It’s no secret that the U.S. has a dearth of affordable rental options for the nation’s most vulnerable households. This scarcity of housing makes it a priority for multifamily to produce more affordable housing, reduce regulatory barriers to production and to provide the technical assistance to local governments to remove the barriers that drive up housing costs.

The nation’s lack of affordable housing has been blamed on a number of culprits, including corporate housing entities, “greedy” landlords charging high rents and even on technology, as in the case of a California renter group accusing YieldStar’s rent-setting software of using an algorithm to unfairly raise rents. The software is similar to that used in the hotel and car rental industries to set prices based on a number of factors.

RealPage multifamily housing analyst Jay Parsons makes a case in a RealPage report that the lack of affordable housing is clearly not about rents.

“One of the most widely misunderstood realities of rent growth and rental affordability in the U.S. is that renters seeing the largest rent hikes are upper-income households living in the most expensive rentals and despite these rent hikes these renters are least likely to miss a rent payment,” Parsons said last year.

On the flip side, rent payments fell the most during COVID in subsidized affordable housing, where they grew the least, since they typically are set to a share of income.

“It’s a different story in Class C or workforce housing and while rents grew at a lesser pace (10 percent since March 2020), there has been more distress in that group and the gap has widened. It’s even more challenging in the subsidized affordable space, where rents typically are locked at a level relative to renter income, although programs can vary,” he said.

As of a year ago, landlord’s rent collections had fallen about four percentage points since COVID hit to just under 87 percent, according to RealPage data.

Parsons suggests the reason market-rate renters were able to continue paying higher rents at essentially pre-COVID levels is because their income also increased during the same period.

Parsons sees rental affordability as more of a tailwind than a headwind, especially for professionally managed rental housing, despite headlines to the contrary.

According to a more recent study by RealPage Market Analytics, income growth did not exactly keep pace with rent growth during COVID, but since the pandemic ended, rent-to-income growth is still relatively low at 23.1 percent, although they vary by location.

“The typical median apartment renter household is much more affluent than the population estimates in the U.S. Census Bureau data, according to RealPage Analytics,” said Parsons, adding that many surveys are incorrect to paint the rental market with a broad brush that distorts facts around rental affordability.

“No matter how you slice it, rent collections are significantly higher than what the tiny Census Household Pulse Survey shows and while the survey itself warns of statistical holes, those holes typically are routinely disregarded by those who use their data,” he said.

Opposing bad policy

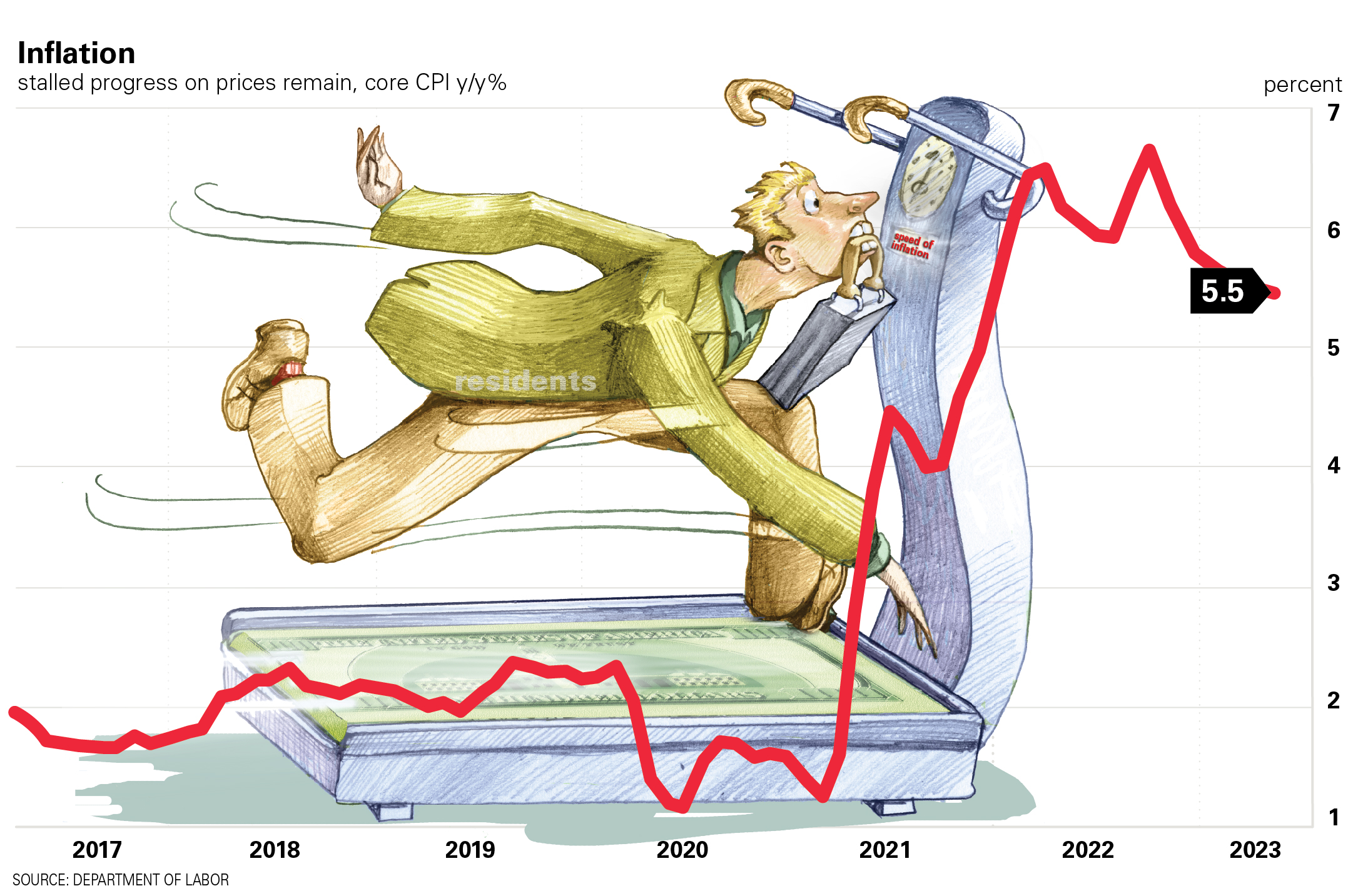

Federal monetary policy must take some of the blame for rent affordability problems plaguing low-income renters and the lack of affordable housing supply.

“Inflation is a regressive tax and impacts those with lower earnings and on fixed income. Everyone is paying 13 percent more for food, but this affects low-income households the most because they pay a higher percentage of their income on rent,” said Parsons.

He notes that many well intentioned local and federal policymakers direct federal benefits to segments of the population that do not need the assistance. Policies that favor homeowners over renters are one example of this and can be seen in the tax deductions given to that demographic.

Laura Cole Jackson, a member of the Washington Affordable Housing Authority, suggests the solution is, “to lift the 1988 Faircloth Amendments that set caps on the number of units any public housing authority can own and operate, effectively halting new construction of public housing, eliminate single-family resident only zones across the board and build, build, build.”

A New York-based owner and operator of transit-oriented multifamily points out that renters paying rent equating to 30 percent or less of gross income have had a significantly higher default rate than market-rate renters, even prior to today’s crazy inflationary environment. He blames this on frivolous spending habits among low-income renters, a very unpopular idea in today’s liberal political climate.

However, there is data to at least partially support this theory. Disparities in the reported income and spending of low-income taxpayers have long been observed in data collected by the Bureau of Labor Statistics Consumer Expenditures report, which consistently shows that low-income renters spend more than their reported income.

Real estate development analyst Jonathan Oman has seen a lot of subsidized rent restricted properties coming on the market with high vacancy and bad debt expense, particularly in cities where eviction moratoriums were more stringent than others.

“Those on the ground tell us that, to at least some extent, it’s because management has difficulty removing problem tenants, which has driven good households to more quiet stable properties. It’s certainly a problem, but could create opportunities for skilled owner/operators and management companies to come in and stabilize operations and add value.”

Scott Forest, who recently retired after 40 years in the commercial real estate space, thinks what is needed are housing programs built around tax benefits to owners.

“If these tax benefits can be used against a tax liability of another real estate property that one also owns, the game changes,” he said.

Meanwhile, apartment investors, owners and their banks are recovering from than a year of rent without evictions and a situation where the Centers for Disease Control exceeded its authority, says Joseph LaMacchia, Capital Velocity LLC. “This has resulted in tenants having to make up, on average, about $18,000, while keeping current on rent payments,” he said.

Media sensationalizes landlords raising rents, but fail to shine a light on the other side—the challenges of running a multifamily business today, like paying the mortgage, the interest rate and insurance increases, said Elizabeth Francisco, ResMan president and chief experience officer at Inhabit IQ.

Policymakers need to be consistently educated because of the turn-over among them, she said.

Jay Harris, principal at Harris Crystal Advisors, agrees. “We have short memories. We forget the billions the industry absorbed in unpaid rent. Some was funded by the federal government backstop, but a lot was not. And this was at a time when people were staying in the properties longer and having tens of thousands owed at move. out because they were able to stay—and eventually the bill came due,” he said.

Stacked roadblocks

National Multifamily Housing Council (NMHC) President Sharon Wilson Geno points out that the policies around housing in our nation do not work collectively well to provide sufficient housing supply for people who need it. She thinks there are many opportunities for the federal government to help increase supply, but instead sees a raft of regulatory issues coming down the pike that could undermine the industry’s efforts to increase supply, because they add cost, time and complications to the development process.

Moreover, the cost of adhering to regulations is a roadblock, she said. NMHC research suggests that it is about 40 percent of the overall cost of developing a housing unit.

“How much more housing could be created if some of the cost of meeting regulations could be redeployed into sticks and bricks,” she asks.

Another issue is the Coronavirus Aid, Relief and Economic Security Act, signed into law in March 2020, requirement of a 30-day notice to vacate before eviction to protect renters in emergency situations, still lingers even with the pandemic and any assistance for owners in the rearview mirror.

Other threats to the multifamily industry’s ability to deliver new rental housing include the Waters of the U.S. Rule that impacts developers’ access to land to develop multifamily, the very flawed reinstatement of the 2013 Disparate Impact Rule and possibly the proposed Renter’s Bill of Rights.

Francisco points to one draft section of the renters’ rights bill discussing stakeholder engagement that will set up tenant meetings with HUD, the White House, the Department of Agriculture and renter advocates to hear renters’ perspective on the rental market to help inform policy and strengthen tenant protections.

Not included in these meetings so far are the actual operators and managers of multifamily housing.

“Maybe that will change,” she said.

Know your rights

One of the issues the Renters’ Bill of Rights is addressing revolves around fees and fee disclosure, sometimes called surprise or junk fees—who can charge them and how to disclose them. These include application and convenience fees, technology bundle fees and collection fees, the latter charged when landlords collect rent by credit card. None of these fees are illegal as long as they are allowed and disclosed, and many, like credit card use fees, are common in other industries.

Application fees present the greatest opportunity for fraud by both renter and manager. During the pandemic and accompanying a spike in unemployment, desperate renters were able to easily purchase fake bank statements, pay stubs, credit scores and even social security numbers. Some even falsified background checks to hide disqualifying information. During that period, 85 percent of landlords reported being victims of rental fraud, an increase of 66 percent from the year prior to COVID.

On the other side, renters may view application fees as prohibitive, especially when applying for units from different owners. For this reason, many states prohibit their use and others prohibit charging more than is needed to cover screening charges. Some states allow reusable applications within a specific period of time.

“It’s in the best interest of housing providers to fully disclose fees. In many states, fees are pretty well spelled out, but HUD is requiring the disclosure all refundable and nonrefundable fees and charges upfront in listings and advertisements as well as in the rental agreement,” said Harris

Online rental platforms have responded by announcing they will provide new tools to help renters determine the all-in price of a desired unit.

Harris stresses the need to articulate the industry’s best case in order to achieve the goal of more affordable housing. “We need more production and we must make sure our P & Ls are not lost in the conversation,” he said.

“We must oppose federal efforts to interfere in the landlord-tenant relationship and use carrots, not sticks, to increase affordable rental housing and choice. Let’s not make participation an antidiscrimination matter. Let’s make it so that housing authorities want to participate and have them learn from professional property managers how best to operate an apartment community. We must also learn which legislators are receptive to our issues. It’s not always the person you think it is, but once identified, they can be a catalyst for getting things done,” said Harris.

Author Wendy Broffman