes a broad look at the apartment business and where it is headed in 2023.

Part of the report uses data from RealPage to assess trends in the new supply and market absorption of units. It notes that absorption rates are down in the face of high expected supply, which will lead to rising vacancy rates next year. Vacancy rates are expected to rise from their current low levels into a range more consistent with historical averages. However, rising vacancy rates will likely lead to a rise in the use of concessions and in their size.

The commentary looks at several specific markets and estimates their apartment absorption based on job growth expectations and looks at the number of new units in the pipeline. Many markets with high job growth rates like Orlando, Miami, Jacksonville, Austin, Phoenix, Dallas and Salt Lake City are still expected to have more new supply over the next year than they are likely to absorb.

Multifamily property sales volumes reached record levels in early 2022 as buyers sought to act before interest rates rose even further. Sales are expected to be significantly lower in 2023. Cap rates are also expected to also rise driven by higher interest rates. Fannie Mae expects them to “increase above 5 percent”, up from an estimated current level of 4.7 percent.

The Fannie Mae forecast discussion can be found here. There are links on that page to the detailed forecasts and to the commentary.