HUD seeks to revive Obama-era disparate impact rule

On Friday June 25, the Department of Housing and Urban Development (HUD) announced that they have published a notice of proposed rulemaking (NPRM) on disparate impact entitled “Restoring HUD’s Discriminatory Effects Standard”.

The objective of...

IMG acquires third San Antonio area apartment community in 2021

Investors Management Group (IMG), a California-based real estate investment and asset management firm, has acquired Heights at Converse, a 200-unit apartment community built in 2015 and located at 7855 Kitty Hawk Drive in Converse,...

Foulger-Pratt to develop 343-unit apartment community in Bethesda, Maryland

Foulger-Pratt based in Potomac, Md. will develop The Rae at Westlake at 10401 Motor City Drive adjacent to Westfield Montgomery Mall in Bethesda, Md. The five-story, 343-unit building will include 299 market-rate and 44...

Luxury Orlando-area apartment community sells

JLL Capital Markets announced that it has closed the sale of The Q at Maitland, a 129-unit luxury apartment community in Maitland, Florida, in the Orlando area.

JLL marketed the property on behalf of the...

Franklin Street arranges $56 million sale of 517-unit St. Petersburg, Florida multifamily community

Franklin Street has arranged the sale of Osprey Pointe Apartments, a 517-unit, garden-style multifamily community in St. Petersburg, Florida, for $56 million, or $108,317 per unit.

Franklin Street’s Tampa-based Multifamily Investment Sales Team of Darron Kattan, Zach...

MassHousing closes approximately $19 million in financing for the second phase of the transformative...

MassHousing has closed on approximately $19 million in affordable and workforce housing financing to Trinity Financial, Inc., which is developing the 111-unit Phase Two of the Enterprise Center in Downtown Brockton for residents with...

Infographic: Down the rabbit hole

Getting to the bottom of an artificial labor market

3 million unemployed U.S. persons

New jobless claims rise even after many states opt out of the feds’ unemployment program

$300-a-week bonus unemployment benefits enacted...

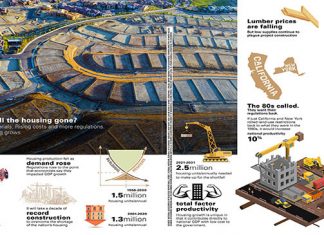

Infographic: Where has all the housing gone?

No labor. No materials. Rising costs and more regulations. The lack of housing grows.

5 million more housing units needed to pace demand

5 million of these are multifamily units

Housing production fell as demand...

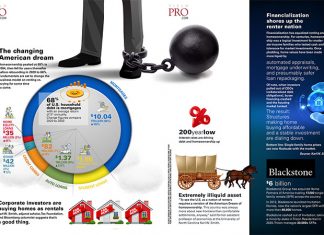

Infographic: The changing American dream

Homeownership peaked at 69% in 2004, then fell for years thereafter before rebounding in 2020 to 66%. Fundamentals are set to change the business model on renting vs. buying for some time to come.

Corporate...

Multifamily property price gains accelerate in May

A report from Real Capital Analytics (RCA) said that multifamily property prices rose 10.1 percent in the year to May as part of a general rise in commercial real estate prices. This represented the...

$110 million sale for Mallory Square in Maryland completed

JLL Capital Markets announced it closed the $110 million sale of Mallory Square, a 365-unit mid-rise apartment community with 1,600 square feet of retail, located in the Shady Grove submarket of Rockville, Maryland.

JLL worked on...

JCHS releases The State of the Nation’s Housing report

The Joint Center for Housing Studies of Harvard University has released the 2021 edition of its report chronicling the issues surrounding housing in the United States. The report brings together data from a wide...

Institutional Property Advisors negotiates Texas Hill Country multifamily asset sale

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Riverhaus Creekside, a 281-unit multifamily asset located within the Town Center at Creekside, a 400-plus-acre mixed-use development in New Braunfels,...

$27.5 million refinancing arranged for multihousing community near St. Louis, MO

JLL Capital Markets announced that it has arranged a $27.5 million refinancing of Promenade at New Town*, a 225-unit multihousing community in the St. Louis-area community of St. Charles, Missouri.

JLL represented Gold Block Ventures...

Levin Johnston directs acquisitions of three Bay Area properties totaling $68.25 million on behalf...

Levin Johnston of Marcus and Millichap, one of the top multifamily brokerage teams in the U.S. specializing in wealth management through commercial real estate investments, announced that it recently directed $68.25 million in acquisitions...