Construction materials prices higher in October

The producer price index (PPI) report from the Bureau of Labor Statistics (BLS) stated that construction materials prices were up 0.2 percent month-over-month in October on a seasonally adjusted basis. In addition, last month’s...

The second life of recycling

Have you ever watched a Godzilla movie? Just when you think Godzilla is on the ropes and going down, dying, he gets up stronger and more powerful and angrier. Recycling is kind of like...

Housing goals set and actions defined for GSEs

The Federal Housing Finance Agency (FHFA) has proposed 2025-2027 housing goals for Fannie Mae and Freddie Mac for lending on both single-family and multifamily housing. Fannie Mae and Freddie Mac have also announced how...

CoStar: multifamily property prices continue rise

CoStar reported that its value-weighted index of multifamily property prices rose 1.4 percent month-over-month in November. However, this index was down 5.2 percent year-over-year.

The month-over-month price movement reported by CoStar varies significantly from that...

Single-family production continues to sag, multifamily permits weakening

Single-family housing starts continued to fall in November, with the pace of construction down 32 percent since February when mortgage rates began to rise. The housing market continues to weaken because stubbornly high construction...

Yardi Matrix reports solid rent growth in June

Yardi Matrix reported that national average apartment rent increased $7 in June from the revised level of the month before. The average rent reached $1,726 per month.

Year-over-year rent growth rate continues to fall

The national...

Labor and land costs to impact seniors housing development in 2020

Seniors housing development costs are expected to rise modestly in 2020, with labor and land the primary drivers of higher expenditure, according to the latest research from CBRE.

Total cost for a seniors housing development...

Biden’s veto of Congressional WOTUS resolution a blow to housing affordability

Alicia Huey, chairman of the National Association of Home Builders (NAHB) and a custom home builder and developer from Birmingham, Ala., today issued the following statement after President Biden vetoed a congressional resolution that...

Remodeling industry confidence is strong despite COVID-19

The National Association of Home Builders (NAHB) released its Remodeling Market Index (RMI) for the fourth quarter of 2020, posting a reading of 79. The finding is a signal of residential remodelers' strong confidence in their markets,...

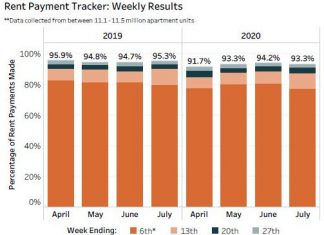

93.3 percent of apartment households paid rent as of July 27

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 93.3 percent of apartment households made a full or partial rent payment by July 27 in its survey of 11.4 million units of professionally...

Speak now …

I always thought that the line in a wedding ceremony “If anyone feels these two should not be married, speak now or forever hold your peace” was weird. Who would procrastinate until the very...

BEA reports on housing inflation

The Bureau of Economic Analysis released its report on personal consumption expenditures (PCE) for the month of August. The overall PCE price index rose 0.3 percent for the month and 6.3 percent from the...

Multifamily CMBS delinquency rate edges higher in May

Trepp reported that delinquency rate for multifamily commercial mortgage-backed securities (CMBS) loans rose slightly in May, climbing 10 basis points.

Overall CBMS delinquency rate also down slightly

For delinquencies, Trepp focuses on loans that are 30...

NMHC Multifamily Construction Survey explores impact of COVID-19 on the industry

The National Multifamily Housing Council (NMHC) today released a new survey on multifamily construction that found more than half (55 percent) of respondents said that they are currently experiencing construction delays in the jurisdictions...

Commercial property loan delinquencies under watch

A pair of reports, one from Trepp and one from the Mortgage Bankers Association (MBA) show that delinquency rates for commercial mortgages are generally low. However, delinquencies rates are rising for certain categories of...