Next Wave expands Las Vegas footprint with acquisition of 216-unit multifamily community

Next Wave Investors, LLC (“Next Wave”) a private equity firm focused on value-add multifamily investments, has acquired Spanish Oaks, a 216-unit garden style multifamily community in Las Vegas, Nevada for $28.075 million.

Through existing broker...

Luxury multifamily property sale completed by Institutional Property Advisors in Greater Salt Lake City

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Axio 8400, a 332-unit multifamily asset located 13 miles from Downtown Salt Lake City in Sandy, Utah.

“The Greater Salt Lake...

North Texas apartment asset sale closed by Institutional Property Advisors

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of The Coventry Apartments, a 240-unit apartment property in the Dallas-Fort Worth suburb of Denton, Texas.

“Denton has seen extraordinary growth in...

Berkadia arranges debt and equity for Class A Houston apartments

Berkadia announces it has arranged debt financing and secured an equity partner for the acquisition of The Henry at Liberty Hills (formerly known as SYNC at Liberty Hills), a 228-unit luxury garden style community...

epIQ Index report on top management companies released

ApartmentRatings and SatisFacts Research have announced the list of 2020's top 100 multifamily property management companies by portfolio size and the top 250 rental communities nationwide as part of their epIQ Index Biannual Report,...

Construction materials prices higher in January

The Bureau of Labor Statistics (BLS) released its producer price index report for January 2021. It showed that the BLS price index of materials and components for construction was up 1.5 percent from December,...

Multifamily housing permits surge in January

The Census Bureau released its monthly new residential construction report for January 2021. It shows a rise in permits and starts of multifamily housing units but a drop in unit completions.

Multifamily housing construction permits...

Rare East King County apartment building sells for $9 million

Calabria, a multifamily property located at 2000 NW Talus Drive in Issaquah, Washington, has sold for $9,000,000 ($450,000 per unit) to a local apartment investor, Fourth Avenue Capital. The seller, Pacifica Companies out of...

Construction headwinds pick up in January

Housing production softened in January as rising lumber prices continue to affect the housing industry. Overall housing starts decreased 6.0 percent to a seasonally adjusted annual rate of 1.58 million units, according to a report from the...

Multifamily mortgage originations rebound in Q4

A report from the Mortgage Banker’s Association (MBA) says that the multifamily mortgage market rebounded in Q4 of 2020 with originations reaching a multi-year high.

Multifamily mortgage lending surges

The first chart, below, shows the quarterly...

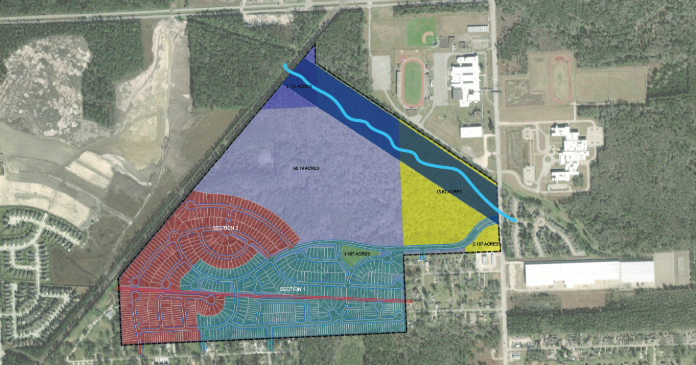

Joint venture of PCCP, LLC and Middle Street Partners acquires site for 323-unit apartment...

PCCP, LLC announced that it formed a joint venture with Middle Street Partners for the site acquisition and construction of BeltLine & Boulevard, a 323-unit Class A multifamily community with 5,000 square feet (sf)...

Haven Realty Capital adds to SFR portfolio with $30.6 million acquisition of townhome community...

Haven Realty Capital (Haven) continues to build its Single-Family Rental (SFR) portfolio closing on the completed first phase of a $30.6 million acquisition of Harrison Landing Townes, a 166-unit purpose-built rental townhome community now under construction in Greenville,...

Debt expert joins JLL’s Chicago Capital Markets group

JLL Capital Markets announced that Philip Galligan has joined the firm as a Director in its Chicago office. Galligan will focus on debt and equity placement transactions across the Midwest and nationally.

Galligan has more...

Berkadia arranges $33 million recapitalization for Tampa multifamily portfolio

Berkadia announces it has arranged $33 million in refinancing for a three-property, 502-unit multifamily portfolio encompassing Uptown Apartments, Montierra Apartments and Palm Square Homes in Tampa, Florida. Managing Director Scott Wadler of Berkadia’s Miami...

Invictus Real Estate Partners secures $55.83 million for acquisition of The Berkeley at Waypointe...

JLL Capital Markets announced it has arranged $55.83 million in acquisition financing for The Berkeley at Waypointe and Quincy Lofts, a multihousing property located at 500 West Ave and 30 Orchard St. in Norwalk,...