Negative leverage: The Fed’s gift to apartment investors

The Federal Reserve’s inflation of the money supply and interest rate manipulation distort capital markets through, among other things, the creation of asset bubbles. As the cost of borrowing decreases and cheap money floods...

Make your own luck

Rumors of America’s death have been greatly exaggerated. The proverbial lucky fool—these United States of America—has proven itself replete with those things that truly matter—an innovative, hard-working citizenry, a self-correcting Constitution and a land...

Housing block

California’s builders and YIMBYs are at loggerheads over a bill cracking down on ‘unchecked sprawl.’ Activists who would like to see more housing built and people who build housing for a living would seem...

19 big errors to avoid in social media management

When companies decide it’s time to up their social media game, they have to figure out a way to manage the work that entails.

Some businesses lean on their marketing team or interns to handle...

Business investment slumps

Orders for American-made durable goods have fallen as business investments slump—a sign of an economic slowdown.

The U.S. industrial sector has been falling into a slump after several years of rapid growth, with many economists...

NMHC launches new website

Across the country, many state and local elected officials are working to develop housing policies intended to address housing affordability challenges. Unfortunately, some of these officials still turn to failed or outdated policies such...

Americans turn to more financing as savings run dry

An increasing number of Americans—many of whom are renters—are turning to buy now and pay later (BNPL) services like layaway as they continue to drain their savings and interest rates on credit cards grow,...

Trends support continued multifamily growth

As the current economic expansion enters its 11th year—the longest on record—the “when will it end” speculation continues apace. As cap rates hover near historic lows and properties trade for historic highs, the question...

Publisher’s note: The mystery of beauty

A neighbor forwarded me a video titled “Germany from Above.” To the built environment enthusiast, the video delivered a steady stream of breathtaking architecture and craftsmanship through time... with a stark and somber visual...

Demographics, they are a ‘changing

The American family has undergone significant change in recent decades. There is no longer one predominant family form, and Americans are experiencing family life in increasingly diverse ways.

In 1970, 67 percent of Americans ages...

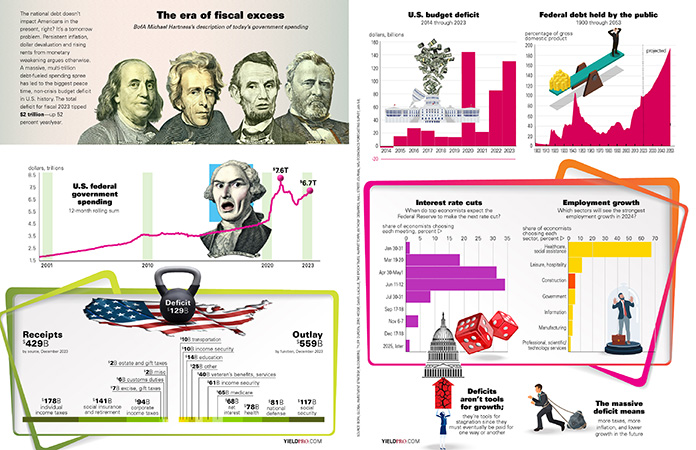

INFOGRAPHIC: The era of fiscal excess

The era of fiscal excess, BofA Michael Hartness’s description of today’s government spending

The national debt doesn’t impact Americans in the present, right? It’s a tomorrow problem. Persistent inflation, dollar devaluation and rising rents from dollar...

Rental fees new target for White House

The Biden administration recently announced a new component of its war on junk fees, curbing rental fees that officials assert are exacerbating housing affordability challenges.

The White House plans to focus on repeated rental application...

THE CLOSER: New solutions to old problems: creating efficient and effective affordable housing...

It’s no secret that there is a nationwide housing crisis. According to the National Low Income Housing Council, “there is a shortage of more than 7 million affordable homes for our nation’s 10.8 million...

What will become of cities?

Everyone was supposed to be back at the office by now. It’s not really happening, how-ever, and this has huge implications for the future of the American city.

Part of the reason is the cost,...

IRS change will push some entrepreneurs into corporate desk jobs

As the end of the year approaches, the IRS has announced its new late repayment penalty rate. The rate has climbed from around 3 percent two years ago to 8 percent today.

Most workers in...