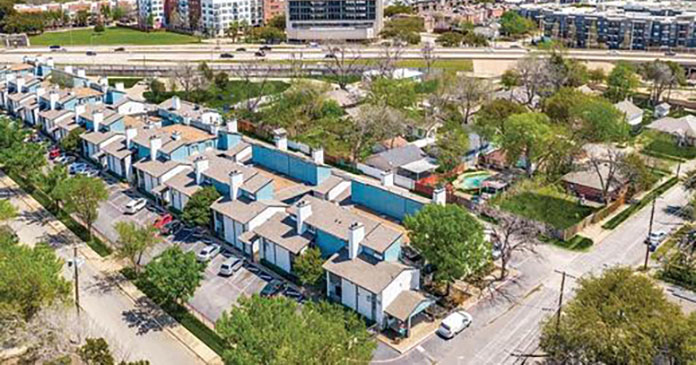

Capstone has closed the sale of Arcadia Plaza Apartments

Capstone has closed the sale of Arcadia Plaza Apartments, a 13,188 SF multifamily property for the sale price of $4,600,000. Pat Knowlton of Capstone represented both the Seller and the Buyer on this transaction.

Arcadia...

Interra Realty brokers $11 million sale of multifamily property on Chicago’s North Shore

Interra Realty, a Chicago-based commercial real estate investment services firm, announced it brokered the sale of a 37-unit multifamily property in Highwood, Ill. The newly built property, located at 546 Green Bay Road, traded...

DLP Capital finances $24 million multifamily by Idaho Capital of Boise

DLP Capital, a private real estate investment and financial services firm, announced that it has provided $24.4 million in acquisition financing for a new, 160-unit multifamily property in the greater Boise, Idaho metro area....

Builder confidence declines for 11 consecutive months as housing weakness continues

Elevated interest rates, stubbornly high building material costs and declining affordability conditions that are pushing more buyers to the sidelines continue to drag down builder sentiment.

Builder confidence in the market for newly built single-family...

Haven Realty Capital, J.P. Morgan launch $415 million joint venture

Haven Realty Capital (Haven) and institutional investors advised by J.P. Morgan Global Alternatives have formed a programmatic joint venture to acquire and develop more than $1 billion in new build-to-rent (BTR) communities throughout the...

WinnCompanies acquires 76 affordable housing units in Passaic, New Jersey

WinnCompanies, an award-winning national developer and manager of apartment communities, announced it has acquired Chestnut Homes, a 76-unit affordable housing community within walking distance of downtown Passaic, New Jersey.

Built in 1983, the townhouse-style community...

Sale of multihousing community in suburban San Diego closes

JLL Capital Markets announced that it has closed the sale and acquisition financing of Veranda La Mesa, a 406-unit, garden-style apartment community located in La Mesa, California.

JLL represented the seller. JLL also worked on...

Institutional Property Advisors brokers $91 million multifamily asset sale North Central Phoenix

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Trailside at Hermosa Pointe, a 336-unit multifamily asset in Phoenix, Arizona. The property traded for $91 million, or $270,833 per...

Avanath Capital Management acquires Ascent, a 168-unit multifamily community in Denver, Colorado for $58.1...

Avanath Capital Management, LLC, a private real estate investment manager, announces it has acquired Ascent, a 168-unit multifamily apartment community for $58.1 million. The property is located in the Denver suburb of Cherry Creek,...

Interra Realty brokers $10.3 million sale of Vintage Evanston, Ill. apartment building

Interra Realty, a Chicago-based commercial real estate investment services firm, announced it brokered the sale of a 43-unit multifamily property in Evanston, Ill. The vintage courtyard building, located at 612 Sheridan Road, traded for...

Veleta Capital Partners provides $18 million in financing for acquisition of Dallas apartment complex

Veleta Capital Partners (VCP), a Los Angeles-based institutional quality small balance bridge platform, has provided $18 million in senior secured, floating-rate bridge financing for the acquisition and renovation of the 137-unit Maverick Oak Lawn...

$34.7 million financing arranged for Tacoma multihousing development

JLL Capital Markets announced that it has arranged the $34.8 million construction financing for Cornus House, a 199-unit, mid-rise multihousing development located in downtown Tacoma, Washington.

JLL represented the developer, Arboreal Investments, to secure the senior...

$26.3 million financing secured for New Jersey multihousing project

JLL Capital Markets announced that it has arranged $26.3 million in construction financing for The Somerset at Montgomery, a luxury, 115-unit multihousing development in Montgomery, New Jersey.

JLL represented the borrower, Country Classics, to secure...

Marcus & Millichap brokers Dallas multifamily asset sale

Marcus & Millichap, a leading commercial real estate brokerage firm specializing in investment sales, financing, research and advisory services, announced the sale of Mountain Valley, a 312-unit apartment property in Dallas, Texas.

“Built in 1969,...

Berkadia arranges $93.6 million loan for Palm Beach County apartment communities

Berkadia announces it has secured a $93.6 million loan to refinance two multifamily communities located in Palm Beach County: Advenir at Banyan Lake and Advenir at La Costa, both vintage garden-style multifamily assets located...