RISE Properties Trust and Aegon Real Assets US acquire Bryson Square Apartments in Kent

RISE Properties Trust (“RISE”) a Canadian real estate trust based in Seattle, and Aegon Real Assets US (“Aegon RA”), an indirect wholly owned subsidiary of Aegon N.V., a multinational life insurance, pensions and asset...

Avison Young brokers $15.4 million sale of 88-unit apartment property in Henderson Nevada

Avison Young announced that the Sauter Multifamily Group, comprised of Principals Patrick Sauter, Art Carll-Tangora, and Steve Nosrat, based in the firm's Las Vegas office closed the $15.4 million sale ($175,000 per unit) of...

JLL arranges $233 million in construction financing for 569-unit Brooklyn rental development

JLL Capital Markets announced that it has secured $233 million in construction financing for the ground-up development of 54 Crown, a 569-unit multihousing development located at 54 Crown St., in Crown Heights, Brooklyn.

JLL worked...

Institutional Property Advisors brokers sale and arranges financing for Scottsdale multifamily asset

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Dwell, a 193-unit multifamily asset in Scottsdale, Arizona. The $41.6 million sales price represents $215,544 per unit.

“Developed in 1963 and...

Alpha Wave Investors, LLC expands presence in Salt Lake City metro with acquisition of...

A subsidiary of Alpha Wave Investors, LLC (Alpha Wave), a private equity investment firm specializing in opportunistic and value-add multifamily and hospitality assets in the Western U.S., has acquired Park Station Apartments, a 94-unit...

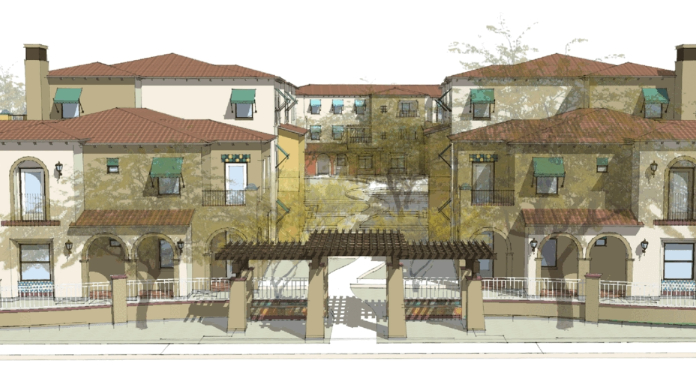

DHA Housing Solutions for North Texas and VOANS Partner on New Affordable Senior Housing...

DHA for North Texas and Volunteers of America National Services (VOANS) partnered on a new, affordable senior housing development in South Dallas. The Oaks a $50 million redevelopment project, expands the inventory of quality...

$69.25 million multifamily asset in Arizona sold by IPA

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announces the sale of Alta Steelyard Lofts, a core Class “A” mid-rise, 301-unit multifamily property located Chandler, Arizona. The property sold for $69.25 million,...

TruAmerica Finalizes $103M Purchase of Apartment Complex in Santa Ana, California

TruAmerica Multifamily, a national, institutionally-focused multifamily investment firm, expanded its Southern California portfolio with the $102.9 million purchase of Nineteen01, a 264-unit apartment asset in Santa Ana, CA. The Class A property, which was...

Stepp Commercial completes $3,025,000 sale of a value-add, 8-unit apartment property in prime West...

Stepp Commercial, a leading multifamily brokerage firm in the Los Angeles market, has completed the $3,025,000 sale of an eight-unit, value-add apartment property located at 1237 N. Orange Grove in the Los Angeles submarket...

Cushman & Wakefield arranges $20 million sale on behalf of 3T Country Club Village...

Cushman & Wakefield announced that the commercial real estate services firm has arranged the sale of The Village at Boca East, an 84-unit apartment community located in Boca Raton, Florida. The final sale price...

Avanath Capital Management acquires 256-unit mixed-use, mixed-income multifamily community in Chicago for $119 million

Avanath Capital Management LLC, a multifamily owner and operator that primarily focuses on affordable and workforce housing, announces that it has acquired Lincoln Park Plaza, a 256-unit mixed-use, mixed-income multifamily community with ground-floor retail,...

$53.16 million acquisition financing secured for apartments near Myrtle Beach

JLL Capital Markets announced it arranged a $53.16 million, 71 percent LTC, acquisition financing for the Harrington Village Apartments, a multihousing property located in Leland, North Carolina, part of the Wilmington, North Carolina metropolitan...

Capstone Recently Closed 20-unit Multifamily Property at 1000 s Logan Street in Denver Colorado

Capstone has closed the sale of 1000 s Logan Street in Denver, Colorado. The 20-unit multifamily property sold for the price of $4,125,000. Jason Koch and Adam riddle of Capstone brokered the transaction.

The vintage...

$53 million acquisition financing secured for Class A multihousing community near Tampa

JLL Capital Markets announced that it has arranged $53 million in acquisition financing for Circa at FishHawk Ranch, a 260-unit, Class A, garden-style multihousing community in the Tampa MSA community of Lithia, Florida.

JLL worked...

Levin Johnston directs sale of transit-oriented multifamily property in downtown San Jose

Levin Johnston, a division of Marcus & Millichap and one of the top ten multifamily brokerage teams in the U.S., has directed the $12.5 million sale of First Street Manor, a 39-unit multifamily community...